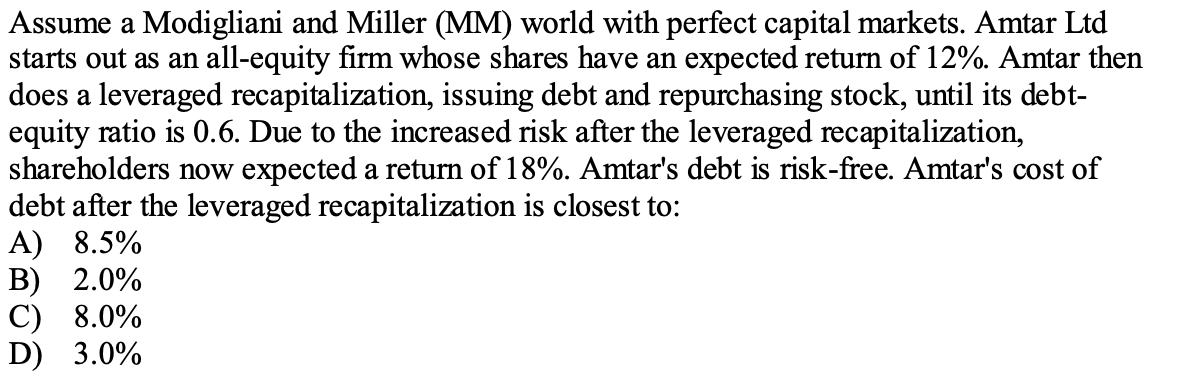

Assume a Modigliani and Miller (MM) world with perfect capital markets. Amtar Ltd starts out as an all-equity firm whose shares have an expected return of 12%. Amtar then does a leveraged recapitalization, issuing debt and repurchasing stock, until its debt- equity ratio is 0.6. Due to the increased risk after the leveraged recapitalization, shareholders now expected a return of 18%. Amtar's debt is risk-free. Amtar's cost of debt after the leveraged recapitalization is closest to: A) 8.5% В) 2.0% С) 8.0% D) 3.0%

Assume a Modigliani and Miller (MM) world with perfect capital markets. Amtar Ltd starts out as an all-equity firm whose shares have an expected return of 12%. Amtar then does a leveraged recapitalization, issuing debt and repurchasing stock, until its debt- equity ratio is 0.6. Due to the increased risk after the leveraged recapitalization, shareholders now expected a return of 18%. Amtar's debt is risk-free. Amtar's cost of debt after the leveraged recapitalization is closest to: A) 8.5% В) 2.0% С) 8.0% D) 3.0%

Financial Management: Theory & Practice

16th Edition

ISBN:9781337909730

Author:Brigham

Publisher:Brigham

Chapter15: Capital Structure Decisions

Section: Chapter Questions

Problem 10MC: Liu Industries is a highly levered firm. Suppose there is a large probability that Liu will default...

Related questions

Question

100%

Can you guys help please? Answer is D

Transcribed Image Text:Assume a Modigliani and Miller (MM) world with perfect capital markets. Amtar Ltd

starts out as an all-equity firm whose shares have an expected return of 12%. Amtar then

does a leveraged recapitalization, issuing debt and repurchasing stock, until its debt-

equity ratio is 0.6. Due to the increased risk after the leveraged recapitalization,

shareholders now expected a return of 18%. Amtar's debt is risk-free. Amtar's cost of

debt after the leveraged recapitalization is closest to:

A) 8.5%

В) 2.0%

С) 8.0%

D) 3.0%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you