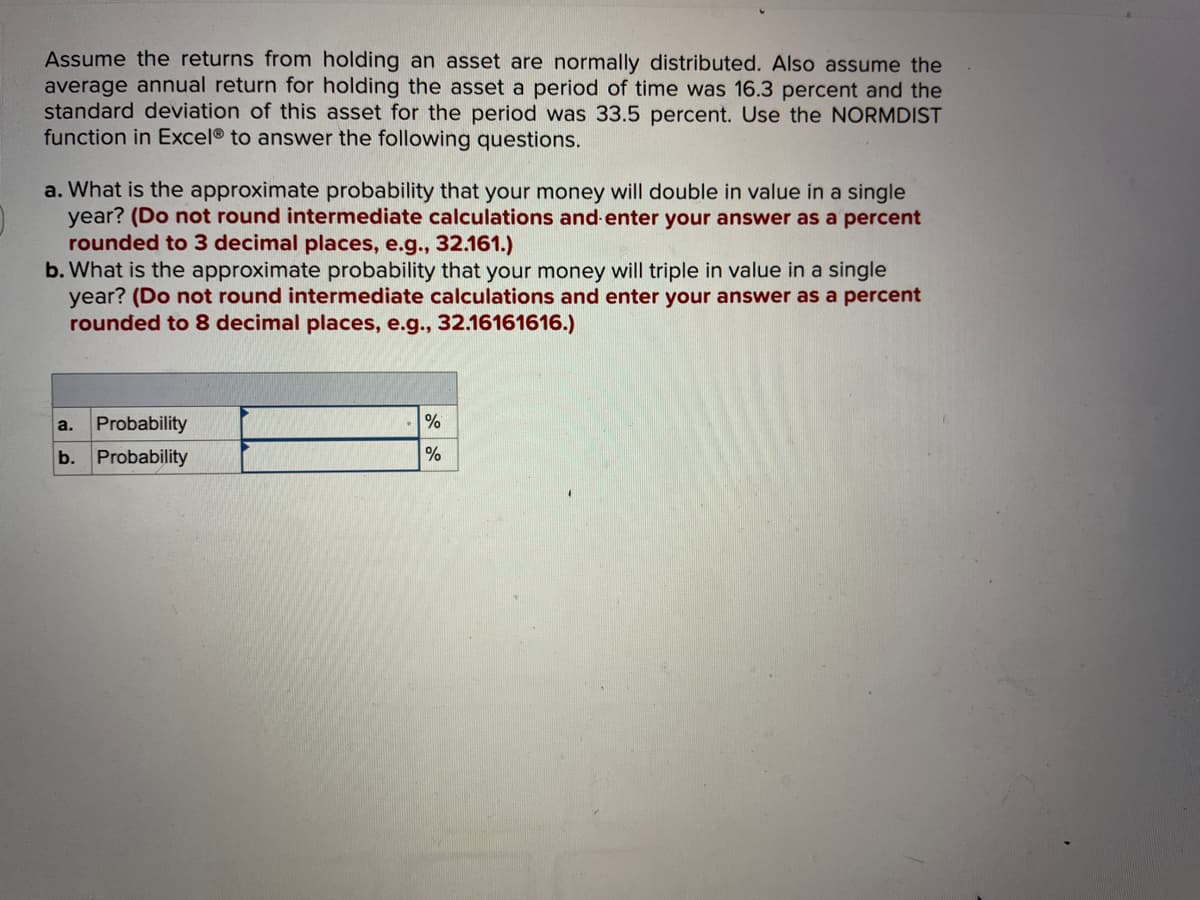

Assume the returns from holding an asset are normally distributed. Also assume the average annual return for holding the asset a period of time was 16.3 percent and the standard deviation of this asset for the period was 33.5 percent. Use the NORMDIST function in Excel® to answer the following questions. a. What is the approximate probability that your money will double in value in a single year? (Do not round intermediate calculations and enter your answer as a percent rounded to 3 decimal places, e.g., 32.161.) b. What is the approximate probability that your money will triple in value in a single year? (Do not round intermediate calculations and enter your answer as a percent rounded to 8 decimal places, e.g., 32.16161616.) a. b. Probability Probability % %

Assume the returns from holding an asset are normally distributed. Also assume the average annual return for holding the asset a period of time was 16.3 percent and the standard deviation of this asset for the period was 33.5 percent. Use the NORMDIST function in Excel® to answer the following questions. a. What is the approximate probability that your money will double in value in a single year? (Do not round intermediate calculations and enter your answer as a percent rounded to 3 decimal places, e.g., 32.161.) b. What is the approximate probability that your money will triple in value in a single year? (Do not round intermediate calculations and enter your answer as a percent rounded to 8 decimal places, e.g., 32.16161616.) a. b. Probability Probability % %

Chapter9: Sequences, Probability And Counting Theory

Section9.7: Probability

Problem 1SE: What term is used to express the likelihood of an event occurring? Are there restrictions on its...

Related questions

Question

Transcribed Image Text:Assume the returns from holding an asset are normally distributed. Also assume the

average annual return for holding the asset a period of time was 16.3 percent and the

standard deviation of this asset for the period was 33.5 percent. Use the NORMDIST

function in Excel® to answer the following questions.

a. What is the approximate probability that your money will double in value in a single

year? (Do not round intermediate calculations and enter your answer as a percent

rounded to 3 decimal places, e.g., 32.161.)

b. What is the approximate probability that your money will triple in value in a single

year? (Do not round intermediate calculations and enter your answer as a percent

rounded to 8 decimal places, e.g., 32.16161616.)

Probability

b. Probability

a.

%

%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Recommended textbooks for you