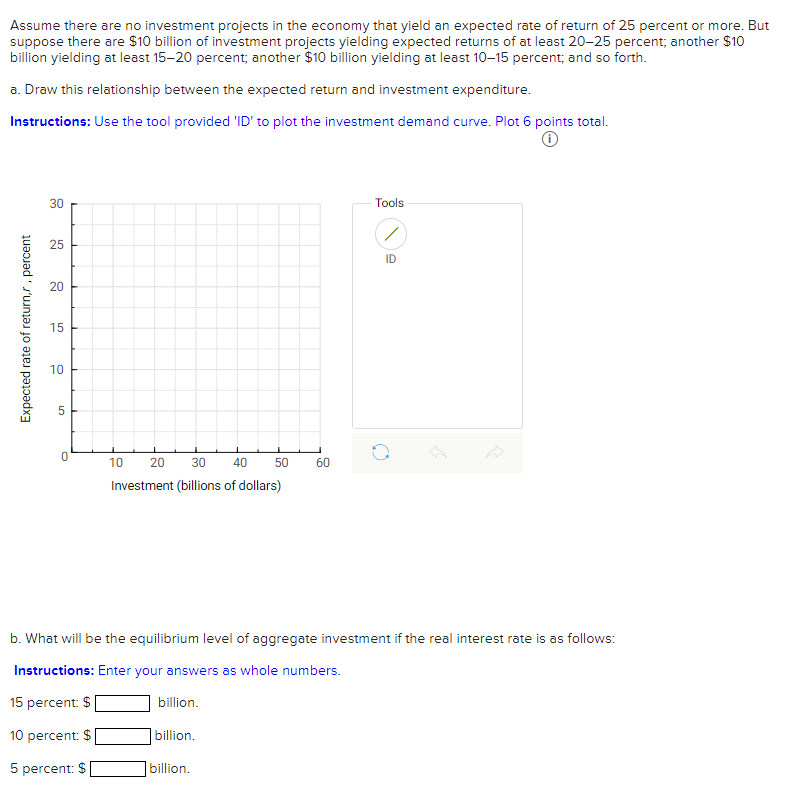

Assume there are no investment projects in the economy that yield an expected rate of return of 25 percent or more. But suppose there are $10 billion of investment projects yielding expected returns of at least 20-25 percent; another $10 billion yielding at least 15-20 percent; another $10 billion yielding at least 10-15 percent; and so forth. a. Draw this relationship between the expected return and investment expenditure. Instructions: Use the tool provided 'ID' to plot the investment demand curve. Plot 6 points total. 30 25 25 20 20 Expected rate of return,r, percent 15 10 60 Tools 0' 10 20 30 40 50 60 Investment (billions of dollars) b. What will be the equilibrium level of aggregate investment if the real interest rate is as follows: Instructions: Enter your answers as whole numbers. 15 percent: $ billion. 10 percent: $ billion. 5 percent: $ billion.

Assume there are no investment projects in the economy that yield an expected rate of return of 25 percent or more. But suppose there are $10 billion of investment projects yielding expected returns of at least 20-25 percent; another $10 billion yielding at least 15-20 percent; another $10 billion yielding at least 10-15 percent; and so forth. a. Draw this relationship between the expected return and investment expenditure. Instructions: Use the tool provided 'ID' to plot the investment demand curve. Plot 6 points total. 30 25 25 20 20 Expected rate of return,r, percent 15 10 60 Tools 0' 10 20 30 40 50 60 Investment (billions of dollars) b. What will be the equilibrium level of aggregate investment if the real interest rate is as follows: Instructions: Enter your answers as whole numbers. 15 percent: $ billion. 10 percent: $ billion. 5 percent: $ billion.

Principles of Economics 2e

2nd Edition

ISBN:9781947172364

Author:Steven A. Greenlaw; David Shapiro

Publisher:Steven A. Greenlaw; David Shapiro

Chapter17: Financial Markets

Section: Chapter Questions

Problem 31CTQ: What are some reasons why the investment strategy of a 30-year-old might differ flow the investment...

Related questions

Question

am. 122.

Transcribed Image Text:Assume there are no investment projects in the economy that yield an expected rate of return of 25 percent or more. But

suppose there are $10 billion of investment projects yielding expected returns of at least 20-25 percent; another $10

billion yielding at least 15-20 percent; another $10 billion yielding at least 10-15 percent; and so forth.

a. Draw this relationship between the expected return and investment expenditure.

Instructions: Use the tool provided 'ID' to plot the investment demand curve. Plot 6 points total.

Expected rate of return,/, percent

30

25

20

15

10

сл

10 20

30 40 50

Investment (billions of dollars)

60

billion.

Tools

/

ID

b. What will be the equilibrium level of aggregate investment if the real interest rate is as follows:

Instructions: Enter your answers as whole numbers.

15 percent: $

billion.

10 percent: $

billion.

5 percent: $

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps with 9 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Economics 2e

Economics

ISBN:

9781947172364

Author:

Steven A. Greenlaw; David Shapiro

Publisher:

OpenStax

Principles of Economics 2e

Economics

ISBN:

9781947172364

Author:

Steven A. Greenlaw; David Shapiro

Publisher:

OpenStax