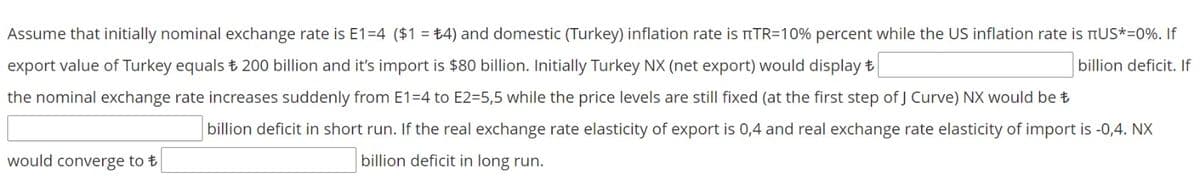

Assume that initially nominal exchange rate is E1=4 ($1 = t4) and domestic (Turkey) inflation rate is nTR=10% percent while the US inflation rate is nUS*=0%. If export value of Turkey equals t 200 billion and it's import is $80 billion. Initially Turkey NX (net export) would display t billion deficit. If the nominal exchange rate increases suddenly from E1=4 to E2=5,5 while the price levels are still fixed (at the first step of J Curve) NX would be t billion deficit in short run. If the real exchange rate elasticity of export is 0,4 and real exchange rate elasticity of import is -0,4. NX would converge to t billion deficit in long run.

Assume that initially nominal exchange rate is E1=4 ($1 = t4) and domestic (Turkey) inflation rate is nTR=10% percent while the US inflation rate is nUS*=0%. If export value of Turkey equals t 200 billion and it's import is $80 billion. Initially Turkey NX (net export) would display t billion deficit. If the nominal exchange rate increases suddenly from E1=4 to E2=5,5 while the price levels are still fixed (at the first step of J Curve) NX would be t billion deficit in short run. If the real exchange rate elasticity of export is 0,4 and real exchange rate elasticity of import is -0,4. NX would converge to t billion deficit in long run.

Brief Principles of Macroeconomics (MindTap Course List)

8th Edition

ISBN:9781337091985

Author:N. Gregory Mankiw

Publisher:N. Gregory Mankiw

Chapter13: Open-economy Macroeconomics: Basic Concepts

Section: Chapter Questions

Problem 9PA

Related questions

Question

Complete the blank spaces in the sentences.

Transcribed Image Text:Assume that initially nominal exchange rate is E1=4 ($1 = ±4) and domestic (Turkey) inflation rate is TTR=10% percent while the US inflation rate is nUS*=0%. If

export value of Turkey equals t 200 billion and it's import is $80 billion. Initially Turkey NX (net export) would display t

billion deficit. If

the nominal exchange rate increases suddenly from E1=4 to E2=5,5 while the price levels are still fixed (at the first step of J Curve) NX would be t

billion deficit in short run. If the real exchange rate elasticity of export is 0,4 and real exchange rate elasticity of import is -0,4. NX

would converge to t

billion deficit in long run.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Brief Principles of Macroeconomics (MindTap Cours…

Economics

ISBN:

9781337091985

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Brief Principles of Macroeconomics (MindTap Cours…

Economics

ISBN:

9781337091985

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning