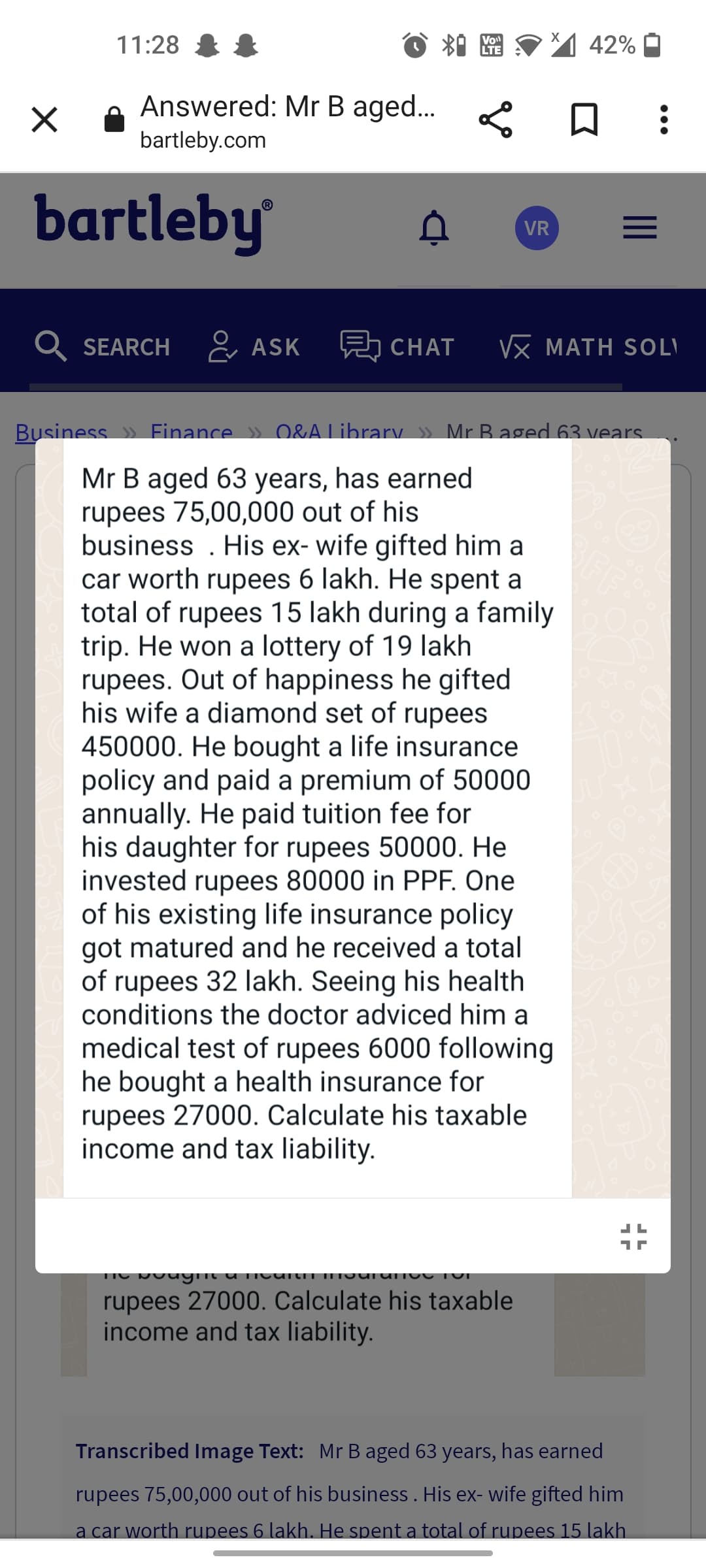

Mr B aged 63 years, has earned rupees 75,00,000 out of his business . His ex- wife gifted him cash in account worth rupees 6 lakh. He spent a total of rupees 15 lakh during a family trip. He won a lottery of 19 lakh rupees. Out of happiness he gifted his wife cash of rupees 450000. He bought a life insurance policy and paid a premium of 50000 annually. He paid tuition fee for his daughter for rupees 50000. He invested rupees 80000 in PPF. One of his existing life insurance policy got matured and he received a total of rupees 32 lakh. Seeing his health conditions the doctor adviced him a medical test of rupees 6000 following he bought a health insurance for rupees 27000. Calculate his taxable income and tax liability.

Mr B aged 63 years, has earned rupees 75,00,000 out of his business . His ex- wife gifted him cash in account worth rupees 6 lakh. He spent a total of rupees 15 lakh during a family trip. He won a lottery of 19 lakh rupees. Out of happiness he gifted his wife cash of rupees 450000. He bought a life insurance policy and paid a premium of 50000 annually. He paid tuition fee for his daughter for rupees 50000. He invested rupees 80000 in

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 4 images