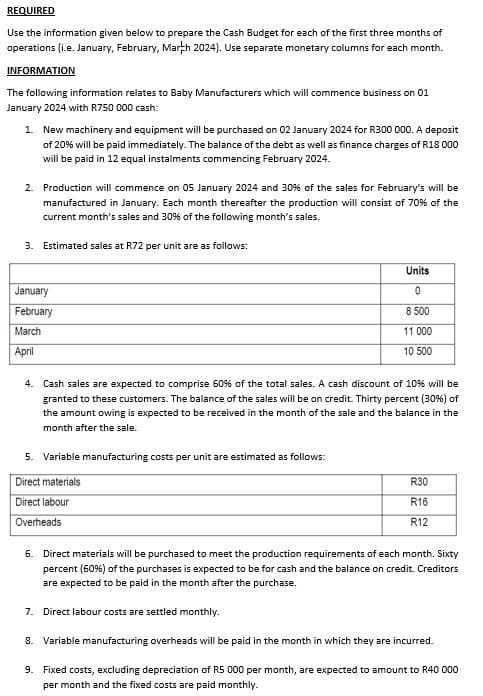

REQUIRED Use the information given below to prepare the Cash Budget for each of the first three months of operations (i.e. January, February, March 2024). Use separate monetary columns for each month. INFORMATION The following information relates to Baby Manufacturers which will commence business on 01 January 2024 with R750 000 cash: 1. New machinery and equipment will be purchased on 02 January 2024 for R300 000. A deposit of 20% will be paid immediately. The balance of the debt as well as finance charges of R18 000 will be paid in 12 equal instalments commencing February 2024. 2. Production will commence on 05 January 2024 and 30% of the sales for February's will be manufactured in January. Each month thereafter the production will consist of 70% of the current month's sales and 30% of the following month's sales. 3. Estimated sales at R72 per unit are as follows: January February March April Units 0 8 500 11 000 10 500 4. Cash sales are expected to comprise 60% of the total sales. A cash discount of 10% will be granted to these customers. The balance of the sales will be on credit. Thirty percent (30%) of the amount owing is expected to be received in the month of the sale and the balance in the month after the sale. 5. Variable manufacturing costs per unit are estimated as follows: Direct materials Direct labour Overheads R30 R16 R12 6. Direct materials will be purchased to meet the production requirements of each month. Sixty percent (60%) of the purchases is expected to be for cash and the balance on credit. Creditors are expected to be paid in the month after the purchase. 7. Direct labour costs are settled monthly. 8. Variable manufacturing overheads will be paid in the month in which they are incurred. 9. Fixed costs, excluding depreciation of R5 000 per month, are expected to amount to R40 000 per month and the fixed costs are paid monthly.

REQUIRED Use the information given below to prepare the Cash Budget for each of the first three months of operations (i.e. January, February, March 2024). Use separate monetary columns for each month. INFORMATION The following information relates to Baby Manufacturers which will commence business on 01 January 2024 with R750 000 cash: 1. New machinery and equipment will be purchased on 02 January 2024 for R300 000. A deposit of 20% will be paid immediately. The balance of the debt as well as finance charges of R18 000 will be paid in 12 equal instalments commencing February 2024. 2. Production will commence on 05 January 2024 and 30% of the sales for February's will be manufactured in January. Each month thereafter the production will consist of 70% of the current month's sales and 30% of the following month's sales. 3. Estimated sales at R72 per unit are as follows: January February March April Units 0 8 500 11 000 10 500 4. Cash sales are expected to comprise 60% of the total sales. A cash discount of 10% will be granted to these customers. The balance of the sales will be on credit. Thirty percent (30%) of the amount owing is expected to be received in the month of the sale and the balance in the month after the sale. 5. Variable manufacturing costs per unit are estimated as follows: Direct materials Direct labour Overheads R30 R16 R12 6. Direct materials will be purchased to meet the production requirements of each month. Sixty percent (60%) of the purchases is expected to be for cash and the balance on credit. Creditors are expected to be paid in the month after the purchase. 7. Direct labour costs are settled monthly. 8. Variable manufacturing overheads will be paid in the month in which they are incurred. 9. Fixed costs, excluding depreciation of R5 000 per month, are expected to amount to R40 000 per month and the fixed costs are paid monthly.

Managerial Accounting

15th Edition

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:Carl Warren, Ph.d. Cma William B. Tayler

Chapter8: Budgeting

Section: Chapter Questions

Problem 5PB: Cash budget The controller of Mercury Shoes Inc. instructs you to prepare a monthly cash budget for...

Related questions

Question

Transcribed Image Text:REQUIRED

Use the information given below to prepare the Cash Budget for each of the first three months of

operations (i.e. January, February, March 2024). Use separate monetary columns for each month.

INFORMATION

The following information relates to Baby Manufacturers which will commence business on 01

January 2024 with R750 000 cash:

1. New machinery and equipment will be purchased on 02 January 2024 for R300 000. A deposit

of 20% will be paid immediately. The balance of the debt as well as finance charges of R18 000

will be paid in 12 equal instalments commencing February 2024.

2. Production will commence on 05 January 2024 and 30% of the sales for February's will be

manufactured in January. Each month thereafter the production will consist of 70% of the

current month's sales and 30% of the following month's sales.

3. Estimated sales at R72 per unit are as follows:

January

February

March

April

Units

0

8 500

11 000

10 500

4. Cash sales are expected to comprise 60% of the total sales. A cash discount of 10% will be

granted to these customers. The balance of the sales will be on credit. Thirty percent (30%) of

the amount owing is expected to be received in the month of the sale and the balance in the

month after the sale.

5. Variable manufacturing costs per unit are estimated as follows:

Direct materials

Direct labour

Overheads

R30

R16

R12

6. Direct materials will be purchased to meet the production requirements of each month. Sixty

percent (60%) of the purchases is expected to be for cash and the balance on credit. Creditors

are expected to be paid in the month after the purchase.

7. Direct labour costs are settled monthly.

8. Variable manufacturing overheads will be paid in the month in which they are incurred.

9. Fixed costs, excluding depreciation of R5 000 per month, are expected to amount to R40 000

per month and the fixed costs are paid monthly.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning