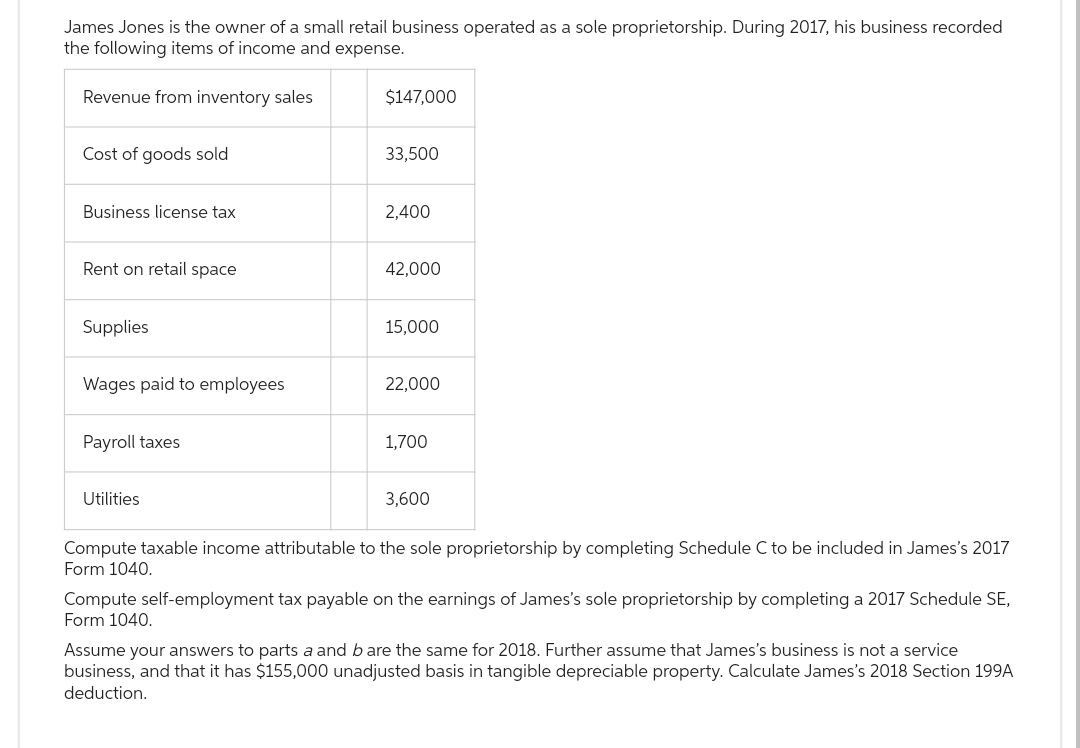

James Jones is the owner of a small retail business operated as a sole proprietorship. During 2017, his business recorded the following items of income and expense. Revenue from inventory sales Cost of goods sold Business license tax Rent on retail space Supplies Wages paid to employees Payroll taxes Utilities $147,000 33,500 2,400 42,000 15,000 22,000 1,700 3,600 Compute taxable income attributable to the sole proprietorship by completing Schedule C to be included in James's 2017 Form 1040. Compute self-employment tax payable on the earnings of James's sole proprietorship by completing a 2017 Schedule SE, Form 1040. Assume your answers to parts a and b are the same for 2018. Further assume that James's business is not a service business, and that it has $155,000 unadjusted basis in tangible depreciable property. Calculate James's 2018 Section 199A deduction.

James Jones is the owner of a small retail business operated as a sole proprietorship. During 2017, his business recorded the following items of income and expense. Revenue from inventory sales Cost of goods sold Business license tax Rent on retail space Supplies Wages paid to employees Payroll taxes Utilities $147,000 33,500 2,400 42,000 15,000 22,000 1,700 3,600 Compute taxable income attributable to the sole proprietorship by completing Schedule C to be included in James's 2017 Form 1040. Compute self-employment tax payable on the earnings of James's sole proprietorship by completing a 2017 Schedule SE, Form 1040. Assume your answers to parts a and b are the same for 2018. Further assume that James's business is not a service business, and that it has $155,000 unadjusted basis in tangible depreciable property. Calculate James's 2018 Section 199A deduction.

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter22: Accounting For Changes And Errors.

Section: Chapter Questions

Problem 12P

Related questions

Question

D11.

Account

Transcribed Image Text:James Jones is the owner of a small retail business operated as a sole proprietorship. During 2017, his business recorded

the following items of income and expense.

Revenue from inventory sales

Cost of goods sold

Business license tax

Rent on retail space

Supplies

Wages paid to employees

Payroll taxes

Utilities

$147,000

33,500

2,400

42,000

15,000

22,000

1,700

3,600

Compute taxable income attributable to the sole proprietorship by completing Schedule C to be included in James's 2017

Form 1040.

Compute self-employment tax payable on the earnings of James's sole proprietorship by completing a 2017 Schedule SE,

Form 1040.

Assume your answers to parts a and b are the same for 2018. Further assume that James's business is not a service

business, and that it has $155,000 unadjusted basis in tangible depreciable property. Calculate James's 2018 Section 199A

deduction.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning