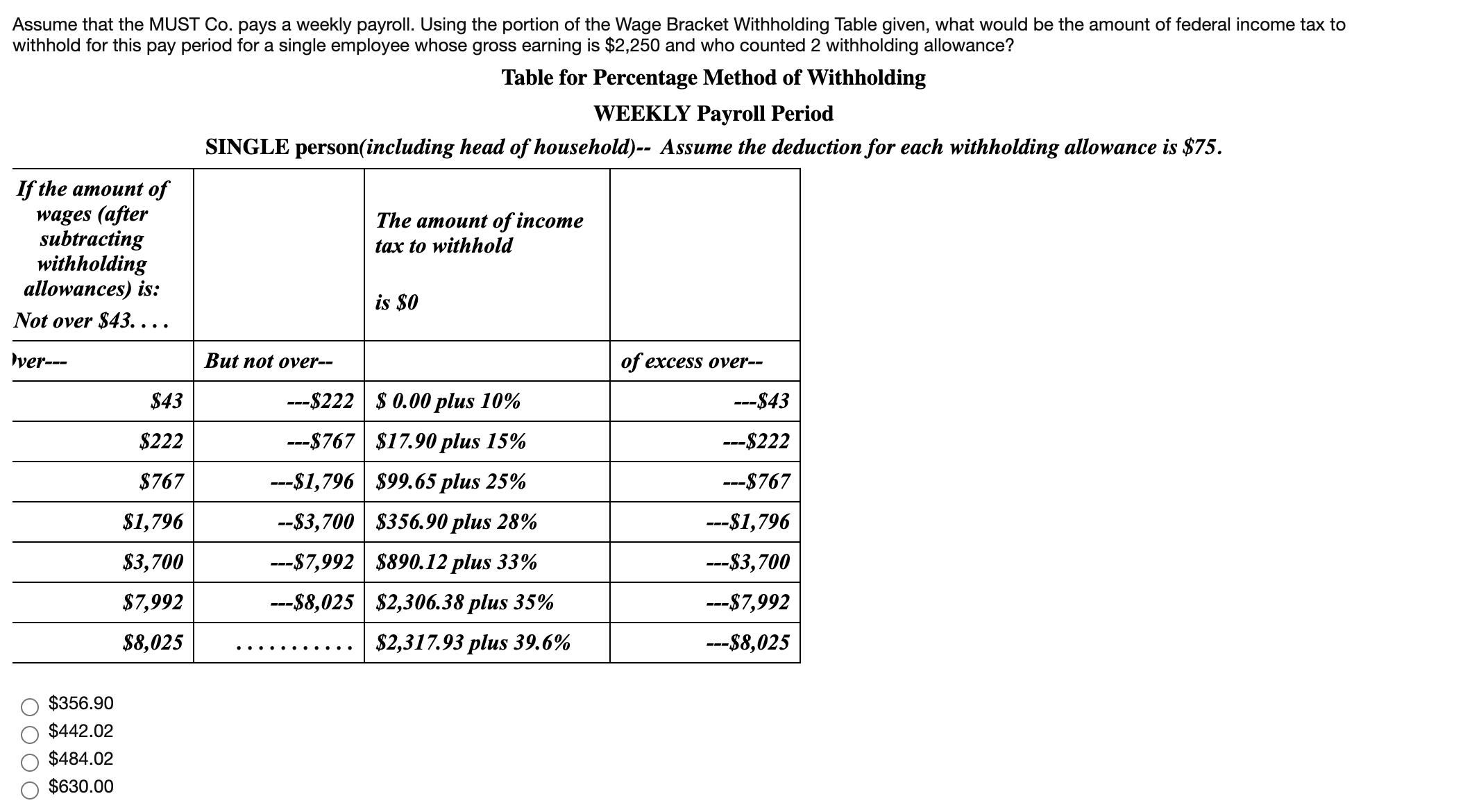

Assume that the MUST Co. pays a weekly payroll. Using the portion of the Wage Bracket Withholding Table given, what would be the amount of federal income tax to withhold for this pay period for a single employee whose gross earning is $2,250 and who counted 2 withholding allowance? Table for Percentage Method of Withholding WEEKLY Payroll Period SINGLE person(including head of household)-- Assume the deduction for each withholding allowance is $75. If the amount of wages (after subtracting withholding allowances) is: The amount of income tax to withhold is $0 Not over $43. . . ver--- But not over-- of excess over-- $43 --$222 | $ 0.00 plus 10% ---$43 $222 ---$767 $17.90 plus 15% --$222 $767 --$1,796| $99.65 plus 25% ---$767 $1,796 --$3,700 $356.90 plus 28% ---$1,796 $3,700 ---87,992 | $890.12 plus 33% --S3,700 $7,992 ---$8,025 | $2,306.38 plus 35% ---$7,992 $8,025 $2,317.93 plus 39.6% ---$8,025 $356.90 $442.02 $484.02 $630.00

Assume that the MUST Co. pays a weekly payroll. Using the portion of the Wage Bracket Withholding Table given, what would be the amount of federal income tax to withhold for this pay period for a single employee whose gross earning is $2,250 and who counted 2 withholding allowance? Table for Percentage Method of Withholding WEEKLY Payroll Period SINGLE person(including head of household)-- Assume the deduction for each withholding allowance is $75. If the amount of wages (after subtracting withholding allowances) is: The amount of income tax to withhold is $0 Not over $43. . . ver--- But not over-- of excess over-- $43 --$222 | $ 0.00 plus 10% ---$43 $222 ---$767 $17.90 plus 15% --$222 $767 --$1,796| $99.65 plus 25% ---$767 $1,796 --$3,700 $356.90 plus 28% ---$1,796 $3,700 ---87,992 | $890.12 plus 33% --S3,700 $7,992 ---$8,025 | $2,306.38 plus 35% ---$7,992 $8,025 $2,317.93 plus 39.6% ---$8,025 $356.90 $442.02 $484.02 $630.00

College Accounting (Book Only): A Career Approach

12th Edition

ISBN:9781305084087

Author:Cathy J. Scott

Publisher:Cathy J. Scott

Chapter8: Employer Taxes, Payments, And Reports

Section: Chapter Questions

Problem 3E

Related questions

Question

Transcribed Image Text:Assume that the MUST Co. pays a weekly payroll. Using the portion of the Wage Bracket Withholding Table given, what would be the amount of federal income tax to

withhold for this pay period for a single employee whose gross earning is $2,250 and who counted 2 withholding allowance?

Table for Percentage Method of Withholding

WEEKLY Payroll Period

SINGLE person(including head of household)-- Assume the deduction for each withholding allowance is $75.

If the amount of

wages (after

subtracting

withholding

allowances) is:

The amount of income

tax to withhold

is $0

Not over $43. . .

ver---

But not over--

of excess over--

$43

--$222 | $ 0.00 plus 10%

---$43

$222

---$767 $17.90 plus 15%

--$222

$767

--$1,796| $99.65 plus 25%

---$767

$1,796

--$3,700 $356.90 plus 28%

---$1,796

$3,700

---87,992 | $890.12 plus 33%

--S3,700

$7,992

---$8,025 | $2,306.38 plus 35%

---$7,992

$8,025

$2,317.93 plus 39.6%

---$8,025

$356.90

$442.02

$484.02

$630.00

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781305084087

Author:

Cathy J. Scott

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781305084087

Author:

Cathy J. Scott

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage