Assuming P omitted certain transactions as illustrated below. You must discuss about the accounting treatment for the omitted (i) and (ii) with reference to any applicable accounting standard. P acquired a new warehouse for RM1,000,000 on 1st Jan 2020 with a estimated useful life of 20 years. The factory was brought into us immediately on the same day. The company adopts a cost model for a property, plant and machinery. i) With a surplus funds of few millions, P invested in a number o commercial lots for RM3,000,000 during the year of 2020. Thes properties are estimated to have a 20-years of useful life. The marke value of these properties stands at RM3,300,000 at the end of Decembe

Assuming P omitted certain transactions as illustrated below. You must discuss about the accounting treatment for the omitted (i) and (ii) with reference to any applicable accounting standard. P acquired a new warehouse for RM1,000,000 on 1st Jan 2020 with a estimated useful life of 20 years. The factory was brought into us immediately on the same day. The company adopts a cost model for a property, plant and machinery. i) With a surplus funds of few millions, P invested in a number o commercial lots for RM3,000,000 during the year of 2020. Thes properties are estimated to have a 20-years of useful life. The marke value of these properties stands at RM3,300,000 at the end of Decembe

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter13: Investments And Long-term Receivables

Section: Chapter Questions

Problem 8RE

Related questions

Question

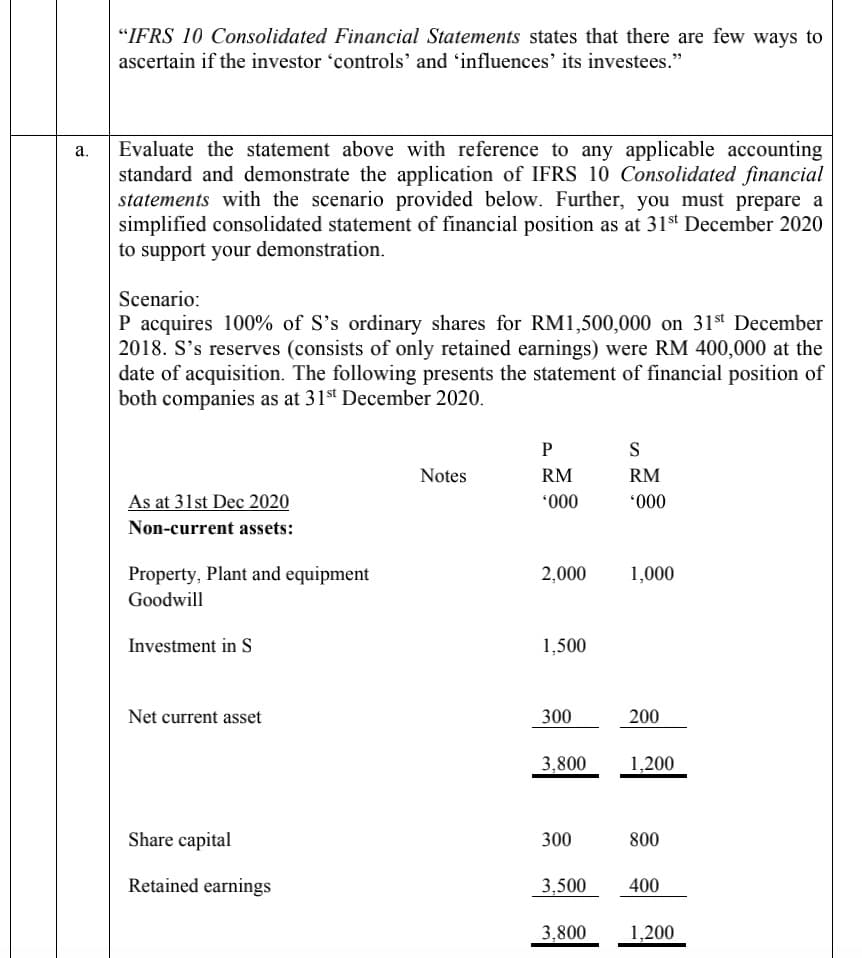

Transcribed Image Text:"IFRS 10 Consolidated Financial Statements states that there are few ways to

ascertain if the investor 'controls' and 'influences' its investees."

Evaluate the statement above with reference to any applicable accounting

standard and demonstrate the application of IFRS 10 Consolidated financial

statements with the scenario provided below. Further, you must prepare a

simplified consolidated statement of financial position as at 31st December 2020

а.

to support your demonstration.

Scenario:

P acquires 100% of S's ordinary shares for RM1,500,000 on 31st December

2018. S's reserves (consists of only retained earnings) were RM 400,000 at the

date of acquisition. The following presents the statement of financial position of

both companies as at 31st December 2020.

P

S

Notes

RM

RM

As at 31st Dec 2020

000.

*000

Non-current assets:

Property, Plant and equipment

Goodwill

2,000

1,000

Investment in S

1,500

Net current asset

300

200

3,800

1,200

Share capital

300

800

Retained earnings

3,500

400

3,800

1,200

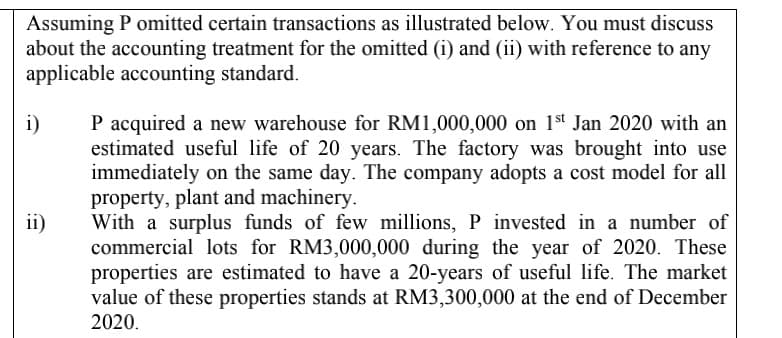

Transcribed Image Text:Assuming P omitted certain transactions as illustrated below. You must discuss

about the accounting treatment for the omitted (i) and (ii) with reference to any

applicable accounting standard.

P acquired a new warehouse for RM1,000,000 on 1st Jan 2020 with an

estimated useful life of 20 years. The factory was brought into use

immediately on the same day. The company adopts a cost model for all

property, plant and machinery.

With a surplus funds of few millions, P invested in a number of

commercial lots for RM3,000,000 during the year of 2020. These

properties are estimated to have a 20-years of useful life. The market

value of these properties stands at RM3,300,000 at the end of December

2020.

i)

ii)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning