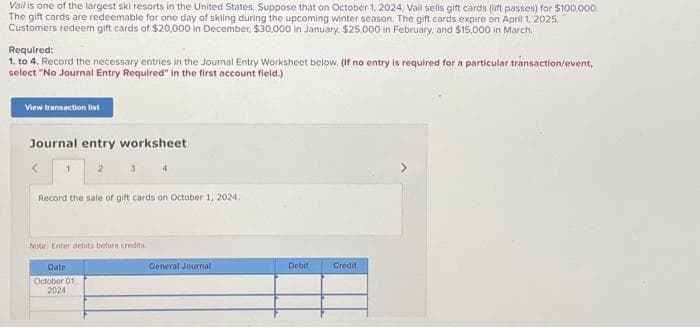

Vail is one of the largest ski resorts in the United States. Suppose that on October 1, 2024, Vall sells gift cards (lift passes) for $100,000. The gift cards are redeemable for one day of skiing during the upcoming winter season. The gift cards expire on April 1, 2025. Customers redeem gift cards of $20,000 in December, $30,000 in January, $25,000 in February, and $15,000 in March. Required: 1. to 4. Record the necessary entries in the Journal Entry Worksheet below. (If no entry is required for a particular transaction/event, select "No Journal Entry Required" in the first account field.) View transaction list Journal entry worksheet < Record the sale of gift cards on October 1, 2024. Note: Enter debits before credits Date October 01, 2024 General Journal Debit Credit

Vail is one of the largest ski resorts in the United States. Suppose that on October 1, 2024, Vall sells gift cards (lift passes) for $100,000. The gift cards are redeemable for one day of skiing during the upcoming winter season. The gift cards expire on April 1, 2025. Customers redeem gift cards of $20,000 in December, $30,000 in January, $25,000 in February, and $15,000 in March. Required: 1. to 4. Record the necessary entries in the Journal Entry Worksheet below. (If no entry is required for a particular transaction/event, select "No Journal Entry Required" in the first account field.) View transaction list Journal entry worksheet < Record the sale of gift cards on October 1, 2024. Note: Enter debits before credits Date October 01, 2024 General Journal Debit Credit

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter17: Advanced Issues In Revenue Recognition

Section: Chapter Questions

Problem 10E: WaterWorld Inc. operates an aquarium and water park in Orlando, Florida. In addition to daily...

Related questions

Question

Hh2.

Account

Transcribed Image Text:Vail is one of the largest ski resorts in the United States. Suppose that on October 1, 2024, Vall sells gift cards (lift passes) for $100,000.

The gift cards are redeemable for one day of skling during the upcoming winter season. The gift cards expire on April 1, 2025.

Customers redeem gift cards of $20,000 in December, $30,000 in January, $25,000 in February, and $15,000 in March.

Required:

1. to 4. Record the necessary entries in the Journal Entry Worksheet below. (If no entry is required for a particular transaction/event,

select "No Journal Entry Required" in the first account field.)

View transaction list

Journal entry worksheet

<

Record the sale of gift cards on October 1, 2024.

Note: Enter debits before credits

Date

October 01,

2024

General Journal

Debit

Credit

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning