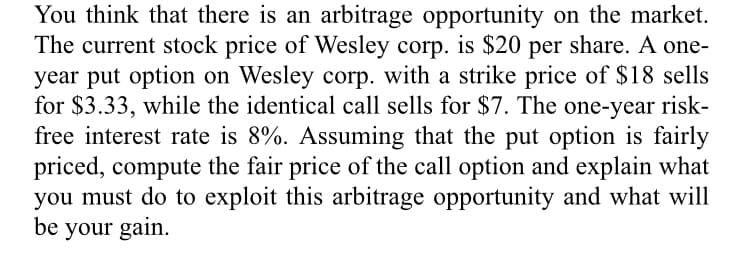

You think that there is an arbitrage opportunity on the market. The current stock price of Wesley corp. is $20 per share. A one- year put option on Wesley corp. with a strike price of $18 sells for $3.33, while the identical call sells for $7. The one-year risk- free interest rate is 8%. Assuming that the put option is fairly priced, compute the fair price of the call option and explain what you must do to exploit this arbitrage opportunity and what will be your gain.

Q: Nana and Abena Sarfo are saving for the university education of their newborn daughter, Akosua. The…

A: Annual university expenses (E) = GH₵ 30000 Expense period (p) = 4 years Interest rate (r) = 0.14…

Q: 7. Assume you currently have all your wealth ($1MM) invested in the Vanguard 500 fund, and that you…

A: By diversification the risk is reduced and overall rate of return increases and hence it is always…

Q: The down payment or equity needed for this investment is $60,000 (outflow) Cash Flow $15,000 5,000…

A: MIRR: By assuming that profits are reinvested at the company's cost of capital and that cash…

Q: Which of the following statements regarding capital budgeting analysis is correct? NPV assumes…

A: Capital budgeting is the process of making investment decisions by a company in which different…

Q: Your factory has been offered a contract to produce a part for a new printer. The contract would…

A: Annual cash inflow for 3 years = $5.14 million Upfront setup cost = $8.11 million Discount rate =…

Q: The financial statements of TVS Motors report the following information (all values are in…

A: The formula to calculate financial leverage is as follows: Financial Leverage = Total…

Q: David Rubin has $100,000 to invest over 5 years. David is very risk-averse and has a target average…

A: Risk free rate of return is the rate which investors get on Treasury bills. These are short term…

Q: Access Enterprise Limited is a private company and has been in operation for over five years. The…

A: Investment Income: Companies usually invest surplus funds in short-term securities to earn interest,…

Q: Revenues - Manufacturing Expenses - Marketing Expenses - Depreciation =EBIT - Taxes (20%) =Unlevered…

A: Capital Budgeting is a technique to understand if a project is adding value to the organization or…

Q: The consumer price index is increasing. The price of gold is also increasing and the Federal Reserve…

A: Yield curve is a graphical representation of the term structure of interest rates.It shows the…

Q: You have a credit card that charges an interest rate of 9.5% compounded monthly. The table below…

A: Average Daily balance method is the method in which interest charges for the period are calculated…

Q: Robert is a fund manager in Man group. He is considering three funds. The first is a stock fund, the…

A: Since you have posted a question with multiple sub-parts, we will solve the first three subparts for…

Q: Your factory has been offered a contract to produce a part for a new printer. The contract would…

A: Cash flow (Year 0) = - $7,970,000 Cash flow (Year 1 - 3) = $4,940,000 Internal rate of return (IRR)…

Q: For a market timer, the ________ will be higher when the market risk premium is higher Select one:…

A: The portfolio beta will be reflective of the systematic risk associated with a particular asset and…

Q: [S1] An American option would be more valuable than a European option. [S2] When the price of the…

A: Options give you opportunity to buy or sale the stock on the maturity by payment of limited premium…

Q: Part B If DeShawn continues his employment at the same rate of increase in yearly salary, for which…

A: As asked in the question, Only Part B is to be solved

Q: Suppose an investor purchases a 3-month call option and a 3-month put option on ABC stock. The the…

A: The options gives the opportunity to buy or sell the stock on expiration by payment of premium but…

Q: Unfortunately it says that that is wrong, thats the answer i came up with at first also

A: Annual payment (A) = $1050 Annual interest rate (r) = 0.06 or 6% Period (p) = 21 years Total value…

Q: Alpha Industries is considering a project with an initial cost of $8.1 million. The project will…

A: Dear Student, As per the Bartleby policy, In case of multiple questions and all questions are…

Q: A generous donor has offered to fund a scholarship at UTP worth RM120,000 per year beginning in year…

A: Perpetuity will be reflective of a stream of cash flows which will be continuing forever. The…

Q: a. What is the firm's current book value per share? b. What is the firm's current P/E ratio? c. (1)…

A: Information Provided: EPS = $6.25 Common stock price per share = $40.00 Book value of common equity…

Q: Suppose the market premium is 12%, market volatility is 20% and the risk-free rate is 6%. Suppose…

A: Expected return E(R) = rf + beta*Risk/market premium Where rf is risk free rate.

Q: Two debts, the first of $1900 due three months ago and the second of $1600 borrowed two years ago…

A: Let us calculate the FV, one year from now of the first debt worth $1900 due 3 months ago.FV = PV x…

Q: ments. The first replacement payment is due in three years and the second payment is due in termine…

A: The effective interest is the interest after considering the impact of compounding on interest and…

Q: Hello! Please help me with as much of this as you can. Thank you! Present Value of an Annuity of $1…

A: Net Present Value = Present Value of Cash Inflows - Initial Investment Cash Payback = Initial…

Q: The following details are provided by a manufacturing company: Investment Useful life Estimated…

A: Payback period means period which is needed to recover initial investment.There is also discounted…

Q: Achieve 225,500 at 8.35% compound continously for 8 years 135 days

A: Compound interest can be calculated annually, semi annually,quarterly monthly or daily. In these…

Q: Huxley lost $400 in the stock market. According to behavioral economics research, how much of a gain…

A: According to behavioral economics the Psychology of investment is very important in the investment…

Q: Stock A – 70,000 invested stocks, 10% expected return Stock B – 90,000 invested stocks, 12%…

A: To Find: Expected return on portfolio

Q: Sutton Corporation, which has a zero tax rate due to tax loss carry-forwards, is considering a…

A: Loan vs lease: Personal loans, home loans, student loans, and other sorts of loans are available.…

Q: What is zero base budgeting? Discuss its merits and limitations.

A: What is zero based budgeting? Zero based budgeting is a concept of planning the future activities in…

Q: If Rita receives $36.44 interest for a deposit earning 6% simple interest for 10 days, what is the…

A: To calculate the deposit amount we will use the below formula Deposit amount = I/(r*d/365) Where I…

Q: ou are interested to value a put option with an exercise price of $100 and one year to expiration.…

A: According to put call parity theory there is certain relation ship between the Put , call and stock…

Q: Eddie has $60,000 saved for retirement. This is currently invested in a conservative Balanced Fund…

A: Initial Amount $ 60,000.00 Balanced Fund rate 5% Time Period (In Years) 20 Extra Amount $…

Q: What is the most we should pay for a bond with a par value of $1000, coupon rate of 4.6% paid…

A: To calculate the price of bond we will use the below formula Value of bond =…

Q: The company expects cash collections during the year of P250,000. In addition, it expects P25,000 in…

A: Cash flows are a source of liquidity for the company and increasing cash flows will increase the…

Q: On March 1st, Frank opens a brokerage account and sell shorts 200 shares of Doggie Treats Inc. at…

A: The margin requirement is the minimum amount that the investor needs to keep in the margin account.…

Q: Darwin is a young entrepreneur trying to keep his business afloat. He has missed two payments to a…

A: We will use the concept of time value of money here. As per the concept of time value of money the…

Q: At i= 18%, what is the annual-equivalence amount for the infinite series shown next? 5 Click the…

A: The annual value method is used to compare different alternatives. It calculates the equivalent…

Q: Explain the differences in how modern and traditional theories of portfolio management approach the…

A: Portfolio management is quite difficult and complex to achieve and it depends on investors need and…

Q: hank you for the explanation. Could you also help with option 4-

A: As per our guidelines, we are supposed to answer only 3 sub-parts (if there are multiple sub-parts…

Q: After four challenging yet fruitful years, you just graduated from college. Your parents gave you…

A: Future Value: The future value is the value of annuity or the sum lump amount after a certain period…

Q: A stock just paid an annual dividend of $7.75 per share. The expected growth rate of the dividend is…

A: Growth rate = 0.1012 or 10.12% Required rate of return = 0.1197 or 11.97% Dividend yield = ?…

Q: Cash discount versus loan The Wood Connection decides to offer cash discounts to its regular credit…

A: The company also makes sales of goods and services on account to increase the sale. The company uses…

Q: ThegreatAlbertEinsteinoncesaid“Compoundinterestistheeighthwonderofthe world. He who understands it…

A: Information Provided: Principal = $500 Years = 30 Interest rate = 15% NOTE: As per our policy,…

Q: Scooter wishes to sell a bond that has a face value of $912. The bond bears an interest rate of…

A: Quarterly bond interest payment = Face value of bond * Interest rate / 4 quarters in a year

Q: the company's common stock has a beta, β, of 1.2. The risk-free rate is 6%, and the market return is…

A: The capital asset pricing model will be applied in order to calculate the cost of equity associated…

Q: Actual Growth Rate Changes in revenue Base-revenue (beginning-of-period revenue) Actual Growth Rate…

A: Actual growth rate Actual growth rate in revenues for a year is calculated as shown below. Actual…

Q: You have an opportunity to invest $50,100 now in return for $59,800 in one year. If your cost of…

A: Amount Invested now is $50,100 Amount returned in one year is $59,800 Cost of capital is 8.2% To…

Q: The company wants to sell a Php 69,000,000 worth of bonds with a maturity of 25 years. The coupon…

A: Face Value = Php1,050 Selling Price = Php 975 Cost of Selling = Php 20 Coupon Rate = 9.5% Time…

Step by step

Solved in 3 steps

- Two investors are evaluating General Electric’s stock for possible purchase. They agree on the expected value of D1, and also on the expected future dividend growth rate. Further, they agree on the risk of the stock. However, one investor normally holds stocks for 2 years and the other normally holds stocks for 10 years. On the basis of the type of analysis done in this chapter, they should both be willing to pay the same price for General Electric’s stock. True or false? Explain.You happen to be checking the newspaper and notice an arbitrage opportunity.The current stock price of Gougou is $20 per share and the one-year risk-free interestrate is 8%. A one-year put on Gougou with a strike price of $18 sells for $3.33, whilethe identical call sells for $7. Explain what you must do to exploit this arbitrageopportunityYou would like to be holding a protective put position on the stock of XYZ Co. to lock in a guaranteed minimum value of $100 at year-end. XYZ currently sells for $100. Over the next year the stock price will increase by 10% or decrease by 10%. The T-bill rate is 5%. Unfortunately, no put options are traded on XYZ Co.a. Suppose the desired put option were traded. How much would it cost to purchase?b. What would have been the cost of the protective put portfolio?c. What portfolio position in stock and T-bills will ensure you a payoff equal to the payoff that would be provided by a protective put with X = 100? Show that the payoff to this portfolio and the cost of establishing the portfolio match those of the desired protective put.

- You would like to be holding a protective put position on the stock of XYZ Company to lock in a guaranteed minimum value of $105 at year-end. XYZ currently sells for $105. Over the next year, the stock price will increase by 9% or decrease by 9%. The T-bill rate is 7%. Unfortunately, no put options are traded on XYZ Company. Required: Suppose the desired put option were traded. How much would it cost to purchase? What would have been the cost of the protective put portfolio? What portfolio position in stock and T-bills will ensure you a payoff equal to the payoff that would be provided by a protective put with X = 105? Show that the payoff to this portfolio and the cost of establishing the portfolio match those of the desired protective put.You expect the stock market to increase, but instead of acquiring stock, you decide to acquire a stock index futures contract. That index is currently 60.4, and the contract has a value that is $500 times the amount of the index. The margin requirement is $2,500. When you make the contract, how much must you put up? Round your answer to the nearest dollar. $ What is the value of the contract based on the index? Round your answer to the nearest dollar. $ If the value of the index rises 2 percent to 61.608, what is the profit on the investment? Round your answer to the nearest cent. $ What is the percentage earned on the funds you put up? Round your answer to one decimal place. % If the value of the index declines 2 percent to 59.192, what percentage of your funds will you lose? Round your answer to one decimal place. Enter your answer as a positive value. % What is the percentage you earn (or lose) if the index falls to 55.4? Round your answer to one decimal place. Enter…Consider a market where the assumptions behind the Black-Scholes model hold. A non-dividend paying share is currently priced at $300. A put option is available on the share with a strike price of $320 and one year to expiry. Volatility of 15% and the risk-free rate is 5% per annum. What would be the fair price of the put option.

- Consider a European put and a European call option which are both written on a non-dividend paying stock, have the same strike price K = £80 and expire in T = 2 months. These options are trading for p = £21 and c = £30.80, respectively. The underlying stock price is S0 = £90. The continuously compounded risk-free rate of interest is r = 10% per annum. What is the present value of the arbitrage profit? Please explain your answer and show your workings. In your response, please show all cash flows (both today and at expiration) and explain why this is an arbitrage (i.e. risk-less) profit.As an option trader, you are constantly looking for opportunities to make an arbitrage transaction (that is, a trade in which you do not need to commit your own capital or take any risk but can still make a profit). Suppose you observe the following prices for options on DRKC Co. stock: $3.18 for a call with an exercise price of $60, and $3.38 for a put with an exercise price of $60. Both options expire in exactly six months, and the price of a six-month T-bill is $97.00 (for face value of $100). a. Using the put-call-spot parity condition, demonstrate graphically how you could synthetically re-create the payoff structure of a share of DRKC stock in six months, using a combination of puts, calls, and T-bills transacted today. b. Given the current market prices for the two options and the T-bill, calculate the no-arbitrage price of a share of DRKC stock. c. If the actual market price of DRKC stock is $60, demonstrate the arbitrage transaction you could create to…Suppose that a stock price is currently 51 dollars, and it is known that one month from now, the price will be either 6 percent higher or 6 percent lower. Find the value of an American call option on the stock that expires one month from now, and has a strike price of 49 dollars. Assume that no arbitrage opportunities exist, and a risk free interest rate of 10 percent

- Shopify, Inc common stock currently sells for $1,229.91 per share, and the standard deviation of returns is 58.67%. A call option with a strike price of $1,100 is currently trading on the market. The option expires in 0.15 years, and the risk-free rate of return is 0.9%. Shopify does not pay a dividend. What is rho (ρ) for this call option assuming a continuous model such as the Black-Scholes model? A) 104.1327 B) 107.2895 C) 57.7772 D) 107.0002Consider an American call and an American put with the same underlying stock share S paying no dividend, the same strike price K = $30 and the same expiration date T = 3 (months). Suppose that the stock price is $31, the risk-free interest rate is 10% per annum compounded continuously, the price of the American call option is $3, and the price of the American put option is $1. Using the no-arbitrage principle, prove that there exists an arbitrage opportunity then.Suppose that a stock price is currently 56 dollars, and it is known that five months from now, the price will be either 22 percent higher or 22 percent lower. Find the value of a European put option on the stock that expires five months from now, and has a strike price of 55 dollars. Assume that no arbitrage opportunities exist, and a risk-free interest rate of 6 percent.