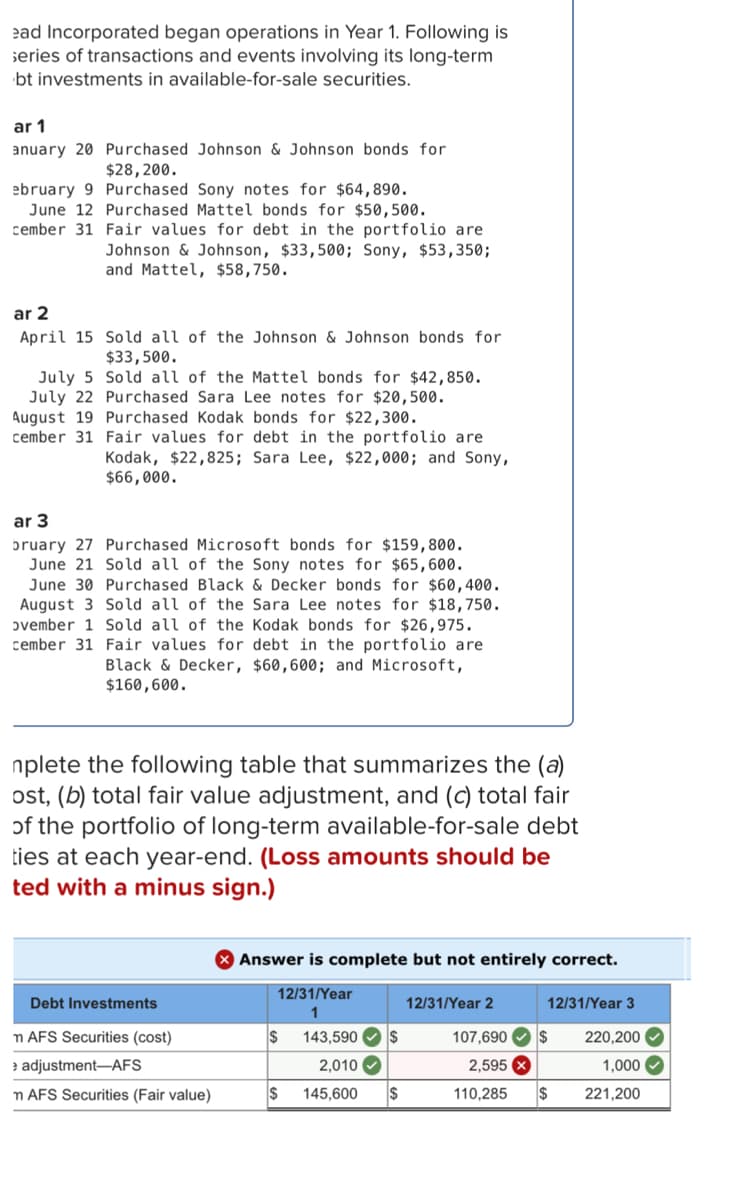

Mead Incorporated began operations in Year 1. Following is a series of transactions and events involving its long-term debt investments in available-for-sale securities. Year 1 January 20 Purchased Johnson & Johnson bonds for $28,200. February 9 Purchased Sony notes for $64,890. June 12 Purchased Mattel bonds for $50,500. December 31 Fair values for debt in the portfolio are Johnson & Johnson, $33,500; Sony, $53,350; and Mattel, $58,750. Year 2 April 15 Sold all of the Johnson & Johnson bonds for $33,500. July 5 Sold all of the Mattel bonds for $42,850. July 22 Purchased Sara Lee notes for $20,500. August 19 Purchased Kodak bonds for $22,300. December 31 Fair values for debt in the portfolio are Kodak, $22,825; Sara Lee, $22,000; and Sony, $66,000. Year 3 February 27 Purchased Microsoft bonds for $159,800. June 21 Sold all of the Sony notes for $65,600. June 30 Purchased Black & Decker bonds for $60,400. August 3 Sold all of the Sara Lee notes for $18,750. November 1 Sold all of the Kodak bonds for $26,975. December 31 Fair values for debt in the portfolio are Black & Decker, $60,600; and Microsoft, $160,600. 2. Complete the following table that summarizes the (a) total cost, (b) total fair value adjustment, and (c) total fair value of the portfolio of long-term available-for-sale debt securities at each year-end. (Loss amounts should be indicated with a minus sign.)

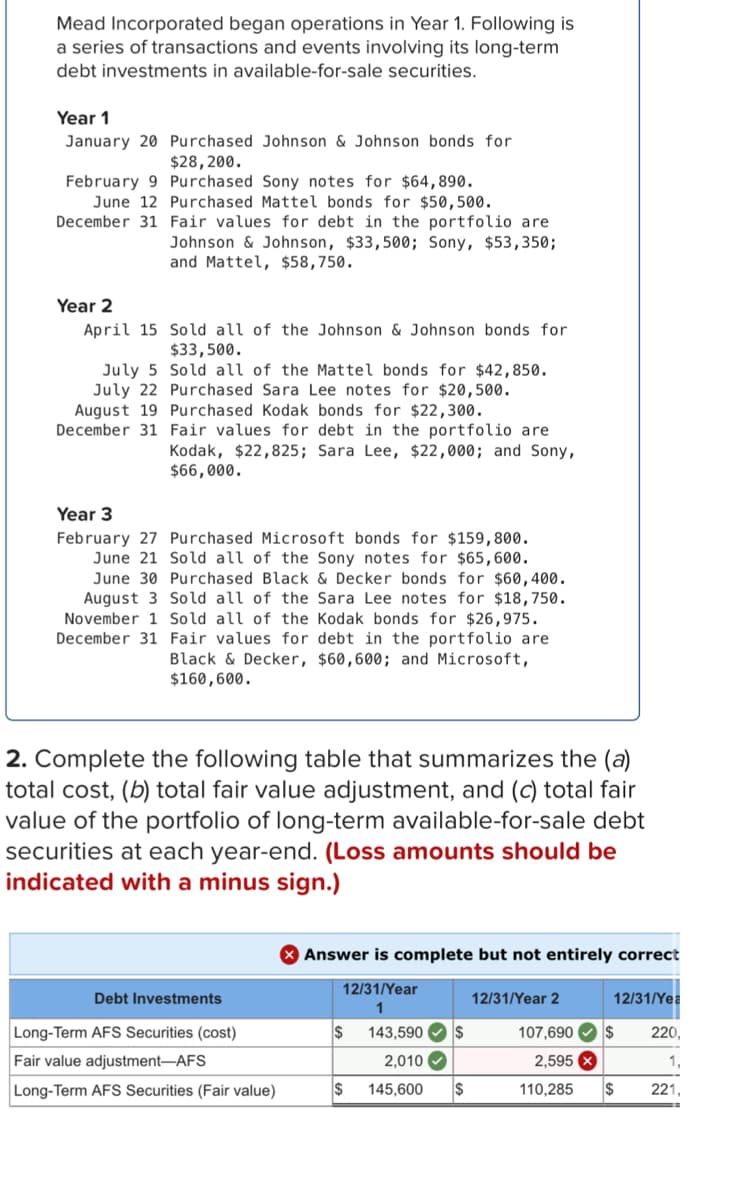

Mead Incorporated began operations in Year 1. Following is a series of transactions and events involving its long-term debt investments in available-for-sale securities. Year 1 January 20 Purchased Johnson & Johnson bonds for $28,200. February 9 Purchased Sony notes for $64,890. June 12 Purchased Mattel bonds for $50,500. December 31 Fair values for debt in the portfolio are Johnson & Johnson, $33,500; Sony, $53,350; and Mattel, $58,750. Year 2 April 15 Sold all of the Johnson & Johnson bonds for $33,500. July 5 Sold all of the Mattel bonds for $42,850. July 22 Purchased Sara Lee notes for $20,500. August 19 Purchased Kodak bonds for $22,300. December 31 Fair values for debt in the portfolio are Kodak, $22,825; Sara Lee, $22,000; and Sony, $66,000. Year 3 February 27 Purchased Microsoft bonds for $159,800. June 21 Sold all of the Sony notes for $65,600. June 30 Purchased Black & Decker bonds for $60,400. August 3 Sold all of the Sara Lee notes for $18,750. November 1 Sold all of the Kodak bonds for $26,975. December 31 Fair values for debt in the portfolio are Black & Decker, $60,600; and Microsoft, $160,600. 2. Complete the following table that summarizes the (a) total cost, (b) total fair value adjustment, and (c) total fair value of the portfolio of long-term available-for-sale debt securities at each year-end. (Loss amounts should be indicated with a minus sign.)

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter14: Financing Liabilities: Bonds And Long-term Notes Payable

Section: Chapter Questions

Problem 21E: On July 2, 2018, McGraw Corporation issued 500,000 of convertible bonds. Each 1,000 bond could be...

Related questions

Question

Transcribed Image Text:ead Incorporated began operations in Year 1. Following is

series of transactions and events involving its long-term

bt investments in available-for-sale securities.

ar 1

anuary 20 Purchased Johnson & Johnson bonds for

$28,200.

ebruary 9

Purchased Sony notes for $64,890.

June 12 Purchased Mattel bonds for $50,500.

cember 31 Fair values for debt in the portfolio are

Johnson & Johnson, $33,500; Sony, $53,350;

and Mattel, $58,750.

ar 2

April 15

Sold all of the Johnson & Johnson bonds for

$33,500.

July 5 Sold all of the Mattel bonds for $42,850.

July 22 Purchased Sara Lee notes for $20,500.

August 19 Purchased Kodak bonds for $22,300.

cember 31

Fair values for debt in the portfolio are

Kodak, $22,825; Sara Lee, $22,000; and Sony,

$66,000.

ar 3

bruary 27 Purchased Microsoft bonds for $159,800.

June 21 Sold all of the Sony notes for $65,600.

June 30 Purchased Black & Decker bonds for $60,400.

August 3 Sold all of the Sara Lee notes for $18,750.

ovember 1 Sold all of the Kodak bonds for $26,975.

cember 31 Fair values for debt in the portfolio are

Black & Decker, $60,600; and Microsoft,

$160,600.

nplete the following table that summarizes the (a)

ost, (b) total fair value adjustment, and (c) total fair

of the portfolio of long-term available-for-sale debt

ties at each year-end. (Loss amounts should be

ted with a minus sign.)

Debt Investments

n AFS Securities (cost)

> adjustment-AFS

n AFS Securities (Fair value)

Answer is complete but not entirely correct.

12/31/Year

1

$ 143,590

$

2,010✔

145,600

$

$

12/31/Year 2

107,690

2,595 x

110,285

12/31/Year 3

$ 220,200✔

1,000

221,200

$

Transcribed Image Text:Mead Incorporated began operations in Year 1. Following is

a series of transactions and events involving its long-term

debt investments in available-for-sale securities.

Year 1

January 20 Purchased Johnson & Johnson bonds for

$28,200.

Purchased Sony notes for $64,890.

Purchased Mattel bonds for $50,500.

Fair values for debt in the portfolio are

Johnson & Johnson, $33,500; Sony, $53,350;

and Mattel, $58,750.

February 9

June 12

December 31

Year 2

April 15

Sold all of the Johnson & Johnson bonds for

$33,500.

July 5

Sold all of the Mattel bonds for $42,850.

July 22 Purchased Sara Lee notes for $20,500.

August 19 Purchased Kodak bonds for $22,300.

December 31

Fair values for debt in the portfolio are

Kodak, $22,825; Sara Lee, $22,000; and Sony,

$66,000.

Year 3

February 27 Purchased Microsoft bonds for $159,800.

June 21 Sold all of the Sony notes for $65,600.

June 30 Purchased Black & Decker bonds for $60,400.

August 3 Sold all of the Sara Lee notes for $18,750.

November 1 Sold all of the Kodak bonds for $26,975.

December 31 Fair values for debt in the portfolio are

Black & Decker, $60,600; and Microsoft,

$160,600.

2. Complete the following table that summarizes the (a)

total cost, (b) total fair value adjustment, and (c) total fair

value of the portfolio of long-term available-for-sale debt

securities at each year-end. (Loss amounts should be

indicated with a minus sign.)

Debt Investments

Long-Term AFS Securities (cost)

Fair value adjustment-AFS

Long-Term AFS Securities (Fair value)

Answer is complete but not entirely correct

12/31/Year

1

$ 143,590✔ $

2,010

$ 145,600 $

12/31/Year 2

12/31/Yea

107,690 $ 220,

2,595 x

1,

221,

110,285

$

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning