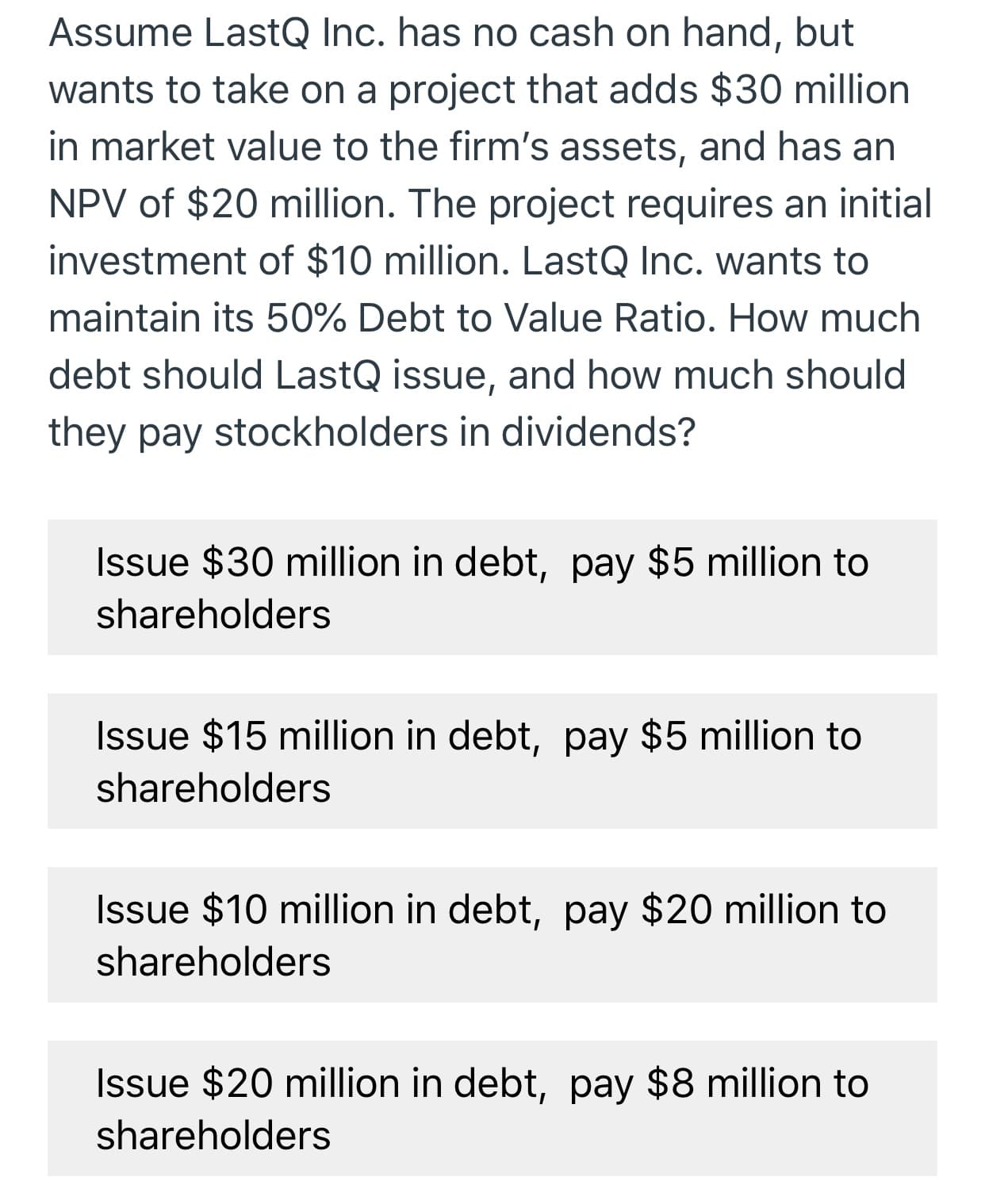

Assume LastQ Inc. has no cash on hand, but wants to take on project that adds $30 million in market value to the firm's assets, and has an NPV of $20 million. The project requires an initial investment of $10 million. LastQ Inc. wants to maintain its 50% Debt to Value Ratio. How much debt should LastQ issue, and how much should they pay stockholders in dividends? Issue $30 million in debt, pay $5 million to shareholders Issue $15 million in debt, pay $5 million to shareholders Issue $10 million in debt, pay $20 million to shareholders Issue $20 million in debt, pay $8 million to shareholders

Assume LastQ Inc. has no cash on hand, but wants to take on project that adds $30 million in market value to the firm's assets, and has an NPV of $20 million. The project requires an initial investment of $10 million. LastQ Inc. wants to maintain its 50% Debt to Value Ratio. How much debt should LastQ issue, and how much should they pay stockholders in dividends? Issue $30 million in debt, pay $5 million to shareholders Issue $15 million in debt, pay $5 million to shareholders Issue $10 million in debt, pay $20 million to shareholders Issue $20 million in debt, pay $8 million to shareholders

Intermediate Financial Management (MindTap Course List)

13th Edition

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Eugene F. Brigham, Phillip R. Daves

Chapter15: Distributions To Shareholders: Dividends And Repurchases

Section: Chapter Questions

Problem 3MC: Assume that IWT has completed its IPO and has a $112.5 million capital budget planned for the coming...

Related questions

Question

Please show all equations and work as needed. Make the correct answer clear. If possible, please type work so it can be copied. Thank you.

Transcribed Image Text:Assume LastQ Inc. has no cash on hand, but

wants to take on

project that adds $30 million

in market value to the firm's assets, and has an

NPV of $20 million. The project requires an initial

investment of $10 million. LastQ Inc. wants to

maintain its 50% Debt to Value Ratio. How much

debt should LastQ issue, and how much should

they pay stockholders in dividends?

Issue $30 million in debt, pay $5 million to

shareholders

Issue $15 million in debt, pay $5 million to

shareholders

Issue $10 million in debt, pay $20 million to

shareholders

Issue $20 million in debt, pay $8 million to

shareholders

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning