Assume you are given the following abbreviated financial statement. ($ in millions) $150.0 $200.0 $350.0 $100.0 $ 50.0 $200.0 $350.0 میزار دو Current assets Fixed and other assets Total assets Current liabilities Long-term debt Stockholders' equity Total liabilities and equities Common shares outstanding Total revenues Total operating costs and expenses Interest expense Income taxes Net profits Dividends paid to common stockholders 10-million shares $500.0 $435.0 $10.0 $ 20.0 35.0 $ 10.0

Assume you are given the following abbreviated financial statement. ($ in millions) $150.0 $200.0 $350.0 $100.0 $ 50.0 $200.0 $350.0 میزار دو Current assets Fixed and other assets Total assets Current liabilities Long-term debt Stockholders' equity Total liabilities and equities Common shares outstanding Total revenues Total operating costs and expenses Interest expense Income taxes Net profits Dividends paid to common stockholders 10-million shares $500.0 $435.0 $10.0 $ 20.0 35.0 $ 10.0

PFIN (with PFIN Online, 1 term (6 months) Printed Access Card) (New, Engaging Titles from 4LTR Press)

6th Edition

ISBN:9781337117005

Author:Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Chapter12: Investing In Stocks And Bonds

Section: Chapter Questions

Problem 4FPE

Related questions

Question

please complete the solution, please all of it (the rest) and thanks Sir

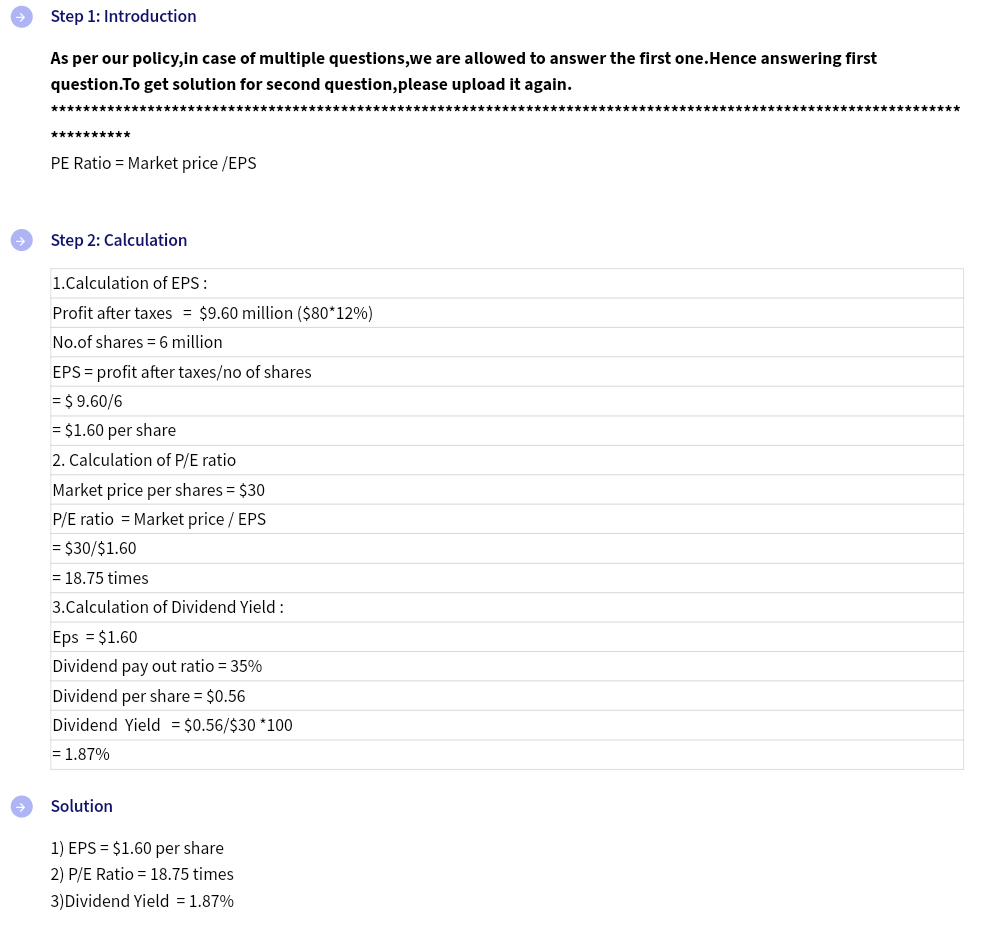

Transcribed Image Text:Step 1: Introduction

As per our policy,in case of multiple questions,we are allowed to answer the first one. Hence answering first

question. To get solution for second question, please upload it again.

*******

**********

PE Ratio = Market price /EPS

Step 2: Calculation

1.Calculation of EPS :

Profit after taxes = $9.60 million ($80*12%)

No.of shares = 6 million

EPS= profit after taxes/no of shares

= $ 9.60/6

= $1.60 per share

2. Calculation of P/E ratio

Market price per shares = $30

P/E ratio Market price / EPS

= $30/$1.60

= 18.75 times

3.Calculation of Dividend Yield:

Eps = $1.60

Dividend pay out ratio = 35%

Dividend per share = $0.56

Dividend Yield = $0.56/$30 *100

= 1.87%

Solution

1) EPS = $1.60 per share

2) P/E Ratio = 18.75 times

3)Dividend Yield = 1.87%

*****************************************

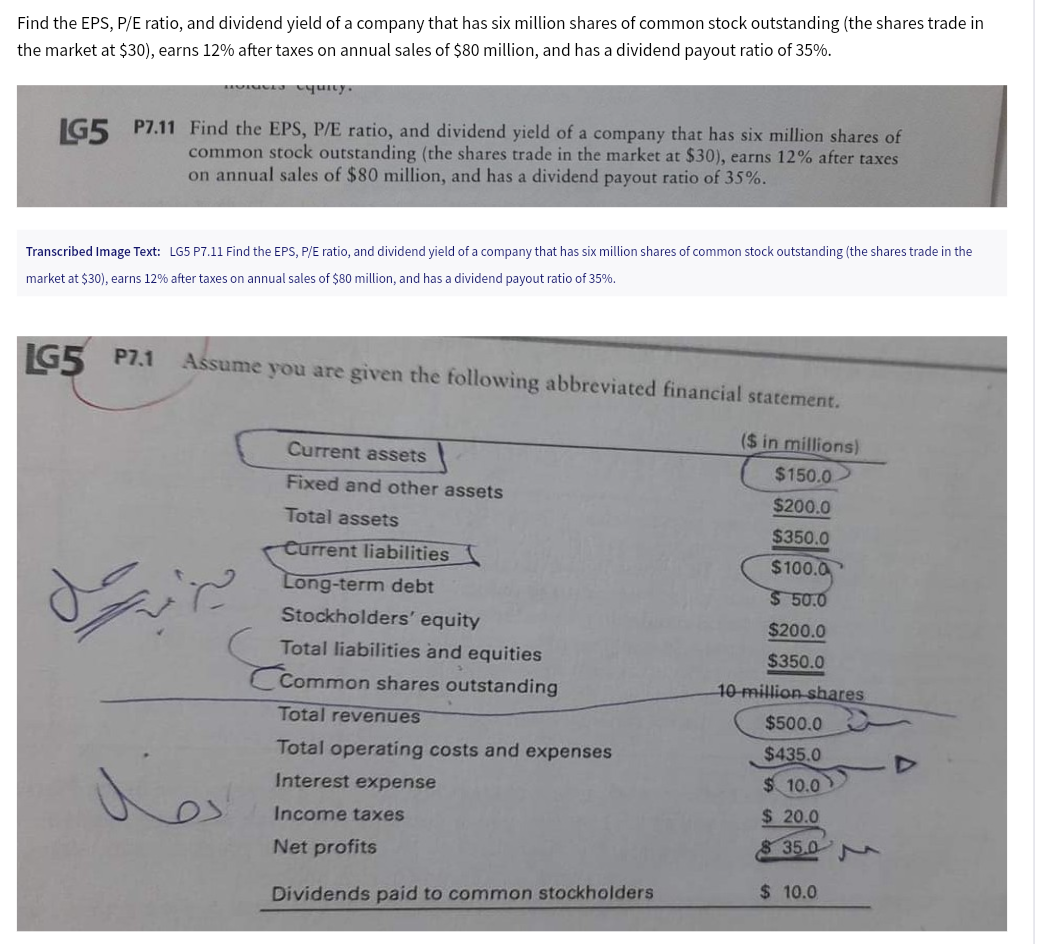

Transcribed Image Text:Find the EPS, P/E ratio, and dividend yield of a company that has six million shares of common stock outstanding (the shares trade in

the market at $30), earns 12% after taxes on annual sales of $80 million, and has a dividend payout ratio of 35%.

LG5 P7.11 Find the EPS, P/E ratio, and dividend yield of a company that has six million shares of

common stock outstanding (the shares trade in the market at $30), earns 12% after taxes

on annual sales of $80 million, and has a dividend payout ratio of 35%.

equity.

Transcribed Image Text: LG5 P7.11 Find the EPS, P/E ratio, and dividend yield of a company that has six million shares of common stock outstanding (the shares trade in the

market at $30), earns 12% after taxes on annual sales of $80 million, and has a dividend payout ratio of 35%.

LG5 P7.1

Assume you are given the following abbreviated financial statement.

($ in millions)

$150.0

$200.0

$350.0

$100.0

$ 50.0

چیزا یه حال

نقل

Current assets

Fixed and other assets

Total assets

Current liabilities

Long-term debt

Stockholders' equity

Total liabilities and equities

Common shares outstanding

Total revenues

Total operating costs and expenses

Interest expense

Income taxes

Net profits

Dividends paid to common stockholders

$200.0

$350.0

10 million shares

$500.0

$435.0

$10.0

$ 20.0

$ 35.0

$ 10.0

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

PFIN (with PFIN Online, 1 term (6 months) Printed…

Finance

ISBN:

9781337117005

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

PFIN (with PFIN Online, 1 term (6 months) Printed…

Finance

ISBN:

9781337117005

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning