Assume that the City of Coyote has produced its financial statements for December 31, 2020, and the year then ended. The city’s general fund was only used to monitor education and parks. Its capital projects funds worked in connection with each of these functions at times during the current year. The city also maintained an enterprise fund to account for its art museum. The government-wide financial statements provide the following figures: Education reports net expenses of $646,000. Parks reports net expenses of

Assume that the City of Coyote has produced its financial statements for December 31, 2020, and the year then ended. The city’s general fund was only used to monitor education and parks. Its capital projects funds worked in connection with each of these functions at times during the current year. The city also maintained an enterprise fund to account for its art museum.

The government-wide financial statements provide the following figures:

- Education reports net expenses of $646,000.

- Parks reports net expenses of $180,000.

- Art museum reports net revenues of $61,000.

- General government revenues for the year were $941,000 with an overall increase in the city's net position of $176,000.

The fund financial statements provide the following for the entire year:

- The general fund reports a $51,500 increase in its fund balance.

- The capital projects fund reports a $52,250 increase in its fund balance.

- The enterprise fund reports a $69,500 increase in its net position.

The city asks the CPA firm of Abernethy and Chapman to examine several transactions that occurred during 2020 and indicate how to correct any erroneous reporting. Officials also want to know the effect of each error. View each of the following situations as independent.

During 2020, the City of Coyote contracts to build a bus stop for schoolchildren costing $15,200 as a special assessments project. The city collects $15,200 from directly affected citizens. The government has no obligation in connection with this project. The city records both a $15,200 revenue and a $15,200 expenditure in the capital projects fund. In preparing government-wide financial statements, the city records an asset and a general revenue for $15,200.

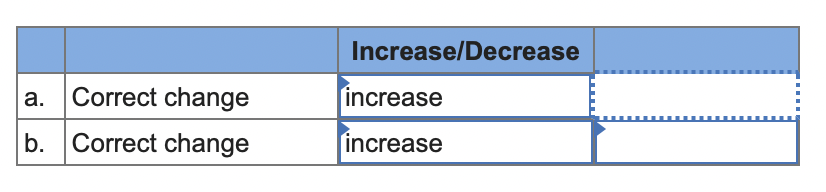

- In the general information, the capital projects fund reports a $52,250 increase in its fund balance for the year. What was the correct change in the capital projects fund balance during 2020?

- In the general information, a $176,000 overall increase in the city’s net position was found on the government-wide financial statements. What was the correct overall change in the city’s net position on the government-wide financial statements?

Trending now

This is a popular solution!

Step by step

Solved in 2 steps