Assume a retailing company has two departments-Department A and Department B. The company's most recent contribution format income statement follows: Total Sales Variable expenses Contribution nargin Fixed expenses $ 800,e00 350,000 450,000 Department A Department B $ 350,000 250,000 10e,e00 $ 450,000 100,000 350,000 400,000 140,000 260,000 Net operating income (loss) $ se,000 $ (40,000) $ 90,000 The company says that S60.000 of the fixed expenses being charged to Department A are sunk costs or allocated costs that will continue if the segment is discontinued. However, if Department A is discontinued the sales in Department B will drop by 18%. What is the financial advantage (disadvantage) of discontinuing Department A? Multiple Choice S003.000) S(83,000) S92.000)

Assume a retailing company has two departments-Department A and Department B. The company's most recent contribution format income statement follows: Total Sales Variable expenses Contribution nargin Fixed expenses $ 800,e00 350,000 450,000 Department A Department B $ 350,000 250,000 10e,e00 $ 450,000 100,000 350,000 400,000 140,000 260,000 Net operating income (loss) $ se,000 $ (40,000) $ 90,000 The company says that S60.000 of the fixed expenses being charged to Department A are sunk costs or allocated costs that will continue if the segment is discontinued. However, if Department A is discontinued the sales in Department B will drop by 18%. What is the financial advantage (disadvantage) of discontinuing Department A? Multiple Choice S003.000) S(83,000) S92.000)

Survey of Accounting (Accounting I)

8th Edition

ISBN:9781305961883

Author:Carl Warren

Publisher:Carl Warren

Chapter14: Decentralized Operations

Section: Chapter Questions

Problem 14.9E: Profit center responsibility reporting On-Demand Sports Co. operates two divisions—the Action Sports...

Related questions

Question

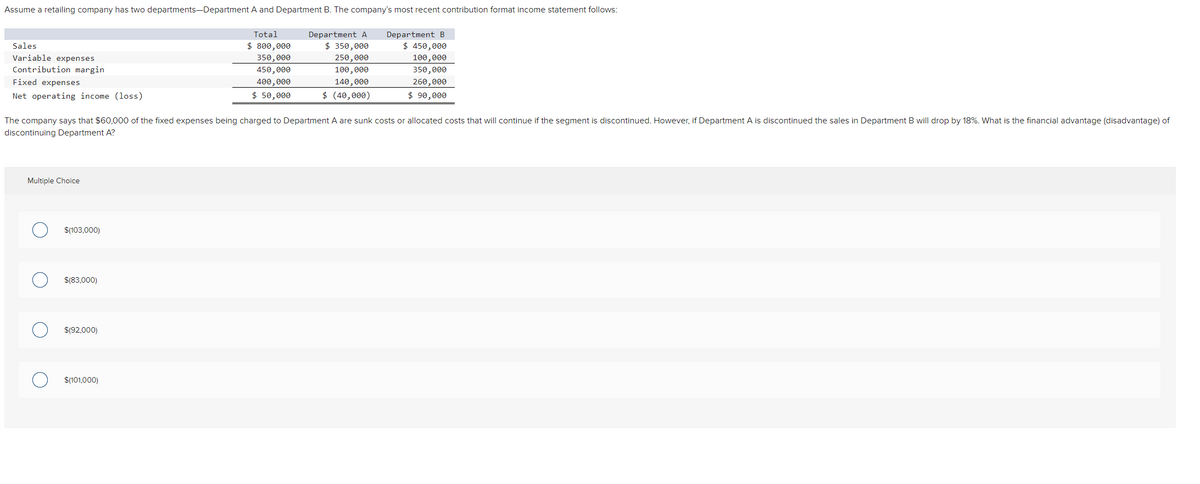

Transcribed Image Text:Assume a retailing company has two departments-Department A and Department B. The company's most recent contribution format income statement follows:

Total

Department A

Department B

$ 800,000

350,000

450,000

$ 350,000

250,000

Sales

$ 450,000

Variable expenses

Contribution margin

100,000

100,000

350,000

Fixed expenses

400,000

140,000

260,000

Net operating income (loss)

$ 50,000

$ (40,000)

$ 90,000

The company says that $60,000 of the fixed expenses being charged to Department A are sunk costs or allocated costs that will continue if the segment is discontinued. However, if Department A is discontinued the sales in Department B will drop by 18%. What is the financial advantage (disadvantage) of

discontinuing Department A?

Multiple Choice

$(103,000)

$(83,000)

$(92,000)

$(101,000)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning