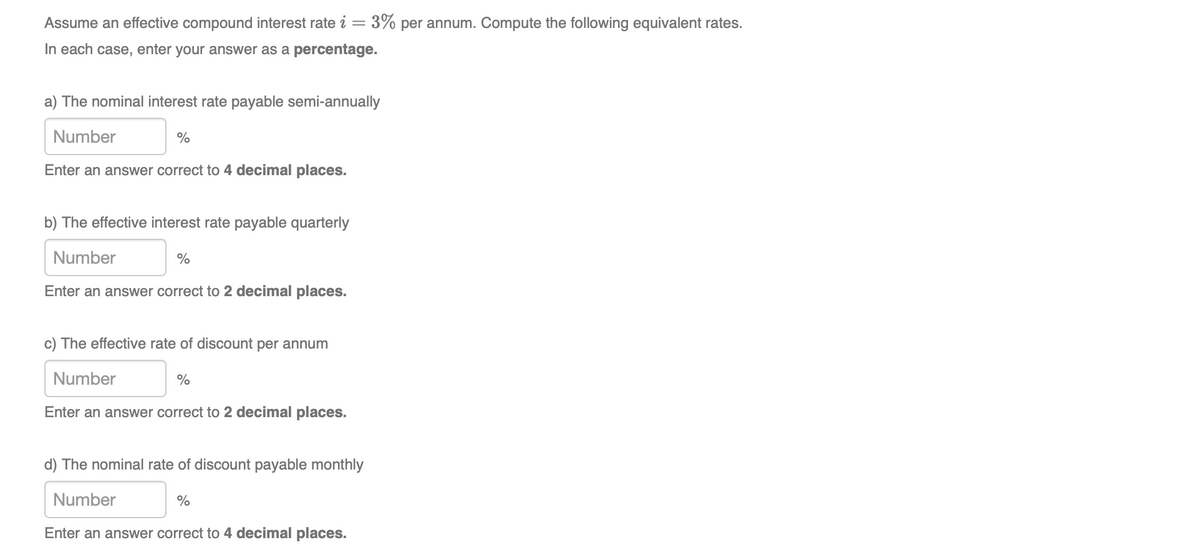

Assume an effective compound interest rate i = 3% per annum. Compute the following equivalent rates. In each case, enter your answer as a percentage. a) The nominal interest rate payable semi-annually Number % Enter an answer correct to 4 decimal places. b) The effective interest rate payable quarterly Number % Enter an answer correct to 2 decimal places. c) The effective rate of discount per annum Number % Enter an answer correct to 2 decimal places. d) The nominal rate of discount payable monthly Number % Enter an answer correct to 4 decimal places.

Assume an effective compound interest rate i = 3% per annum. Compute the following equivalent rates. In each case, enter your answer as a percentage. a) The nominal interest rate payable semi-annually Number % Enter an answer correct to 4 decimal places. b) The effective interest rate payable quarterly Number % Enter an answer correct to 2 decimal places. c) The effective rate of discount per annum Number % Enter an answer correct to 2 decimal places. d) The nominal rate of discount payable monthly Number % Enter an answer correct to 4 decimal places.

Chapter5: The Time Value Of Money

Section: Chapter Questions

Problem 7P

Related questions

Question

Transcribed Image Text:Assume an effective compound interest rate i= 3% per annum. Compute the following equivalent rates.

In each case, enter your answer as a percentage.

a) The nominal interest rate payable semi-annually

Number

%

Enter an answer correct to 4 decimal places.

b) The effective interest rate payable quarterly

Number

Enter an answer correct to 2 decimal places.

c) The effective rate of discount per annum

Number

Enter an answer correct to 2 decimal places.

d) The nominal rate of discount payable monthly

Number

%

Enter an answer correct to 4 decimal places.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 5 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT