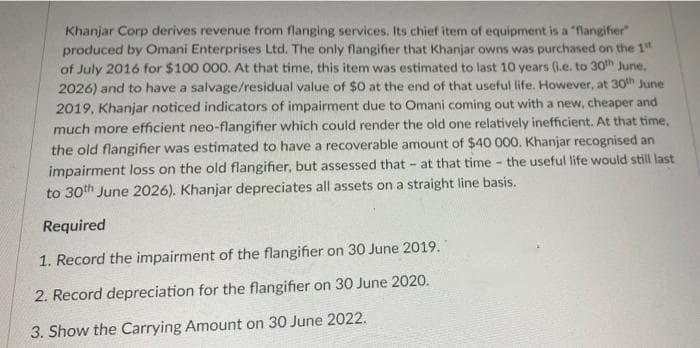

Khanjar Corp derives revenue from flanging services. Its chief item of equipment is a "flangifier" produced by Omani Enterprises Ltd. The only flangifier that Khanjar owns was purchased on the 1st of July 2016 for $100 000. At that time, this item was estimated to last 10 years (.e. to 30th June, 2026) and to have a salvage/residual value of $0 at the end of that useful life. However, at 30th June 2019, Khanjar noticed indicators of impairment due to Omani coming out with a new, cheaper and much more efficient neo-flangifier which could render the old one relatively inefficient. At that time, the old flangifier was estimated to have a recoverable amount of $40 000. Khanjar recognised an impairment loss on the old flangifier, but assessed that at that time the useful life would still last to 30th June 2026). Khanjar depreciates all assets on a straight line basis. Required 1. Record the impairment of the flangifier on 30 June 2019. 2. Record depreciation for the flangifier on 30 June 2020. 3. Show the Carrying Amount on 30 June 2022.

Khanjar Corp derives revenue from flanging services. Its chief item of equipment is a "flangifier" produced by Omani Enterprises Ltd. The only flangifier that Khanjar owns was purchased on the 1st of July 2016 for $100 000. At that time, this item was estimated to last 10 years (.e. to 30th June, 2026) and to have a salvage/residual value of $0 at the end of that useful life. However, at 30th June 2019, Khanjar noticed indicators of impairment due to Omani coming out with a new, cheaper and much more efficient neo-flangifier which could render the old one relatively inefficient. At that time, the old flangifier was estimated to have a recoverable amount of $40 000. Khanjar recognised an impairment loss on the old flangifier, but assessed that at that time the useful life would still last to 30th June 2026). Khanjar depreciates all assets on a straight line basis. Required 1. Record the impairment of the flangifier on 30 June 2019. 2. Record depreciation for the flangifier on 30 June 2020. 3. Show the Carrying Amount on 30 June 2022.

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter11: Depreciation, Depletion, Impairment, And Disposal

Section: Chapter Questions

Problem 14P: Hunter Company purchased a light truck on January 2, 2019 for 18,000. The truck, which will be used...

Related questions

Question

Transcribed Image Text:Khanjar Corp derives revenue from flanging services. Its chief item of equipment is a "flangifier"

produced by Omani Enterprises Ltd. The only flangifier that Khanjar owns was purchased on the 1st

of July 2016 for $100 000. At that time, this item was estimated to last 10 years (i.e. to 30th June,

2026) and to have a salvage/residual value of $0 at the end of that useful life. However, at 30th June

2019, Khanjar noticed indicators of impairment due to Omani coming out with a new, cheaper and

much more efficient neo-flangifier which could render the old one relatively inefficient. At that time,

the old flangifier was estimated to have a recoverable amount of $40 000. Khanjar recognised an

impairment loss on the old flangifier, but assessed that at that time the useful life would still last

to 30th June 2026). Khanjar depreciates all assets on a straight line basis.

-

Required

1. Record the impairment of the flangifier on 30 June 2019.

2. Record depreciation for the flangifier on 30 June 2020.

3. Show the Carrying Amount on 30 June 2022.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 5 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT