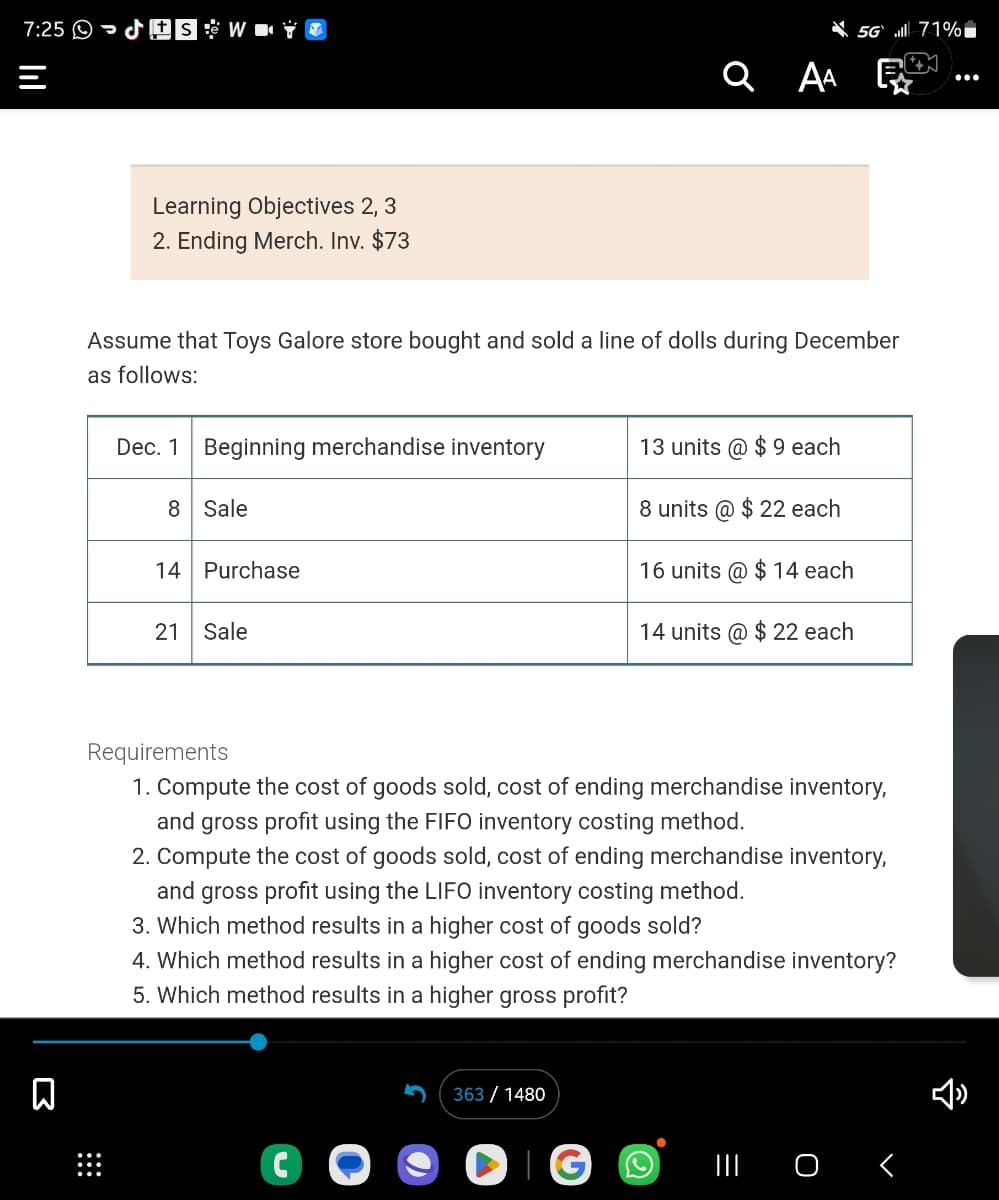

Assume that Toys Galore store bought and sold a line of dolls during December as follows: Dec. 1 Beginning merchandise inventory 8 Sale 14 Purchase 21 Sale 13 units @ $9 each 8 units @ $22 each 16 units @ $ 14 each 14 units @ $ 22 each

Assume that Toys Galore store bought and sold a line of dolls during December as follows: Dec. 1 Beginning merchandise inventory 8 Sale 14 Purchase 21 Sale 13 units @ $9 each 8 units @ $22 each 16 units @ $ 14 each 14 units @ $ 22 each

Corporate Financial Accounting

14th Edition

ISBN:9781305653535

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Carl Warren, James M. Reeve, Jonathan Duchac

Chapter6: Inventories

Section: Chapter Questions

Problem 6.2BE: Perpetual inventory using FIFO Beginning inventory, purchases, and sales for Item Zeta9 are as...

Related questions

Question

Transcribed Image Text:7:25SW YO

□

Learning Objectives 2, 3

2. Ending Merch. Inv. $73

Dec. 1 Beginning merchandise inventory

Assume that Toys Galore store bought and sold a line of dolls during December

as follows:

8 Sale

14 Purchase

21 Sale

QAA

C

363/ 1480

13 units @ $9 each

8 units @ $ 22 each

16 units @ $ 14 each

5G 71%

14 units @ $22 each

Requirements

1. Compute the cost of goods sold, cost of ending merchandise inventory,

and gross profit using the FIFO inventory costing method.

2. Compute the cost of goods sold, cost of ending merchandise inventory,

and gross profit using the LIFO inventory costing method.

3. Which method results in a higher cost of goods sold?

4. Which method results in a higher cost of ending merchandise inventory?

5. Which method results in a higher gross profit?

GO ||| 0 <

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Accounting (Text Only)

Accounting

ISBN:

9781285743615

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781337398169

Author:

Carl Warren, Jeff Jones

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Accounting (Text Only)

Accounting

ISBN:

9781285743615

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781337398169

Author:

Carl Warren, Jeff Jones

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781337119207

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning