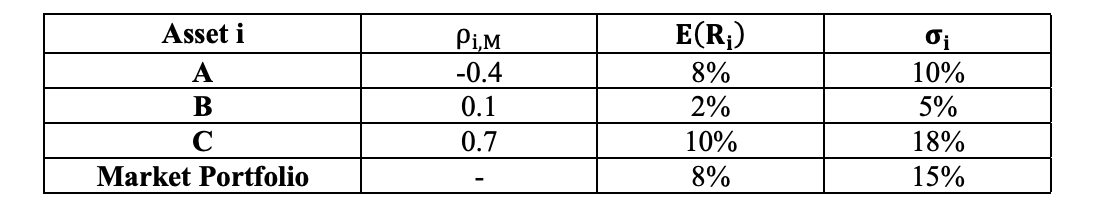

Assume that the CAPM holds. Although you currently own shares of two well-known securities, A and B, you are interested in improving upon your portfolio of assets. From the currently available information, you are aware that the average historical market risk premium is 5.3% and that the return on T-Bills is 3%. You also have the following data: image a) Asset A is undervalued and therefore I will long the asset. b) Asset B is overvalued and therefore I will short the asset. c) Asset C is undervalued and therefore I will long the asset. d) a) and d) are true. e) None of the above. Pls show procedure, thanks

Assume that the CAPM holds. Although you currently own shares of two well-known securities, A and B, you are interested in improving upon your portfolio of assets. From the currently available information, you are aware that the average historical market risk premium is 5.3% and that the return on T-Bills is 3%. You also have the following data: image a) Asset A is undervalued and therefore I will long the asset. b) Asset B is overvalued and therefore I will short the asset. c) Asset C is undervalued and therefore I will long the asset. d) a) and d) are true. e) None of the above. Pls show procedure, thanks

Chapter12: Capital Structure

Section: Chapter Questions

Problem 1PROB

Related questions

Question

Assume that the CAPM holds. Although you currently own shares of two well-known securities, A and B, you are interested in improving upon your portfolio of assets. From the currently available information, you are aware that the average historical market risk premium is 5.3% and that the return on T-Bills is 3%. You also have the following data: image

a) Asset A is undervalued and therefore I will long the asset.

b) Asset B is overvalued and therefore I will short the asset.

c) Asset C is undervalued and therefore I will long the asset.

d) a) and d) are true.

e) None of the above.

Pls show procedure, thanks

Transcribed Image Text:Asset i

E(R¡)

Pi,M

-0.4

10%

5%

A

8%

В

0.1

2%

C

0.7

10%

18%

Market Portfolio

8%

15%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 5 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you