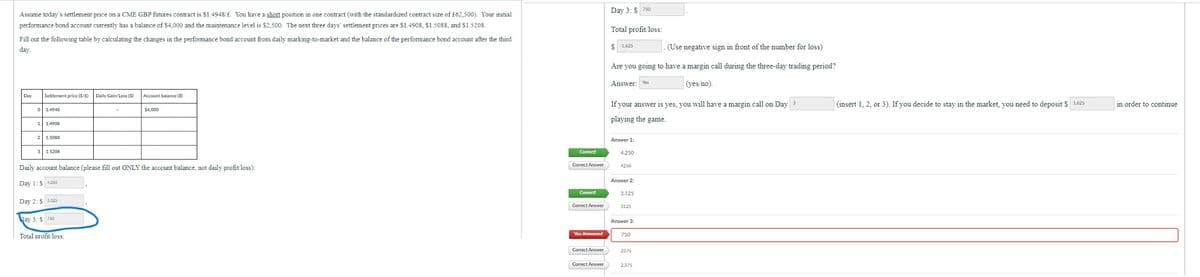

Assume today's settlement price on a CME GBP futures contract is $1.4948/£. You have a short position in one contract (with the standardized contract size of £62,500). Your initial performance bond account currently has a balance of $4,000 and the maintenance level is $2,500. The next three days' settlement prices are $1.4908, $1.5088, and $1.5208. Fill out the following table by calculating the changes in the performance bond account from daily marking-to-market and the balance of the performance bond account after the third day. Day Settlement price ($/£) Daily Gain/Loss (5) Account balance (5) 0 1.4948 1 1.4908 2 1.5088 3 1.5208 $4,000 Daily account balance (please fill out ONLY the account balance, not daily profit/loss): Day 1: $4250 Day 2: $ 3.125 Day 3: $750 Total profit/loss: Day 3: $ 750 Total profit/loss: $ -1.625 . (Use negative sign in front of the number for loss) Are you going to have a margin call during the three-day trading period? Answer: Yes (yes/no). If your answer is yes, you will have a margin call on Day 3 playing the game. Answer 1: Correct! 4,250 Correct Answer 4250 Answer 2: Correct! 3,125 Correct Answer 3125 Answer 3: You Answered 750 Correct Answer 2375 Correct Answer 2.375 (insert 1, 2, or 3). If you decide to stay in the market, you need to deposit $ 1,625 in order to continue

Assume today's settlement price on a CME GBP futures contract is $1.4948/£. You have a short position in one contract (with the standardized contract size of £62,500). Your initial performance bond account currently has a balance of $4,000 and the maintenance level is $2,500. The next three days' settlement prices are $1.4908, $1.5088, and $1.5208. Fill out the following table by calculating the changes in the performance bond account from daily marking-to-market and the balance of the performance bond account after the third day. Day Settlement price ($/£) Daily Gain/Loss (5) Account balance (5) 0 1.4948 1 1.4908 2 1.5088 3 1.5208 $4,000 Daily account balance (please fill out ONLY the account balance, not daily profit/loss): Day 1: $4250 Day 2: $ 3.125 Day 3: $750 Total profit/loss: Day 3: $ 750 Total profit/loss: $ -1.625 . (Use negative sign in front of the number for loss) Are you going to have a margin call during the three-day trading period? Answer: Yes (yes/no). If your answer is yes, you will have a margin call on Day 3 playing the game. Answer 1: Correct! 4,250 Correct Answer 4250 Answer 2: Correct! 3,125 Correct Answer 3125 Answer 3: You Answered 750 Correct Answer 2375 Correct Answer 2.375 (insert 1, 2, or 3). If you decide to stay in the market, you need to deposit $ 1,625 in order to continue

Chapter5: Currency Derivatives

Section: Chapter Questions

Problem 3IEE

Related questions

Question

Transcribed Image Text:Assume today's settlement price on a CME GBP futures contract is $1.4948/£. You have a short position in one contract (with the standardized contract size of £62,500). Your initial

performance bond account currently has a balance of $4,000 and the maintenance level is $2,500. The next three days' settlement prices are $1.4908, $1.5088, and $1.5208.

Fill out the following table by calculating the changes in the performance bond account from daily marking-to-market and the balance of the performance bond account after the third

day.

Day

Settlement price ($/£)

Daily Gain/Loss (5)

Account balance (5)

0 1.4948

1 1.4908

2 1.5088

3 1.5208

$4,000

Daily account balance (please fill out ONLY the account balance, not daily profit/loss):

Day 1: $4250

Day 2: $ 3.125

Day 3: $750

Total profit/loss:

Day 3: $ 750

Total profit/loss:

$ -1.625

. (Use negative sign in front of the number for loss)

Are you going to have a margin call during the three-day trading period?

Answer: Yes

(yes/no).

If your answer is yes, you will have a margin call on Day 3

playing the game.

Answer 1:

Correct!

4,250

Correct Answer

4250

Answer 2:

Correct!

3,125

Correct Answer

3125

Answer 3:

You Answered

750

Correct Answer

2375

Correct Answer

2.375

(insert 1, 2, or 3). If you decide to stay in the market, you need to deposit $ 1,625

in order to continue

AI-Generated Solution

Unlock instant AI solutions

Tap the button

to generate a solution

Recommended textbooks for you