In December 2020, Joe's Company, engaged into a factoring armangement with Gaba's Bank (factor), where Joe transferred accounts receivable that had a book value of S400.000. The transfer was made with recourse. In return, Gaba remitted to Joe cash equal to 85% of the factored amount, Gaba retained the remaining 159% to cover its factoring fee of 3% of the factored amount and to provide a cushion against potential sales returns and allowances. After Gaba has collected cash equal to the amount advanced to Joe plus the factoring fee, Gaba will remit the excess to Joe. Therefore, Joe has a beneficial interest in the transferred receivables equal to the fair value of the last 15% of the receivables to be collected, which management estimates to equal $45,000 less the 3% factoring fee. Management estimates the fair value of the recourse obligation to be $4,000. Required: 1. Prepare the journal entry that Joe's Company would need to make to record the transaction

In December 2020, Joe's Company, engaged into a factoring armangement with Gaba's Bank (factor), where Joe transferred accounts receivable that had a book value of S400.000. The transfer was made with recourse. In return, Gaba remitted to Joe cash equal to 85% of the factored amount, Gaba retained the remaining 159% to cover its factoring fee of 3% of the factored amount and to provide a cushion against potential sales returns and allowances. After Gaba has collected cash equal to the amount advanced to Joe plus the factoring fee, Gaba will remit the excess to Joe. Therefore, Joe has a beneficial interest in the transferred receivables equal to the fair value of the last 15% of the receivables to be collected, which management estimates to equal $45,000 less the 3% factoring fee. Management estimates the fair value of the recourse obligation to be $4,000. Required: 1. Prepare the journal entry that Joe's Company would need to make to record the transaction

Chapter11: Property Dispositions

Section: Chapter Questions

Problem 84TA

Related questions

Question

Please help me to solve this problem

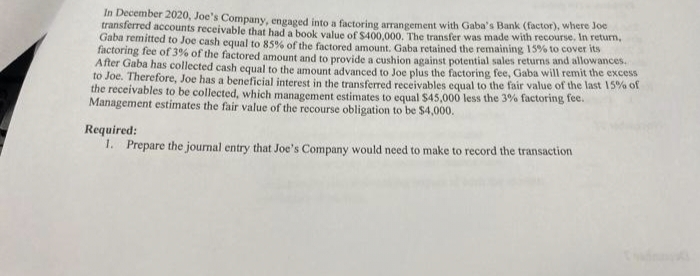

Transcribed Image Text:In December 2020, Joe's Company, engaged into a factoring arrangement with Gaba's Bank (factor), where Joe

transferred accounts receivable that had a book value of S400.000, The transfer was made with recourse. In return,

Gaba remitted to Joe cash equal to 85% of the factored amount. Gaba retained the remaining 15% to cover its

factoring fee of 3% of the factored amount and to provide a cushion against potential sales returns and allowances.

After Gaba has collected cash equal to the amount advanced to Joe plus the factoring fee, Gaba will remit the excess

to Joe. Therefore, Joe has a beneficial interest in the transferred receivables equal to the fair value of the last 15% of

the receivables to be collected, which management estimates to equal $45,000 less the 3% factoring fee.

Management estimates the fair value of the recourse obligation to be $4,000.

Required:

1. Prepare the journal entry that Joe's Company would need to make to record the transaction

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning