Assume that you are 30 years old today and that you are planning on retirement at age 65. Your current salary is $45,000 and you expect your salary to increase at a rate of 5% per year as long as you work. To save for your retirement, you plan on making annual contributions to a retirement account. Your first contribution will be mad on your 31st birthday and will be 8% of this year's salary. Likewise, you expect to deposit 8% of your salary each year until you reach age 65. Assume that the rate of interest is 7%. The present value (at age 30) of your retirement savings is closest to: OA. $87,000. OB. $46,600. O C. $75,230. OD. $108.000.

Assume that you are 30 years old today and that you are planning on retirement at age 65. Your current salary is $45,000 and you expect your salary to increase at a rate of 5% per year as long as you work. To save for your retirement, you plan on making annual contributions to a retirement account. Your first contribution will be mad on your 31st birthday and will be 8% of this year's salary. Likewise, you expect to deposit 8% of your salary each year until you reach age 65. Assume that the rate of interest is 7%. The present value (at age 30) of your retirement savings is closest to: OA. $87,000. OB. $46,600. O C. $75,230. OD. $108.000.

Chapter5: The Time Value Of Money

Section: Chapter Questions

Problem 39P

Related questions

Question

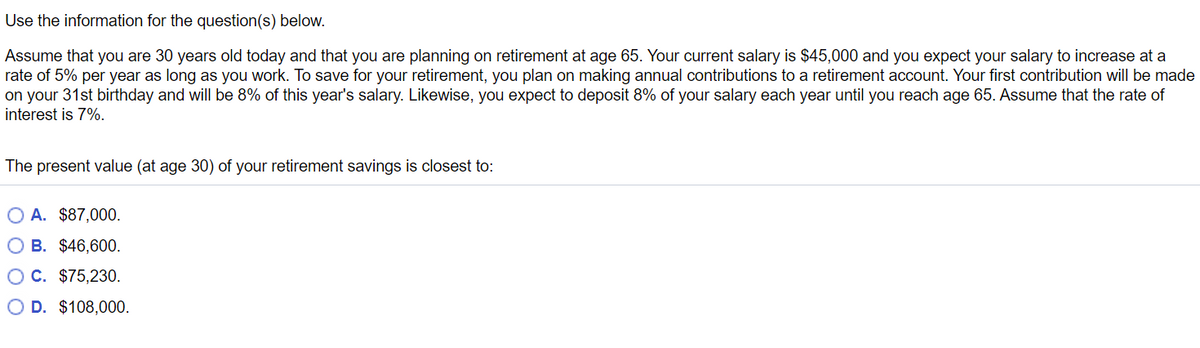

Transcribed Image Text:Use the information for the question(s) below.

Assume that you are 30 years old today and that you are planning on retirement at age 65. Your current salary is $45,000 and you expect your salary to increase at a

rate of 5% per year as long as you work. To save for your retirement, you plan on making annual contributions to a retirement account. Your first contribution will be made

on your 31st birthday and will be 8% of this year's salary. Likewise, you expect to deposit 8% of your salary each year until you reach age 65. Assume that the rate of

interest is 7%.

The present value (at age 30) of your retirement savings is closest to:

O A. $87,000.

OB. $46,600.

OC. $75,230.

O D. $108,000.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 7 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning