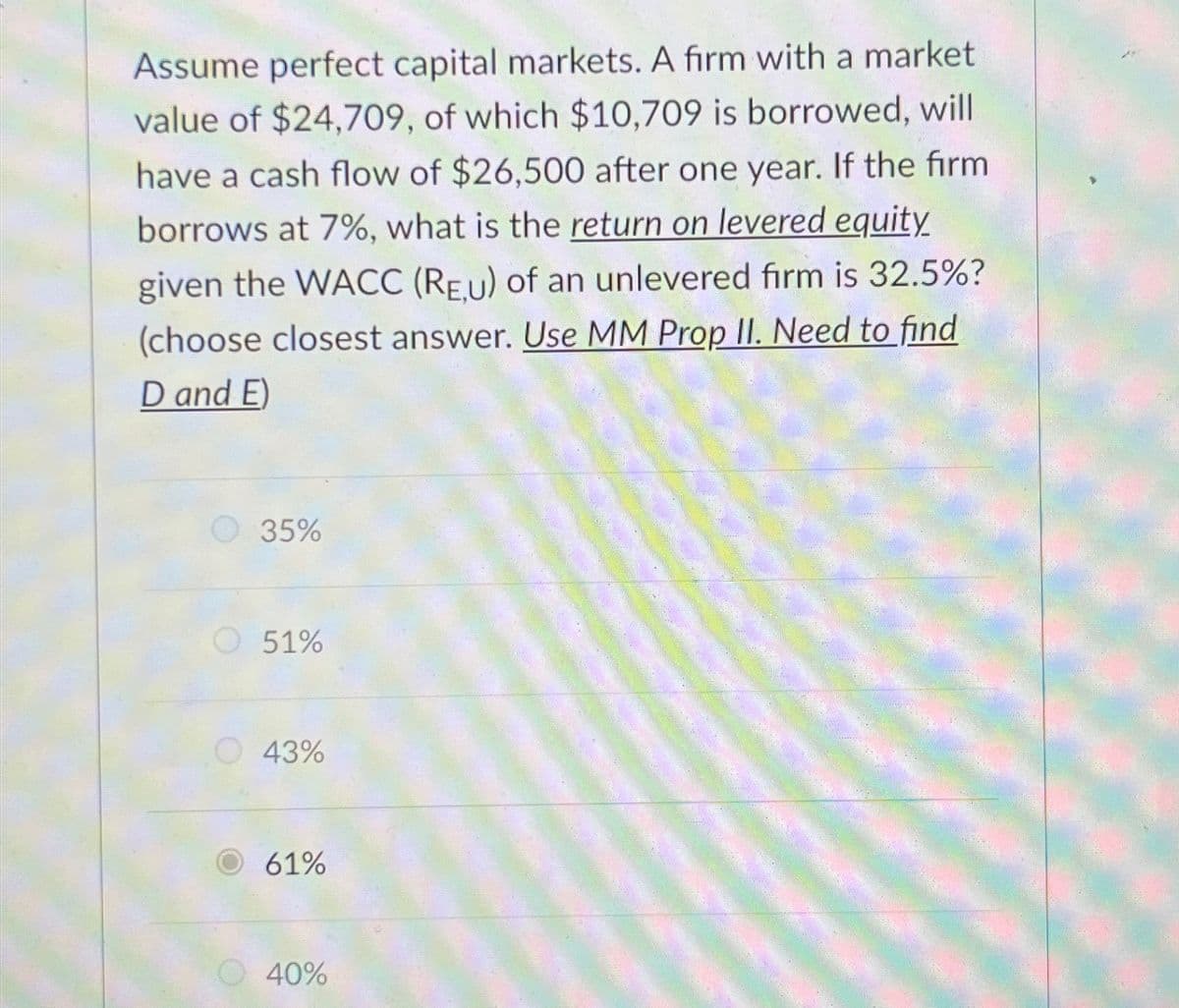

Assume perfect capital markets. A firm with a market value of $24,709, of which $10,709 is borrowed, will have a cash flow of $26,500 after one year. If the firm borrows at 7%, what is the return on levered equity given the WACC (REU) of an unlevered firm is 32.5%? (choose closest answer. Use MM Prop II. Need to find D and E) 35% 51% 43% 61% 40%

Q: Exhibit: Deposit Expansion Stages New New New New Cumulative Checkable Required Excess Loans New…

A: The correct answer is $128.To arrive at this solution, we need to understand the concept of deposit…

Q: 5 A high-interest savings account has a balance of $[A]. After (B) years of accumulating interest at…

A: Step-by-step analysis of the answers:A) FV1 = $29,550Step 1: Calculate the monthly interest…

Q: An investment project requires an initial cash outlay of $800 and then generates the following cash…

A:

Q: You are evaluating a project for The Ultimate recreational tennis racket, guaranteed to correct that…

A: ## Cash Flow Analysis for The Ultimate Tennis Racket ProjectHere's a breakdown of the cash flows for…

Q: Suppose today is December 4, 2020, and your firm produces breakfast cereal and needs 135,000 bushels…

A: a. We need to know the precise closing price of the corn futures contract for delivery in March 2021…

Q: None

A: Step 1:We have to calculate the price of the stock one year from now.The formula for calculating the…

Q: Please give Answer in Step by Step Otherwise I give you DISLIKES !!

A: The financial analyst conducted a hypothesis test to compare the turnover rates of…

Q: Explain how dividend policy affects the need for external financing.

A: I. High Dividend Payouts:Companies that have a high dividend payout ratio distribute a large portion…

Q: If returns of S&P 500 stocks are normally distributed, what range of returns would you expect to see…

A: Step 1: Step 2: Step 3: Step 4:

Q: Question 2 ECM Manufacturing Company Limited has three (3) possible suppliers, all of which offer…

A: 1. Sources of Spontaneous Short-Term Financing: - Accounts Payable: This represents the amount owed…

Q: F1

A: Given information: Cost of capital (r) = 6% or 0.06 (in millions) Initial Investment or cash outflow…

Q: F2

A: Step 1:Company's total value means total worth of the company after deducting all the…

Q: Please Write Step by Step Answer Otherwise i give DISLIKE !!

A: Question 1 . A sunk cost, sometimes called a retrospective cost, refers to an investment already…

Q: What is the pre-tax cost of debt for 10-year bonds issued 3 years ago if the current price is 101…

A: Step 1:We have to calculate the pre-tax cost of debt.We will use the RATE function in Excel to…

Q: McGilla Golf has decided to sell a new line of golf clubs. The clubs will sell for $895 per set and…

A: McGilla Golf's analysis of its new line of golf clubs reveals promising financial prospects. The…

Q: A piece of property is to be purchased at $305,000 for mining a precious metal. The annual net…

A: Cash Flow Diagram for Mining Investmenta. Cash Flow DiagramYear 0: -$305,000 (Initial Investment for…

Q: Bhupatbhai

A: To calculate the Sharpe and Treynor ratios for the given mutual fund, market index, and risk-free…

Q: Explain with each answer

A: Can be either higher or lower than the contract rent: This option is incorrect because the effective…

Q: Help with this question

A: referenceKumar, S. (2023). Exploratory review of esg factor attribution to the portfolio return in…

Q: REQUIRED Use the information given below to prepare the Cash Budget for each of the first three…

A: Step 1:

Q: None

A: Important Note:The provided answer ($2,375,512.727) seems significantly off compared to our…

Q: Harris Inc. is a book publisher that is considering developing an e-reader. The project requires…

A: To calculate the project's net present value (NPV) under two different financing scenarios: (a)…

Q: Question 27 of 30 View Policies Current Attempt in Progress -/0.1 E: Sandhill Bancorp has made an…

A: To find the payback period, we need to determine how long it takes for the cumulative cash flows to…

Q: Problem 3. (14 points) Consider the following rate and price tree for a straight bond. 981.65 9%…

A: The image you sent is a decision tree for a European put option on a straight bond. A straight bond…

Q: A pension fund currently invests in five different stocks as follows: Stock A B C D E Invested…

A: Expected Return Calculations using CAPMThe Capital Asset Pricing Model (CAPM) formula is used to…

Q: The Sisyphean Company is planning on investing in a new project. This will involve the purchase of…

A:

Q: Suppose that Goodwin Co., a U.S. based MNC, knows that it will receive 200,000 pounds in one year.…

A: Now, we'll plot these points on the graph. Here's how the contingency graph would look with the…

Q: None

A: Step 1: Given Value for Calculation Cash Flow for Year 0 = - $12,100Cash Flow for Year 1 = $3460Cash…

Q: 11-24. White Ski Resorts operates a series of ski resorts in northern Europe and reports under IFRS.…

A: According to IFRS 16 there are two ways to account for PPE- the cost and revaluation model. The cost…

Q: Consider a project with a 5-year life and no salvage value. The initial cost to set up the project…

A: Sale price per unit = $70Variable cost per unit = $40Contribution per unit = Sales - Variable cost=…

Q: Check my work 10 percent. Thirty thousand dollars in out-of-pocket costs will be incurred. For a…

A: Net Amount to Lenders:This is the initial amount available after out-of-pocket costs: $1,000,000…

Q: The following price quotations are for exchange-listed options on Primo Corporation common stock.…

A: Given information,Strike: 55Expiration: FebCall option: 7.21Put option: 0.48Contract: 100 sharesTo…

Q: We will derive a two-state put option value in this problem. Data: S = $130; X = $140; 1+r=1.10. The…

A: Step 1: Compute for the hedge ratio Hedge ratio is the ratio or comparative value of an open…

Q: O Calculate the Annual Percentage Rate (APR) for each: a. One Lump Sum: Calculate the APR for a…

A: The Annual Percentage Rate (APR) for a $2000 loan with an 8% stated annual interest rate, when paid…

Q: (please correct answer and step by step solutions this question) The current price of a stock is…

A: Step 1: Calculate the Risk-Free Daily RateThe daily risk-free rate (r(daily)) is derived from the…

Q: Problem 15-15 (Algo) P/E ratio for new public issue [LO15-2] Richmond Rent-A-Car is about to go…

A: The price-earnings ratio is the ratio of the stock price and the earnings per share of the company.…

Q: Suppose you just purchased a 8 year, $1,000 par value bond. The coupon rate on this bond is 7%…

A: The objective of this question is to calculate the price of a bond given its par value, coupon rate,…

Q: Find the EAC for each of the following light bulbs:

A: Absolutely, I can help you calculate the Equivalent Annual Cost (EAC) for both incandescent and LED…

Q: 30) General Mills bought September call options for wheat with an exercise price of $2.80 at a price…

A: Step 1: Determine the value of the call option.The call option will have a value if the market price…

Q: State of Economy Bust Probability of Security Returns if State Occurs State of Economy Roll Ross…

A: To calculate the volatility of a portfolio consisting of 35% Roll and 65% Ross, we first need to…

Q: The yield to maturity on 1-year zero-coupon bonds is currently 7%; the YTM on 2-year zeros is 8%.…

A:

Q: Nikul

A: Part 2:Explanation:Step 1: Calculate the excess returns for each portfolio.For Portfolio A:\[E(R)_A…

Q: The IRR evaluation method assumes that cash flows from the project are reinvested at the same rate…

A: Approach to Calculating Modified Internal Rate of Return (MIRR)1. Understanding the ConceptIRR…

Q: Question Two (a) A six-month European Call option on a non-dividend paying Stock Index has a strike…

A: Build the Binomial Tree as the first step.We are able to construct a two-step binomial tree by using…

Q: Beryl's Iced Tea currently rents a bottling machine for $50,000 per year, including all maintenance…

A: Analyzing Beryl's Iced Tea's OptionsWe need to calculate the Net Present Value (NPV) of the Free…

Q: Attempts 0 Keep the Highest 0/9 9. Problem 16-11 (Capital Structure Analysis) eBook Capital…

A: Problem 16-11 (Capital Structure)This problem likely deals with the Capital Asset Pricing Model…

Q: During the year just ended, Anna Schultz's portfolio, which has a beta of 0.96, earned a return of…

A: The above answer can be explained as under - Treynor's measure can be calculated as - Treynor's…

Q: Inez can earn an annual rate of return of 5.3%, compounded semiannually. If she made consecutive…

A: It is possible that Inez will have a balance of RM500 at the beginning of the year if she makes the…

Q: Discuss the merits of the following statement: Inside directors should constitute the majority of a…

A: Title: The Role of Inside Directors in Corporate Boards: Balancing Insider Knowledge and External…

Q: Please Write SteP by Step Answer Otherwise I give you DISLIKES !

A: **Step 1: Depreciation Calculation**The depreciation expense per year is calculated using the…

Raghubhai

Step by step

Solved in 2 steps

- An all-equity firm consists of a single project that will produce a perpetual cash flow of either $100M (good state) or $30M (bad state) next year. The probability of the good state is 30 percent. The beta of the asset cash flows is 1.25 and the risk-free rate is 3 percent and the market risk premium is 8 percent. There are 6M shares outstanding. Suppose the firm announces it will issue $40M in debt. The debt has an interest rate of 8 percent, and will mature in 3 years. Because the debt is ___ , any bankruptcy costs would ___ the firm's share price after the announcement. a. Safe, not change b. risky, raise c. risky, lower(a) Equity holders’ investment in the firm is K100 million, and the beta of the equity is 0.6. if the T-bill rate 6 %, and the market risk premium is 8 %. What would be a fair annual profit? (b) Stock XYZ has an expected return of 12 %, and risk of β and = 1.0. Stock ABC is expected to return 13 % with a beta of 1.5. The markets expected return is 11 % and risk free rate is 5 %. Which stock is a better buy? What is the alpha of each stock? Plot the SML and the two stocks and show the alphas of each on the graph? (c) The risk free rate is 8 % and the expected return on the market portfolio is 16 %. A firm is considering a project with an estimated beta of 1.3. What is the required rate of return on the project? If the IRR is of the project is 19 %, what is the project alpha?AnthroPort has a beta of 1.1 and its RWACC is 13.6 percent. The market risk premium is 7.2 percent and the risk-free rate is 2.3 percent. The firm's cash flow at Time 4 is $28,800 with a growth rate of 2.1 percent. What is the value of the firm at Time 4?

- Salalah Oil,has a cost of equity capital equal to 22.8 percent. If the risk-free rate of return is 10 percent and the expected return on the market is 18 percent, then what is the firm's beta. Select one: a. None of these b. 1.20 c. 1.25 d. 1.60Landscapers R Us, Inc., has a beta of 1.6 and is trying to calculate its cost of equity capital. If the risk-free rate of return is 4 percent and the expected return on the market is 10 percent, then what is the firm's cost of equity capital?ABC, Inc. has equity beta of 1.75 with total assets financed with 80% of equity. The expected excess return on the market is 7 percent, and the risk-free rate is 3 percent. The firm is considering cutting total equity to 60% of total value. What would the cost of equity be if the firm meets its target?

- Suppose the Machine Corp. has a capital structure of 80% equity and 20% debt with the following information: a Beta of 1.3, Market Risk Premium of 10%. Kamino's average long term debt pays a 10% annual coupon with ten years to maturity, currently selling for $800 (face value of $1,000). If Kamino's tax rate is 20% and the risk free rate is 2%, what is the Weighted Average Cost of Capital?The FMS Corporation needs to raise investment money amounting to $40 million in new equity. The firm’s market risk is βM = 1.4, which means the firm is believed to be riskier than the market average. The risk free interest rate is 2.8% and the average market return is 9% per year. What is the cost of equity for the $40 million?Assume perfect capital markets. A firm has a market value of $30, 000 and debt of $7, 500 horrowed at 7%. The return on equity is 18%. What is the return on equity if the firm was unlevered? (Hint: Think about WACC, WACCL = WACCU)

- If the financial Manager of Evergreen wants to decrease its cost of capital by adding more debt to its capital structure and arrive at a debt-equity ratio of 0.60. If its debt is in the form of a 6% semiannual bond issue outstanding with 15 years to maturity. The bond currently sells for 95% of its face value of $1000. On the other hand, suppose the risk-free rate is 3% and the market portfolio has an expected return of 9% and the company has a beta of 2. If the tax rate is 40%. Question 1 Calculate the company,s after-tax cost of debt. Question 2 Calculate the company,s cost of equity. Question 3 What would be the company’s overall cost of capital (WACC) at the targeted capital structure of debt equity ratio of 0.60? Question 4 If the company achieves this new cost of capital, would your investment decision change regarding the previous two investment opportunities? Explain your answer.Suppose Mechis Technologies has a capital structure of 40% equity and 60% debt with the following information: a Beta of 0.7, Market Risk Premium of 5%. Mechis's average long term debt pays a 5% annual coupon with fifteen years to maturity, currently selling for $980 (face value of $1,000). If Mechis's tax rate is 15% and the risk free rate is 3%, what is the Weighted Average Cost of Capital?Hardware Co. is estimating its optimal capital structure. Hardware Co. has a capital structure that consists of 80% equity and 20% debt and a corporate tax rate of 40%. Based on the short-term treasury bill rates the risk-free rate is 6% and the market return is 11%. Hardware Co. computed its cost of equity based on the CAPM – 12%. The company will shift its capital structure to 50% debt and 50% equity funded. 1. What is the levered beta on the capital structure of 50% debt and 50% equity funded?