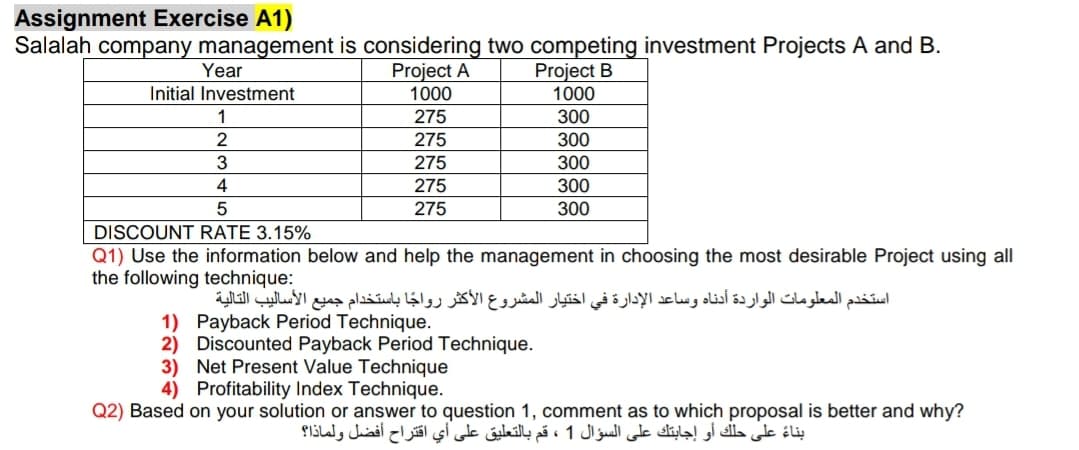

Assignment Exercise A1) Salalah company management is considering two competing investment Projects A and B. Project A 1000 Year Project B Initial Investment 1000 1 275 300 275 300 3 275 300 4 275 300 275 300 DISCOUNT RATE 3.15% Q1) Use the information below and help the management in choosing the most desirable Project using all the following technique: استخدم المعلومات الواردة أدناه وساعد الإدارة في اختيار المشروع الأكثر رواجا باستخدام جميع الأساليب التالية 1) Payback Period Technique. 2) Discounted Payback Period Technique. 3) Net Present Value Technique

Assignment Exercise A1) Salalah company management is considering two competing investment Projects A and B. Project A 1000 Year Project B Initial Investment 1000 1 275 300 275 300 3 275 300 4 275 300 275 300 DISCOUNT RATE 3.15% Q1) Use the information below and help the management in choosing the most desirable Project using all the following technique: استخدم المعلومات الواردة أدناه وساعد الإدارة في اختيار المشروع الأكثر رواجا باستخدام جميع الأساليب التالية 1) Payback Period Technique. 2) Discounted Payback Period Technique. 3) Net Present Value Technique

Chapter10: Project Cash Flows And Risk

Section: Chapter Questions

Problem 19PROB

Related questions

Question

Transcribed Image Text:Assignment Exercise A1)

Salalah company management is considering two competing investment Projects A and B.

Project A

1000

Project B

1000

Year

Initial Investment

1

275

300

275

300

275

300

4

275

300

300

5

275

DISCOUNT RATE 3.15%

Q1) Use the information below and help the management in choosing the most desirable Project using all

the following technique:

استخدم المعلومات الواردة أدناه وساعد الإدارة في اختيار المشروع الأكثر رواجا باستخدام جميع الأساليب التالية

1) Payback Period Technique.

2) Discounted Payback Period Technique.

3) Net Present Value Technique

4) Profitability Index Technique.

Q2) Based on your solution or answer to question 1, comment as to which proposal is better and why?

بناءً على حلك أو إجابتك على السؤال 1 ، قم بالتعليق على أي اقتراح أفضل ولماذا؟

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 8 steps with 6 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you