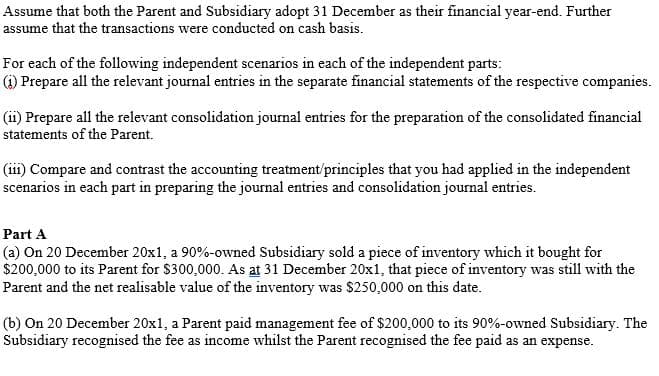

Assume that both the Parent and Subsidiary adopt 31 December as their financial year-end. Further assume that the transactions were conducted on cash basis. For each of the following independent scenarios in each of the independent parts: i) Prepare all the relevant journal entries in the separate financial statements of the respective companies. (ii) Prepare all the relevant consolidation journal entries for the preparation of the consolidated financial statements of the Parent. (iii) Compare and contrast the accounting treatment/principles that you had applied in the independent scenarios in each part in preparing the journal entries and consolidation journal entries. Part A (a) On 20 December 20x1, a 90%-owned Subsidiary sold a piece of inventory which it bought for $200,000 to its Parent for $300,000. As at 31 December 20x1, that piece of inventory was still with the Parent and the net realisable value of the inventory was $250,000 on this date. (b) On 20 December 20x1, a Parent paid management fee of $200,000 to its 90%-owned Subsidiary. The Subsidiary recognised the fee as income whilst the Parent recognised the fee paid as an expense.

Assume that both the Parent and Subsidiary adopt 31 December as their financial year-end. Further assume that the transactions were conducted on cash basis. For each of the following independent scenarios in each of the independent parts: i) Prepare all the relevant journal entries in the separate financial statements of the respective companies. (ii) Prepare all the relevant consolidation journal entries for the preparation of the consolidated financial statements of the Parent. (iii) Compare and contrast the accounting treatment/principles that you had applied in the independent scenarios in each part in preparing the journal entries and consolidation journal entries. Part A (a) On 20 December 20x1, a 90%-owned Subsidiary sold a piece of inventory which it bought for $200,000 to its Parent for $300,000. As at 31 December 20x1, that piece of inventory was still with the Parent and the net realisable value of the inventory was $250,000 on this date. (b) On 20 December 20x1, a Parent paid management fee of $200,000 to its 90%-owned Subsidiary. The Subsidiary recognised the fee as income whilst the Parent recognised the fee paid as an expense.

Auditing: A Risk Based-Approach (MindTap Course List)

11th Edition

ISBN:9781337619455

Author:Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Chapter6: Audit Evidence

Section: Chapter Questions

Problem 15CYBK

Related questions

Question

100%

Transcribed Image Text:Assume that both the Parent and Subsidiary adopt 31 December as their financial year-end. Further

assume that the transactions were conducted on cash basis.

For each of the following independent scenarios in each of the independent parts:

(1) Prepare all the relevant journal entries in the separate financial statements of the respective companies.

(ii) Prepare all the relevant consolidation journal entries for the preparation of the consolidated financial

statements of the Parent.

(iii) Compare and contrast the accounting treatment/principles that you had applied in the independent

scenarios in each part in preparing the journal entries and consolidation journal entries.

Part A

(a) On 20 December 20x1, a 90%-owned Subsidiary sold a piece of inventory which it bought for

$200,000 to its Parent for $300,000. As at 31 December 20x1, that piece of inventory was still with the

Parent and the net realisable value of the inventory was $250,000 on this date.

(b) On 20 December 20x1, a Parent paid management fee of $200,000 to its 90%-owned Subsidiary. The

Subsidiary recognised the fee as income whilst the Parent recognised the fee paid as an expense.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps with 5 images

Recommended textbooks for you

Auditing: A Risk Based-Approach (MindTap Course L…

Accounting

ISBN:

9781337619455

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

Cengage Learning

Auditing: A Risk Based-Approach (MindTap Course L…

Accounting

ISBN:

9781337619455

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

Cengage Learning