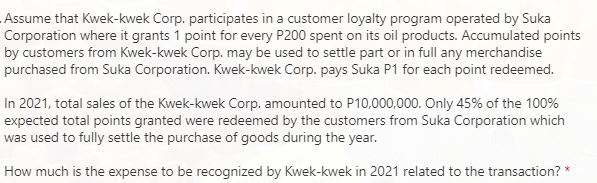

Assume that Kwek-kwek Corp. participates in a customer loyalty program operated by Suka Corporation where it grants 1 point for every P200 spent on its oil products. Accumulated points by customers from Kwek-kwek Corp. may be used to settle part or in full any merchandise purchased from Suka Corporation. Kwek-kwek Corp. pays Suka P1 for each point redeemed. In 2021, total sales of the Kwek-kwek Corp. amounted to P10,000,000. Only 45% of the 100% expected total points granted were redeemed by the customers from Suka Corporation which was used to fully settle the purchase of goods during the year. How much is the expense to be recognized by Kwek-kwek in 2021 related to the transaction? *

Assume that Kwek-kwek Corp. participates in a customer loyalty program operated by Suka Corporation where it grants 1 point for every P200 spent on its oil products. Accumulated points by customers from Kwek-kwek Corp. may be used to settle part or in full any merchandise purchased from Suka Corporation. Kwek-kwek Corp. pays Suka P1 for each point redeemed. In 2021, total sales of the Kwek-kwek Corp. amounted to P10,000,000. Only 45% of the 100% expected total points granted were redeemed by the customers from Suka Corporation which was used to fully settle the purchase of goods during the year. How much is the expense to be recognized by Kwek-kwek in 2021 related to the transaction? *

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter17: Advanced Issues In Revenue Recognition

Section: Chapter Questions

Problem 19E: Rix Company sells home appliances and provides installation and service for its customers. On April...

Related questions

Question

p10

Transcribed Image Text:Assume that Kwek-kwek Corp. participates in a customer loyalty program operated by Suka

Corporation where it grants 1 point for every P200 spent on its oil products. Accumulated points

by customers from Kwek-kwek Corp. may be used to settle part or in full any merchandise

purchased from Suka Corporation. Kwek-kwek Corp. pays Suka P1 for each point redeemed.

In 2021, total sales of the Kwek-kwek Corp. amounted to P10,000,000. Only 45% of the 100%

expected total points granted were redeemed by the customers from Suka Corporation which

was used to fully settle the purchase of goods during the year.

How much is the expense to be recognized by Kwek-kwek in 2021 related to the transaction? *

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT