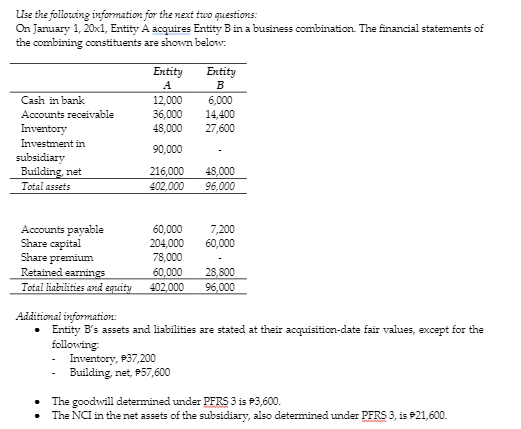

Use the follouing information for the next two questions: On January 1, 20x1, Entity A acquires Entity B in a business combination. The financial statements of the combining constituents are shown below: Entity Entity B Cash in bank Accounts receivable Inventory Investment in 12,000 6,000 36,000 48,000 14,400 27,600 90,000 subsidiary Building net Total assets 216,000 48,000 402.000 96.000 Accounts payable Share capital Share premium Retained earrings Total liabilities and eguity 402,000 96,000 7,200 204,000 60,000 78,000 60,000 60,000 25,800 Adäitional information: Entity B's assets and liabilities are stated at their acquisition-date fair values, except for the following Inventory, P37,200 Building, net, P57,600 The goodwill determined under PFRS 3 is P3,600. The NCI in the net assets of the subsidiary, also determined under PFRS 3, is 921,600.

Use the follouing information for the next two questions: On January 1, 20x1, Entity A acquires Entity B in a business combination. The financial statements of the combining constituents are shown below: Entity Entity B Cash in bank Accounts receivable Inventory Investment in 12,000 6,000 36,000 48,000 14,400 27,600 90,000 subsidiary Building net Total assets 216,000 48,000 402.000 96.000 Accounts payable Share capital Share premium Retained earrings Total liabilities and eguity 402,000 96,000 7,200 204,000 60,000 78,000 60,000 60,000 25,800 Adäitional information: Entity B's assets and liabilities are stated at their acquisition-date fair values, except for the following Inventory, P37,200 Building, net, P57,600 The goodwill determined under PFRS 3 is P3,600. The NCI in the net assets of the subsidiary, also determined under PFRS 3, is 921,600.

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

ChapterA2: Investments

Section: Chapter Questions

Problem 28E

Related questions

Question

100%

How much is the consolidated total assets on January 1, 20x1? *

Transcribed Image Text:LIse the following information for the next two questions:

On January 1, 20x1, Entity A acquires Entity Bin a business combination. The financial statements of

the combining constituents are shown below:

Entity

Entity

A

B

Cash in bank

6,000

14,400

27,600

12,000

Accounts receivable

36,000

48,000

Inventory

Investment in

90,000

subsidiary

Building, net

Total assets

216,000

48,000

96,000

402,000

Accounts payable

Share capital

Share premium

Retained earnings

Total liabilities and equity

60,000

7,200

60,000

204,000

78,000

60,000

402,000

28,800

96,000

Additional information:

• Entity B's assets and liabilities are stated at their acquisition-date fair values, except for the

following

Inventory, P37,200

Building, net, P57,600

The goodwill determined under PFRS 3 is P3,600.

The NCI in the net assets of the subsidiary, also determined under PFRS 3, is P21,600.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Auditing: A Risk Based-Approach (MindTap Course L…

Accounting

ISBN:

9781337619455

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Auditing: A Risk Based-Approach (MindTap Course L…

Accounting

ISBN:

9781337619455

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning