Assume that a company is considering buying a new piece of equipment for $240.000 that would have a useful life of five years and no salvage value. The equipment would generate the following estimated annual revenues and expenses: Revenues Less operating expenses: Commissions Insurance Depreciation. Maintenance Net operating income $ 15,000 5,000 48,000 30,000 $ 137,100 98,000 $ 39,100 Click here to view Exhibit 1281 and Exhibit 120.2. to determine the appropriate discount factor(s) using the tables provided. The internal rate of return for this investment is closest to

Assume that a company is considering buying a new piece of equipment for $240.000 that would have a useful life of five years and no salvage value. The equipment would generate the following estimated annual revenues and expenses: Revenues Less operating expenses: Commissions Insurance Depreciation. Maintenance Net operating income $ 15,000 5,000 48,000 30,000 $ 137,100 98,000 $ 39,100 Click here to view Exhibit 1281 and Exhibit 120.2. to determine the appropriate discount factor(s) using the tables provided. The internal rate of return for this investment is closest to

Excel Applications for Accounting Principles

4th Edition

ISBN:9781111581565

Author:Gaylord N. Smith

Publisher:Gaylord N. Smith

Chapter9: Depreciation (deprec)

Section: Chapter Questions

Problem 1R: Dunedin Drilling Company recently acquired a new machine at a cost of 350,000. The machine has an...

Related questions

Question

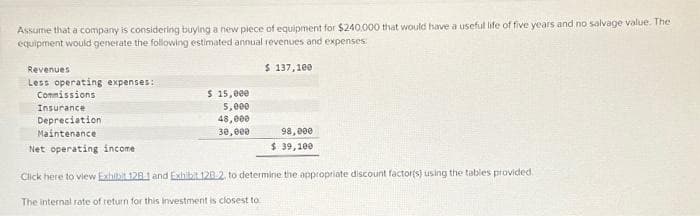

Transcribed Image Text:Assume that a company is considering buying a new piece of equipment for $240,000 that would have a useful life of five years and no salvage value. The

equipment would generate the following estimated annual revenues and expenses:

Revenues

Less operating expenses:

Commissions

Insurance

Depreciation.

Maintenance

Net operating income

$ 15,000

5,000

48,000

30,000

$ 137,100

98,000

$ 39,100

Click here to view Exhibit 128-1 and Exhibit 128.2. to determine the appropriate discount factor(s) using the tables provided.

The internal rate of return for this Investment is closest to

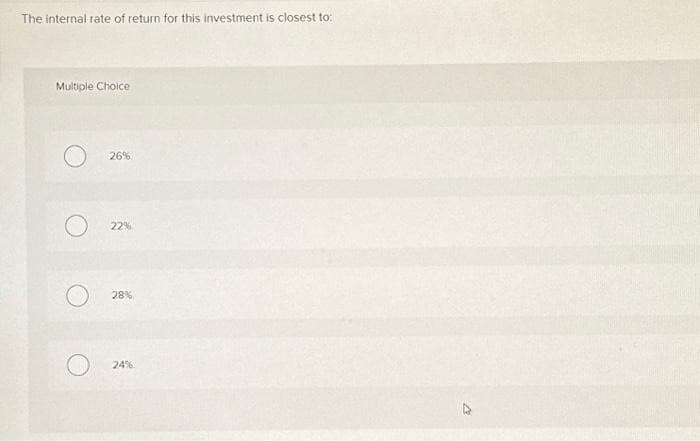

Transcribed Image Text:The internal rate of return for this investment is closest to:

Multiple Choice

O

26%

22%

28%

24%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 2 images

Recommended textbooks for you

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

College Accounting, Chapters 1-27 (New in Account…

Accounting

ISBN:

9781305666160

Author:

James A. Heintz, Robert W. Parry

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

College Accounting, Chapters 1-27 (New in Account…

Accounting

ISBN:

9781305666160

Author:

James A. Heintz, Robert W. Parry

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College