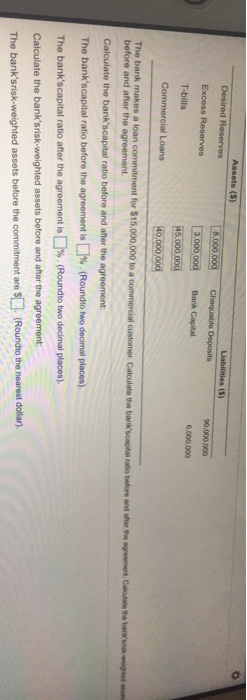

Assets (S) Liabilities (S) Desired Reserves 8.000.000 Chequable Deposits 90.000.000 Excess Resenrves 3.000 000 Bank Capital 6.000.000 T-bills 45.000.000 Commercial Loans 40,000,000 The bank makes a loan commitment for $15.000.000 to a commercial customer. Calouate the bank'scapital ratio before and aher the agreement. Caloulate before and after the agreement. wrisk-wighled Calculate the bank'scapital ratio before and after the agreement The bank'scapital ratio before the agreement is %. (Roundto two decimal places). The bank'scapital ratio after the agreement is . (Roundto two decimal places). Calculate the bank'srisk-weighted assets before and after the agreement: The bank'srisk-weighted assets before the commitment are S (Roundto the nearest dollar).

Assets (S) Liabilities (S) Desired Reserves 8.000.000 Chequable Deposits 90.000.000 Excess Resenrves 3.000 000 Bank Capital 6.000.000 T-bills 45.000.000 Commercial Loans 40,000,000 The bank makes a loan commitment for $15.000.000 to a commercial customer. Calouate the bank'scapital ratio before and aher the agreement. Caloulate before and after the agreement. wrisk-wighled Calculate the bank'scapital ratio before and after the agreement The bank'scapital ratio before the agreement is %. (Roundto two decimal places). The bank'scapital ratio after the agreement is . (Roundto two decimal places). Calculate the bank'srisk-weighted assets before and after the agreement: The bank'srisk-weighted assets before the commitment are S (Roundto the nearest dollar).

Economics Today and Tomorrow, Student Edition

1st Edition

ISBN:9780078747663

Author:McGraw-Hill

Publisher:McGraw-Hill

Chapter4: Going Into Debt

Section: Chapter Questions

Problem 6AA

Related questions

Question

Solve this all subparts now definitely we upvote solution

Transcribed Image Text:Assets (S)

Liabilities (S)

Desired Reserves

8.000.000

Chequable Deposits

90.000.000

Excess Resenrves

3.000 000

Bank Capital

6.000.000

T-bills

45.000.000

Commercial Loans

40,000,000

The bank makes a loan commitment for $15.000.000 to a commercial customer. Calouate the bank'scapital ratio before and aher the agreement. Caloulate

before and after the agreement.

wrisk-wighled

Calculate the bank'scapital ratio before and after the agreement

The bank'scapital ratio before the agreement is %. (Roundto two decimal places).

The bank'scapital ratio after the agreement is . (Roundto two decimal places).

Calculate the bank'srisk-weighted assets before and after the agreement:

The bank'srisk-weighted assets before the commitment are S (Roundto the nearest dollar).

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Economics Today and Tomorrow, Student Edition

Economics

ISBN:

9780078747663

Author:

McGraw-Hill

Publisher:

Glencoe/McGraw-Hill School Pub Co

Principles of Economics 2e

Economics

ISBN:

9781947172364

Author:

Steven A. Greenlaw; David Shapiro

Publisher:

OpenStax

Essentials of Economics (MindTap Course List)

Economics

ISBN:

9781337091992

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Economics Today and Tomorrow, Student Edition

Economics

ISBN:

9780078747663

Author:

McGraw-Hill

Publisher:

Glencoe/McGraw-Hill School Pub Co

Principles of Economics 2e

Economics

ISBN:

9781947172364

Author:

Steven A. Greenlaw; David Shapiro

Publisher:

OpenStax

Essentials of Economics (MindTap Course List)

Economics

ISBN:

9781337091992

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Macroeconomics (MindTap Course List)

Economics

ISBN:

9781305971509

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Economics (MindTap Course List)

Economics

ISBN:

9781305585126

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Economics, 7th Edition (MindTap Cou…

Economics

ISBN:

9781285165875

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning