Compute the Federal income tax withholding for each employee using the percentage method in Appendix C. Assume that no pre- deductions exist for any employee. (Round your intermediate calculations and final answers to 2 decimal places.) Marital Status No. of Pay Exemptions Frequency Weekly Pay Amount Federal Income Tax Employee S. Turner 6. 4,700 $ 2,371.95 D. McGorray 10 Monthly 2$ 23,500 A. Kennedy 14 Daily $ 1,350 R. Thomas M. Annually $ 120,000

Compute the Federal income tax withholding for each employee using the percentage method in Appendix C. Assume that no pre- deductions exist for any employee. (Round your intermediate calculations and final answers to 2 decimal places.) Marital Status No. of Pay Exemptions Frequency Weekly Pay Amount Federal Income Tax Employee S. Turner 6. 4,700 $ 2,371.95 D. McGorray 10 Monthly 2$ 23,500 A. Kennedy 14 Daily $ 1,350 R. Thomas M. Annually $ 120,000

Century 21 Accounting Multicolumn Journal

11th Edition

ISBN:9781337679503

Author:Gilbertson

Publisher:Gilbertson

Chapter12: Preparing Payroll Records

Section: Chapter Questions

Problem 3AP

Related questions

Question

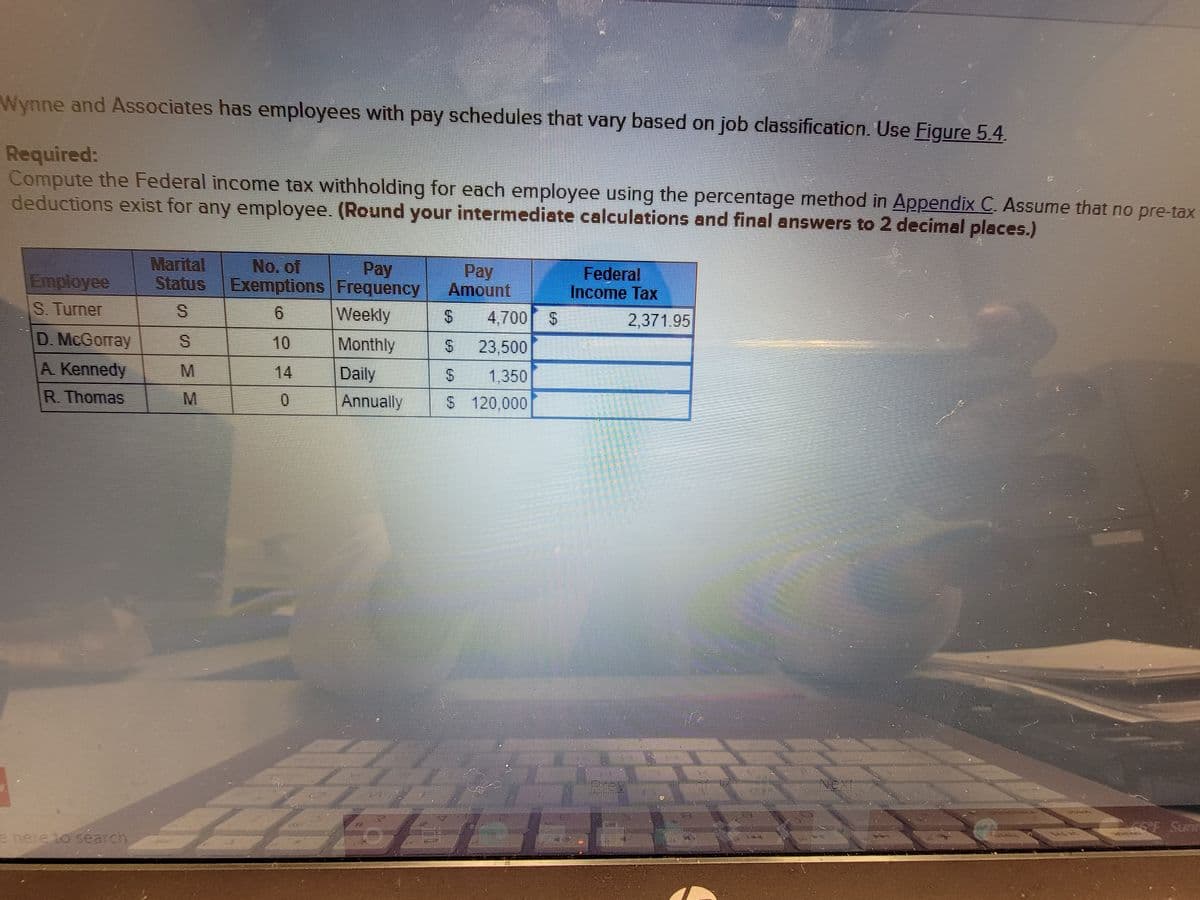

Transcribed Image Text:Wynne and Associates has employees with pay schedules that vary based on job classification. Use Figure 5.4.

Required:

Compute the Federal income tax withholding for each employee using the percentage method in Appendix C. Assume that no pre-tax

deductions exist for any employee. (Round your intermediate calculations and final answers to 2 decimal places.)

Marital

Status

No. of

Pay

Exemptions Frequency

Weekly

Monthly

Pay

Amount

Federal

Income Tax

Employee

S. Turner

9.

S.

4,700 S

2,371.95

D. McGorray

A Kennedy

10

23,500

M.

14.

Daily

1,350

R. Thomas

M

0.

Annually

S 120,000

66F Sunn

e nere to séarch

%24

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781305084087

Author:

Cathy J. Scott

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

College Accounting, Chapters 1-27 (New in Account…

Accounting

ISBN:

9781305666160

Author:

James A. Heintz, Robert W. Parry

Publisher:

Cengage Learning