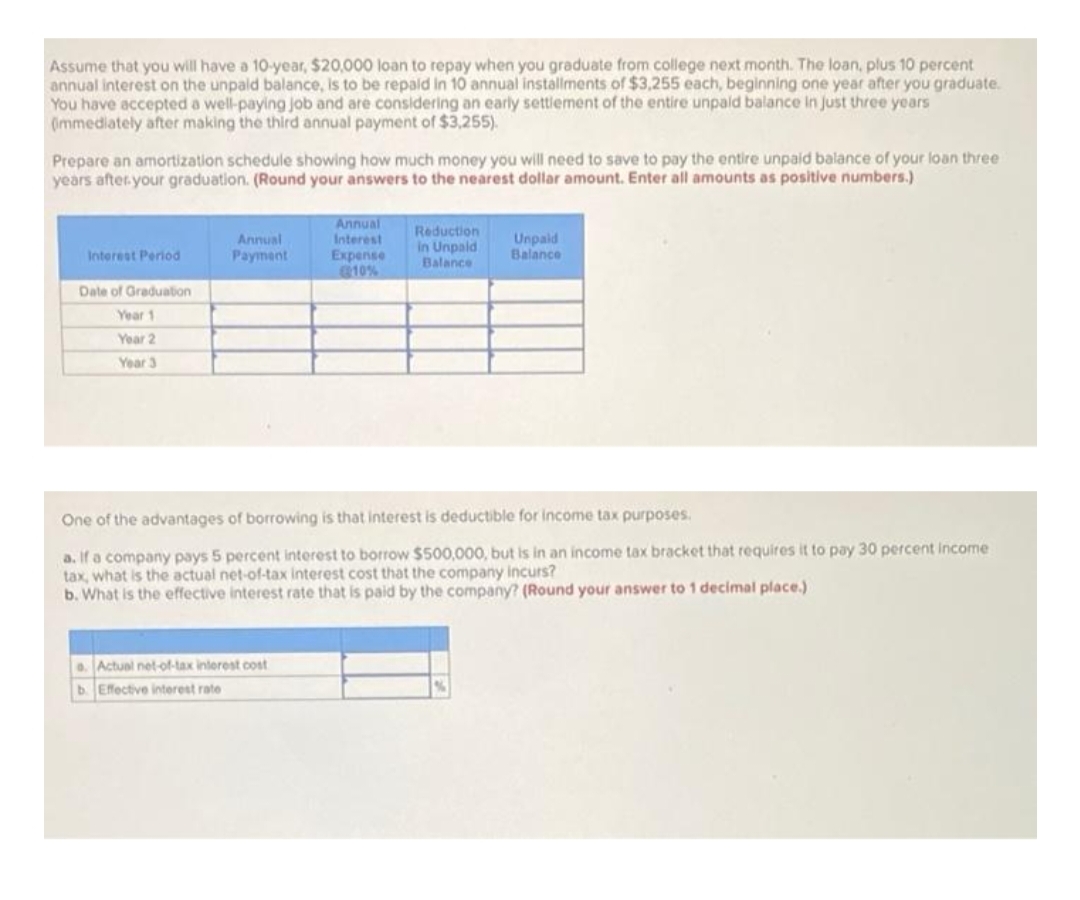

Assume that you will have a 10-year, $20,000 loan to repay when you graduate from college next month. The loan, plus 10 percent annual interest on the unpaid balance, is to be repaid in 10 annual installments of $3,255 each, beginning one year after you graduate. You have accepted a well-paying job and are considering an early settlement of the entire unpaid balance in just three years (mmediately after making the third annual payment of $3,255). Prepare an amortization schedule showing how much money you will need to save to pay the entire unpaid balance of your loan three years after your graduation. (Round your answers to the nearest dollar amount. Enter all amounts as positive numbers.) Interest Period Date of Graduation Year 1 Year 2 Year 3 Annual Payment Annual Interest Expense @10% Reduction in Unpaid Balance Unpaid Balance

Assume that you will have a 10-year, $20,000 loan to repay when you graduate from college next month. The loan, plus 10 percent annual interest on the unpaid balance, is to be repaid in 10 annual installments of $3,255 each, beginning one year after you graduate. You have accepted a well-paying job and are considering an early settlement of the entire unpaid balance in just three years (mmediately after making the third annual payment of $3,255). Prepare an amortization schedule showing how much money you will need to save to pay the entire unpaid balance of your loan three years after your graduation. (Round your answers to the nearest dollar amount. Enter all amounts as positive numbers.) Interest Period Date of Graduation Year 1 Year 2 Year 3 Annual Payment Annual Interest Expense @10% Reduction in Unpaid Balance Unpaid Balance

Chapter5: The Time Value Of Money

Section: Chapter Questions

Problem 33P

Related questions

Question

Transcribed Image Text:Assume that you will have a 10-year, $20,000 loan to repay when you graduate from college next month. The loan, plus 10 percent

annual interest on the unpaid balance, is to be repaid in 10 annual installments of $3,255 each, beginning one year after you graduate.

You have accepted a well-paying job and are considering an early settlement of the entire unpaid balance in just three years

(immediately after making the third annual payment of $3,255).

Prepare an amortization schedule showing how much money you will need to save to pay the entire unpaid balance of your loan three

years after your graduation. (Round your answers to the nearest dollar amount. Enter all amounts as positive numbers.)

Interest Period

Date of Graduation

Year 1

Year 2

Year

3

Annual

Payment

Annual

Interest

Expense

@10%

a. Actual net-of-tax interest cost

b. Effective interest rate

Reduction

in Unpaid

Balance

Unpaid

Balance

One of the advantages of borrowing is that interest is deductible for income tax purposes.

a. If a company pays 5 percent interest to borrow $500,000, but is in an income tax bracket that requires it to pay 30 percent income.

tax, what is the actual net-of-tax interest cost that the company incurs?

b. What is the effective interest rate that is paid by the company? (Round your answer to 1 decimal place.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 1 images

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning