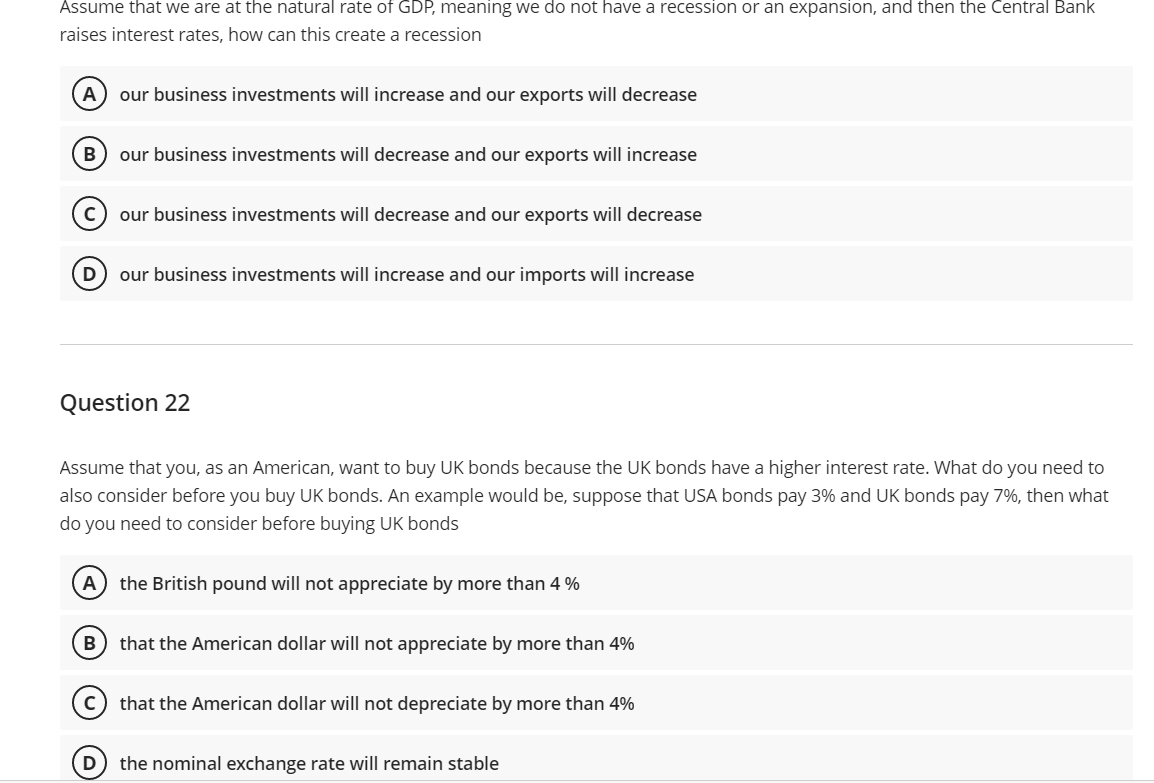

Assume that we are at the natural rate of GDP, meaning we do not have a recession or an expansion, and then the Central Bank raises interest rates, how can this create a recession A our business investments will increase and our exports will decrease B our business investments will decrease and our exports will increase C) our business investments will decrease and our exports will decrease D our business investments will increase and our imports will increase Question 22 Assume that you, as an American, want to buy UK bonds because the UK bonds have a higher interest rate. What do you need to also consider before you buy UK bonds. An example would be, suppose that USA bonds pay 3% and UK bonds pay 7%, then what do you need to consider before buying UK bonds A the British pound will not appreciate by more than 4% (B) that the American dollar will not appreciate by more than 4% that the American dollar will not depreciate by more than 4% the nominal exchange rate will remain stable

Assume that we are at the natural rate of GDP, meaning we do not have a recession or an expansion, and then the Central Bank raises interest rates, how can this create a recession A our business investments will increase and our exports will decrease B our business investments will decrease and our exports will increase C) our business investments will decrease and our exports will decrease D our business investments will increase and our imports will increase Question 22 Assume that you, as an American, want to buy UK bonds because the UK bonds have a higher interest rate. What do you need to also consider before you buy UK bonds. An example would be, suppose that USA bonds pay 3% and UK bonds pay 7%, then what do you need to consider before buying UK bonds A the British pound will not appreciate by more than 4% (B) that the American dollar will not appreciate by more than 4% that the American dollar will not depreciate by more than 4% the nominal exchange rate will remain stable

Chapter8: Relationships Among Inflation, Interest Rates, And Exchange Rates

Section: Chapter Questions

Problem 16QA

Related questions

Question

H4.

Transcribed Image Text:Assume that we are at the natural rate of GDP, meaning we do not have a recession or an expansion, and then the Central Bank

raises interest rates, how can this create a recession

A our business investments will increase and our exports will decrease

B our business investments will decrease and our exports will increase

с our business investments will decrease and our exports will decrease

D

our business investments will increase and our imports will increase

Question 22

Assume that you, as an American, want to buy UK bonds because the UK bonds have a higher interest rate. What do you need to

also consider before you buy UK bonds. An example would be, suppose that USA bonds pay 3% and UK bonds pay 7%, then what

do you need to consider before buying UK bonds

A the British pound will not appreciate by more than 4 %

B) that the American dollar will not appreciate by more than 4%

C) that the American dollar will not depreciate by more than 4%

the nominal exchange rate will remain stable

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Recommended textbooks for you