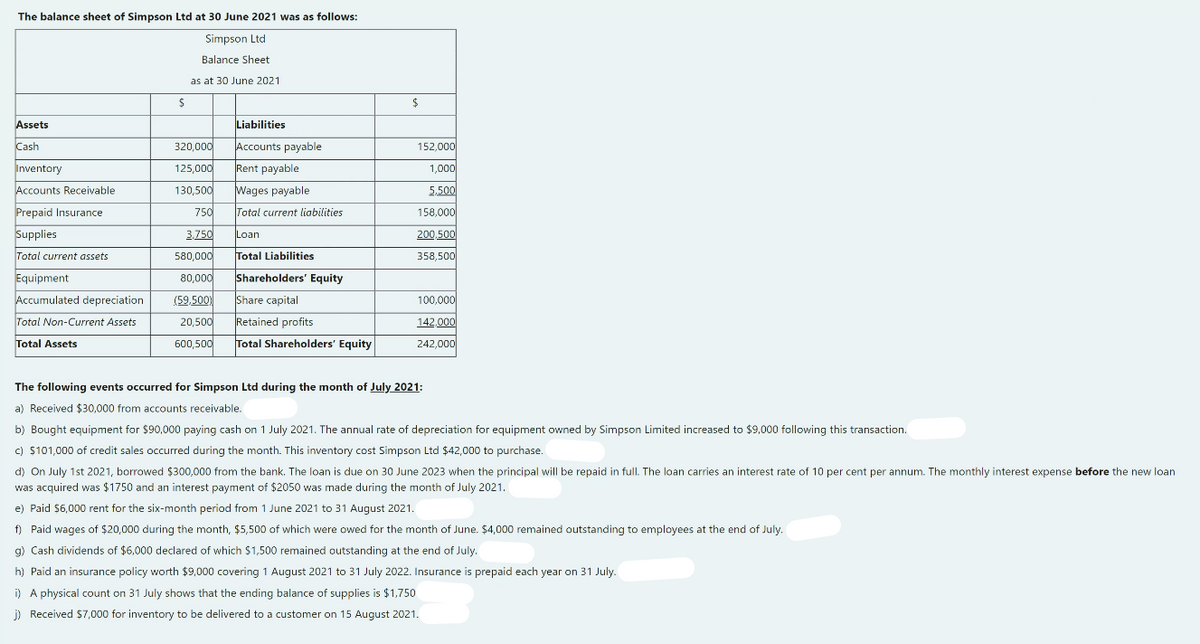

The balance sheet of Simpson Ltd at 30 June 2021 was as follows: Simpson Ltd Balance Sheet as at 30 June 2021 Assets Liabilities Cash 320,000 Accounts payable 152,000 Inventory 125,000 Rent payable 1,000 Accounts Receivable 130,500 Wages payable 5,500 Prepaid Insurance 750 Total current liabilities 158,000 Supplies 3.750 Loan 200 500 Total current assets 580,000 Total Liabilities 358,500 Equipment 80,000 Shareholders' Equity Accumulated depreciation (59,500 Share capital 100,000 Total Non-Current Assets Retained profits Total Shareholders' Equity 20,500 142.000 Total Assets 600,500 242,000 The following events occurred for Simpson Ltd during the month of July 2021: a) Received $30,000 from accounts receivable. b) Bought equipment for $90,000 paying cash on 1 July 2021. The annual rate of depreciation for equipment owned by Simpson Limited increased to $9,000 following this transaction. c) $101,000 of credit sales occurred during the month. This inventory cost Simpson Ltd $42,000 to purchase. d) On July 1st 2021, borrowed $300,000 from the bank. The loan is due on 30 June 2023 when the principal will be repaid in full. The loan carries an interest rate of 10 per cent per annum. The monthly interest expense before the new loan was acquired was $1750 and an interest payment of $2050 was made during the month of July 2021. e) Paid $6,000 rent for the six-month period from 1 June 2021 to 31 August 2021. f) Paid wages of $20,000 during the month, $5,500 of which were owed for the month of June. $4,000 remained outstanding to employees at the end of July. g) Cash dividends of $6.000 declared of which $1,500 remained outstanding at the end of July. h) Paid an insurance policy worth $9,000 covering 1 August 2021 to 31 July 2022. Insurance is prepaid each year on 31 July. i) A physical count on 31 July shows that the ending balance of supplies is $1,750 j ) Received S7,000 for inventory to be delivered to a customer on 15 August 2021.

The balance sheet of Simpson Ltd at 30 June 2021 was as follows: Simpson Ltd Balance Sheet as at 30 June 2021 Assets Liabilities Cash 320,000 Accounts payable 152,000 Inventory 125,000 Rent payable 1,000 Accounts Receivable 130,500 Wages payable 5,500 Prepaid Insurance 750 Total current liabilities 158,000 Supplies 3.750 Loan 200 500 Total current assets 580,000 Total Liabilities 358,500 Equipment 80,000 Shareholders' Equity Accumulated depreciation (59,500 Share capital 100,000 Total Non-Current Assets Retained profits Total Shareholders' Equity 20,500 142.000 Total Assets 600,500 242,000 The following events occurred for Simpson Ltd during the month of July 2021: a) Received $30,000 from accounts receivable. b) Bought equipment for $90,000 paying cash on 1 July 2021. The annual rate of depreciation for equipment owned by Simpson Limited increased to $9,000 following this transaction. c) $101,000 of credit sales occurred during the month. This inventory cost Simpson Ltd $42,000 to purchase. d) On July 1st 2021, borrowed $300,000 from the bank. The loan is due on 30 June 2023 when the principal will be repaid in full. The loan carries an interest rate of 10 per cent per annum. The monthly interest expense before the new loan was acquired was $1750 and an interest payment of $2050 was made during the month of July 2021. e) Paid $6,000 rent for the six-month period from 1 June 2021 to 31 August 2021. f) Paid wages of $20,000 during the month, $5,500 of which were owed for the month of June. $4,000 remained outstanding to employees at the end of July. g) Cash dividends of $6.000 declared of which $1,500 remained outstanding at the end of July. h) Paid an insurance policy worth $9,000 covering 1 August 2021 to 31 July 2022. Insurance is prepaid each year on 31 July. i) A physical count on 31 July shows that the ending balance of supplies is $1,750 j ) Received S7,000 for inventory to be delivered to a customer on 15 August 2021.

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter9: Long-term Liabilities

Section: Chapter Questions

Problem 103.3C

Related questions

Question

Help me please

Transcribed Image Text:The balance sheet of Simpson Ltd at 30 June 2021 was as follows:

Simpson Ltd

Balance Sheet

as at 30 June 2021

Assets

Liabilities

Cash

320,000

Accounts payable

152,000

Inventory

125,000

Rent payable

1,000

Accounts Receivable

130,500

Wages payable

5.500

Prepaid Insurance

750

Total current liabilities

158,000

Supplies

3,750

Loan

200,500

Total current assets

580,000

Total Liabilities

358,500

Equipment

80,000

Shareholders' Equity

Accumulated depreciation

(59,500)

Share capital

100,000

Total Non-Current Assets

20,500

Retained profits

142,000

Total Assets

600,500

Total Shareholders' Equity

242,000

The following events occurred for Simpson Ltd during the month of July 2021:

a) Received $30,000 from accounts receivable.

b) Bought equipment for $90,000 paying cash on 1 July 2021. The annual rate of depreciation for equipment owned by Simpson Limited increased to $9,000 following this transaction.

c) $101,000 of credit sales occurred during the month. This inventory cost Simpson Ltd $42,000 to purchase.

d) On July 1st 2021, borrowed $300,000 from the bank. The loan is due on 30 June 2023 when the principal will be repaid in full. The loan carries an interest rate of 10 per cent per annum. The monthly interest expense before the new loan

was acquired was $1750 and an interest payment of $2050 was made during the month of July 2021.

e) Paid $6,000 rent for the six-month period from 1 June 2021 to 31 August 2021.

f) Paid wages of $20,000 during the month, $5,500 of which were owed for the month of June. $4,000 remained outstanding to employees at the end of July.

g) Cash dividends of $6,000 declared of which $1,500 remained outstanding at the end of July.

h) Paid an insurance policy worth $9,000 covering 1 August 2021 to 31 July 2022. Insurance is prepaid each year on 31 July.

i) A physical count on 31 July shows that the ending balance of supplies is $1,750

j) Received $7,000 for inventory to be delivered to a customer on 15 August 2021.

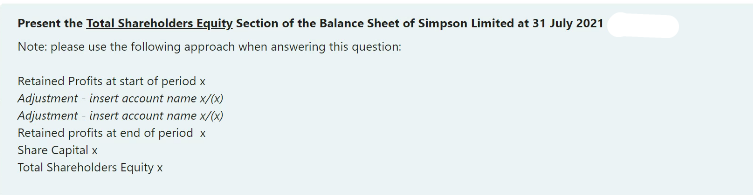

Transcribed Image Text:Present the Total Shareholders Equity Section of the Balance Sheet of Simpson Limited at 31 July 2021

Note: please use the following approach when answering this question:

Retained Profits at start of period x

Adjustment - insert account name x/(x)

Adjustment - insert account name x/(x)

Retained profits at end of period x

Share Capital x

Total Shareholders Equity x

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning