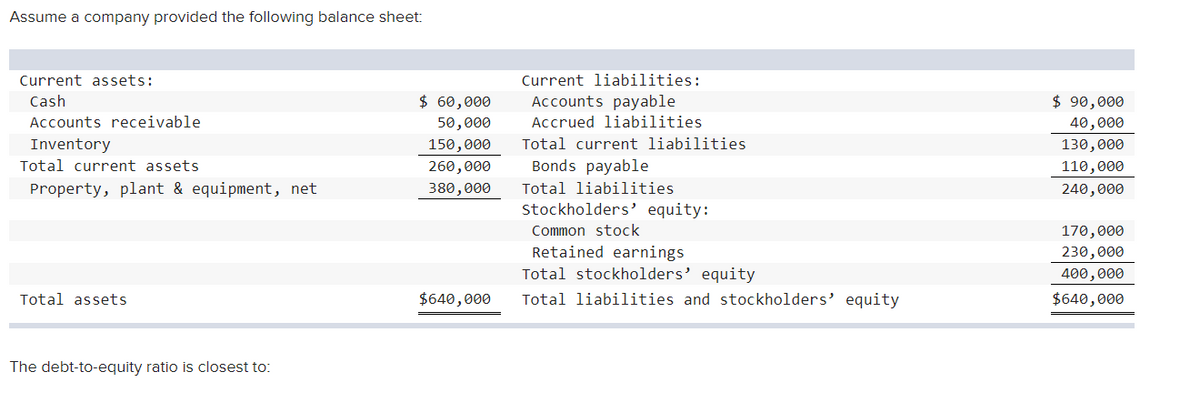

Assume a company provided the following balance sheet: Current assets: Current liabilities: Cash $ 60,000 Accounts payable $ 90,000 Accounts receivable 50,000 Accrued liabilities 40,000 Total current liabilities Inventory Total current assets 150,000 130,000 260,000 Bonds payable 110,000 Property, plant & equipment, net 380,000 Total liabilities 240,000 stockholders' equity: Common stock 170,000 Retained earnings Total stockholders' equity Total liabilities and stockholders' equity 230,000 400,000 Total assets $640,000 $640,000 The debt-to-equity ratio is closest to:

Assume a company provided the following balance sheet: Current assets: Current liabilities: Cash $ 60,000 Accounts payable $ 90,000 Accounts receivable 50,000 Accrued liabilities 40,000 Total current liabilities Inventory Total current assets 150,000 130,000 260,000 Bonds payable 110,000 Property, plant & equipment, net 380,000 Total liabilities 240,000 stockholders' equity: Common stock 170,000 Retained earnings Total stockholders' equity Total liabilities and stockholders' equity 230,000 400,000 Total assets $640,000 $640,000 The debt-to-equity ratio is closest to:

Financial Accounting: The Impact on Decision Makers

10th Edition

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Gary A. Porter, Curtis L. Norton

Chapter2: Financial Statements And The Annual Report

Section: Chapter Questions

Problem 2.5E: Classification of Assets and Liabilities Indicate the appropriate classification of each of the...

Related questions

Question

Transcribed Image Text:Assume a company provided the following balance sheet:

Current assets:

Current liabilities:

$ 60,000

Accounts payable

Accrued liabilities

$ 90,000

Cash

Accounts receivable

50,000

40,000

Inventory

150,000

Total current liabilities

130,000

Total current assets

260,000

Bonds payable

110,000

Property, plant & equipment, net

380,000

Total liabilities

240,000

Stockholders' equity:

Common stock

170,000

Retained earnings

230,000

Total stockholders' equity

400,000

Total assets

$640,000

Total liabilities and stockholders' equity

$640,000

The debt-to-equity ratio is closest to:

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning