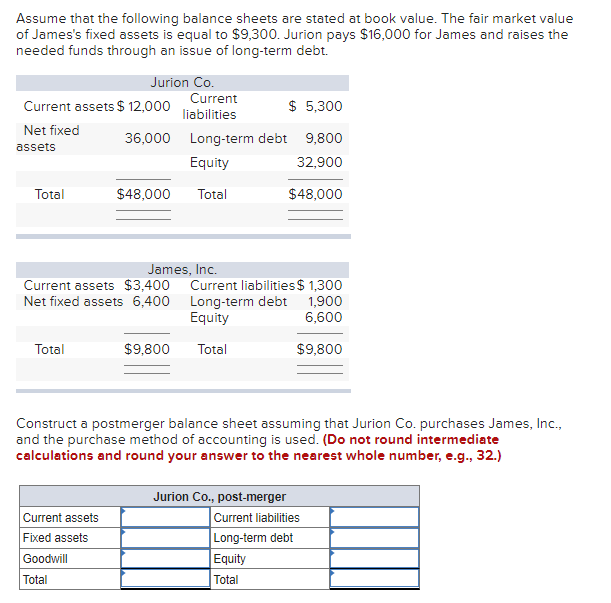

Assume that the following balance sheets are stated at book value. The fair market value of James's fixed assets is equal to $9,300. Jurion pays $16,000 for James and raises the needed funds through an issue of long-term debt. Jurion Co. Current liabilities Current assets $ 12,000 $ 5,300 Net fixed 36,000 Long-term debt 9,800 assets Equity 32,900 Total $48,000 Total $48,000 James, Inc. Current assets $3,400 Net fixed assets 6,400 Current liabilities$ 1,300 Long-term debt 1,900 Equity 6,600 Total $9,800 Total $9,800 Construct a postmerger balance sheet assuming that Jurion Co. purchases James, Inc., and the purchase method of accounting is used. (Do not round intermediate calculations and round your answer to the nearest whole number, e.g., 32.) Jurion Co., post-merger Current liabilities Long-term debt Equity Current assets Fixed assets Goodwill Total Total

Assume that the following balance sheets are stated at book value. The fair market value of James's fixed assets is equal to $9,300. Jurion pays $16,000 for James and raises the needed funds through an issue of long-term debt. Jurion Co. Current liabilities Current assets $ 12,000 $ 5,300 Net fixed 36,000 Long-term debt 9,800 assets Equity 32,900 Total $48,000 Total $48,000 James, Inc. Current assets $3,400 Net fixed assets 6,400 Current liabilities$ 1,300 Long-term debt 1,900 Equity 6,600 Total $9,800 Total $9,800 Construct a postmerger balance sheet assuming that Jurion Co. purchases James, Inc., and the purchase method of accounting is used. (Do not round intermediate calculations and round your answer to the nearest whole number, e.g., 32.) Jurion Co., post-merger Current liabilities Long-term debt Equity Current assets Fixed assets Goodwill Total Total

Financial Reporting, Financial Statement Analysis and Valuation

8th Edition

ISBN:9781285190907

Author:James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Chapter7: Financial Activities

Section: Chapter Questions

Problem 6QE

Related questions

Question

Transcribed Image Text:Assume that the following balance sheets are stated at book value. The fair market value

of James's fixed assets is equal to $9,300. Jurion pays $16,000 for James and raises the

needed funds through an issue of long-term debt.

Jurion Co.

Current

Current assets $ 12,000

$ 5,300

liabilities

Net fixed

36,000 Long-term debt

9,800

assets

Equity

32,900

Total

$48,000

Total

$48,000

James, Inc.

Current assets $3,400 Current liabilities$ 1,300

Net fixed assets 6,400 Long-term debt 1,900

Equity

6,600

Total

$9,800

Total

$9,800

Construct a postmerger balance sheet assuming that Jurion Co. purchases James, Inc.,

and the purchase method of accounting is used. (Do not round intermediate

calculations and round your answer to the nearest whole number, e.g., 32.)

Jurion Co., post-merger

Current assets

Fixed assets

Current liabilities

Long-term debt

Goodwill

Equity

Total

Total

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning