Q: If markets are efficient, an investor's best investment strategy involves the correct choice of

A: This is multiple choice question, in this we explained that if Market is efficient then what's the…

Q: An analyst wanting to assess the downside risk of an alternative investment and is considering the…

A: Downside risk is a statistical measure that defines the probability of potential loss from a fall in…

Q: What is Security selection: A) determining beta of securities. B) investing…

A: Security selection refers to choosing specific securities within each asset class.

Q: risk-taker (likes to take risks) type of investor prefer equities over fixed income?

A: Most of investors invest in the equity and like to take high risk and would invest in stock market.

Q: How does the magnitude of firm-specific risk affect the extent to which an active investor will be…

A: The question is based on the role of risk factor in selection of portfolio, which is simply…

Q: The investor should accept?

A: Investor's money is due on December 31. However Juliette is willing to make an early payment on…

Q: what better to suggest in terms of investing, to invest in a low risk outlet such as the money…

A: To answer the above question one needs to understand what is a low-risk outlet and what is a…

Q: (a) Compute and identify the stock that has the most systematic risk. (b) Compute and justify the…

A: It has been given in the question that the risk premium is the 7.5% and the risk-free rate of return…

Q: ince investors tend to dislike risk and like certainty, the more volatile a stock, the less valuable…

A: Volatile stocks : Risk and Return While it's true that a rational investor likes to avoid risk, it…

Q: Why a risk taker (likes to take risk) type of investor prefer equities over fixed income?

A: Risk takers are the individuals who are willing to take risk besides the consequences comes with it.…

Q: Indicate why you agree with justifications to the following statements: “An investor should be…

A: Risk are of systematic and unsystematic.

Q: fter combining a riskfree asset with the efficient frontier of risky portfolios, you no longer need…

A: Step 1 The effective limit of a set of relevant portfolios provides the highest expected return on a…

Q: Would a market-neutral hedge fund be a good candidate for an investor’s entire retirement portfolio?…

A: The investment options available to an investor which uses various strategies to generate revenues…

Q: If a given investor believes that a stock’s expected return exceeds its required return, then the…

A: Required rate of return is the minimum return which an investor expect on its investment. This is…

Q: The following is a concise explanation of the primary investment risk characteristics that investors…

A: Introduction : Investing assessment and appraisal is crucial for investors because it is a kind of…

Q: If an investor prefers investment with higher risk , regardless to the return then he is following…

A: Risk awareness strategy is defined as the raise in an understanding in the existence of the risks…

Q: When would individual equity securities be a better choice over ETFs for a risk adverse investor?…

A: There are various alternatives available for investment. Equity security and ETFs are also an…

Q: An investor who wishes to form a portfolio that lies to the right of the optimal risky portfolio on…

A: CAL and CAPM are widely used concept in portfolio theory

Q: Indicate why you agree or disagree with justifications to the following statements: - “An investor…

A: Diversified portfolio- It refers to a portfolio of investments in which unsystematic risk or firm…

Q: be regarded as high risky when

A: Risk and return are positively correlated. If the risk for an investment is high, the more will be…

Q: will you suggest to a relative, to invest in a low risk outlet such as the money market or to a high…

A: In this we have to choose between the debt and equity and choose the proper based on our risk…

Q: According to Peter Bernstein "When we take a risk, we are betting an outcome that will result from a…

A: Risks are the situations and conditions that have exposure to losses or damages. Risks expose…

Q: Discuss whether you think the stock is a good investment or not.

A: Stock is essentially an equity instrument in which the investor gets part ownership in the company…

Q: Both investors and gamblers take on risk. The difference between an investor and a gambler is that…

A:

Q: After doing analysis, an investor with a bearish attitude would be inclined to buy shares only as…

A: Short cover or short selling takes place when an investor sells a stock without owning the stocks.…

Q: estment with higher risk, regardless to the return then he is following a strategy. O a. risk-aware…

A: Here, it is required to identify the correct option.

Q: When would individual equity securities be a better choice over ETFs for a risk adverse investor?…

A: Introduction: Risk can be characterized in terms of the uncertainty of future consequences resulting…

Q: Which of the following statements correctly describe characteristics of a risk averse investor?…

A: Introduction: A risk-seeking investor is the one which always focuses on getting exposed to a higher…

Q: If you must choose only two stocks to your investment portfolio, what would be your choice?

A: Hello. Since your question has multiple parts, we will solve first question for you. If you want…

Q: There are numerous uses of preferred stocks that may fit in for both conservative and aggressive…

A:

Q: of investor prefer fixed income

A: Risk-Averse-: Some investor who is a Risk-Averse has the trait of inclining toward preventing loss…

Q: Explain what is the criterion used by a rational investor for choosing a financial investment in…

A:

Q: Differentiate among the three basic risk preferences: risk-indifferent, risk-averse, and…

A: Risk: It refers to uncertainty arises in the event of doing any transaction. The outcome of your…

Q: Which investment management style would an equities fund manager who utilises a value approach to…

A: Fundamental analysis (FA) It may be a strategy of calculating the intrinsic value of a security by…

Q: Step by step explaination (use attached diagram) This question relates to Diagram 6 from the…

A: The investors are categories on the basis of their risk tolerance capability. A person who is taking…

Q: Rational risk-averse investors will always prefer portfolios ______________. Group of answer…

A: The difference in the capital market line and the efficient frontier is that in - Capital market…

Q: what better to suggest in investing, to invest in a low risk outlet such as the money market or to a…

A: What to invest in will depend on factors like the investment goal of the concerned person, his/her…

Q: What follows is a brief summary of major investment risk characteristics that must be considered by…

A: Investment evaluation and appraisal is important for investors because it is a form of fundamental…

Q: 1. Based on the risk-return relationship, which stock should a risk averse investor prefer if she…

A: Given, Stock Expected return Standard deviation beta coefficient AZ 8% 6% 1 BY 12.5% 5% 1.8…

Q: What are five risks a conservative investor could have that can impact him/her portfolio and…

A: Risk is referred as uncertainty or loss. Financial risk is referred as the variability of actual…

Q: What are the trade-offs facing an investor who is considering writing a call option on an existing…

A: Writing a call option refers to taking a covered call position on an existing portfolio.

Q: What are the trade-offs facing an investor who is considering buying a put option on an existing…

A: Purchasing a put option on an existing portfolio means insuring the portfolio from the downside…

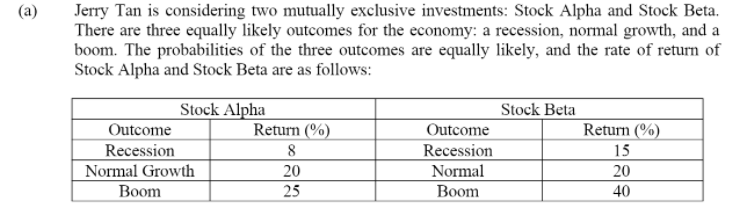

Assuming that Jerry Tan is a risk-adverse investor, recommend which stock he should select for long term investment.

Step by step

Solved in 3 steps with 2 images

- Consider the following information about the various states of economy and the returns ofvarious investment alternatives for each scenario. Answer the questions that follow. % Return on T-Bills, Stocks and Market IndexState of the Economy Probability TBills Phillips Payup Rubbermade Market Index Recession 0.2 7 -22 28 10 -13 Below Average 0.1 7 -2 14.7 -10 1 Average 0.3 7 20 0 7 15 Above Average 0.3 7 35…Consider the following information about the various states of economy and the returns ofvarious investment alternatives for each scenario. Answer the questions that follow. % Return on T-Bills, Stocks and Market Index State of the Economy Probability T- Phillips Pay- Rubber- Market Bills up made Index Recession 0.2 7 -22 28 10 -13 Below Average 0.1 7 -2 14.7 -10 1 Average 0.3 7 20 0 7 15 Above Average 0.3 7 35 -10 45 29…An investor holds a portfolio of stocks and is considering investing in the DBB Company. The firm’s prospects look neutral and you estimate the following probability distribution of possible returns: Conditions P Returns on DBB Returns on DVI Recession 0.10 -30% -15% Below Average 0.20 -15% 4% Average 0.40 15% 8% Above Average 0.20 28% 20% Boom 0.10 40% 22% a) How much is the expected return for DBB? b) How much is the coefficient of variation for DBB? c) Now let’s say you want to add another asset, DVI, to your portfolio. You sell 20% of DBB to purchase DVI. How much is your expected return for this portfolio? d) How much is the coefficient of variation for the new portfolio? Please show the Excel formulas.

- Consider the following information about the various states of economy and the returns of various investment alternatives for each scenario. Answer the questions that follow. % Return on T-Bills, Stocks and Market Index States of Economy Probability T-Bills Phillips Pay-up Rubber-Made Market Index Recession 0.2 7 -22 28 10 -13 Below Average 0.1 7 -2 14.7 -10 1 Average 0.3 7 20 0 7 15 Above Average 0.3 7 35 -10 45 29 Boom 0.1 7 50 -20 30 43 Mean Variance (%) ^2 Standard Deviation Coefficient of Variation Covariance wit MP Correlation with Market Index Beta CAPM Req. Return Valuation ( Overvalued / Undervalued/Fairly Valued) Nature of Stock…Consider the following information about the various states of economy and the returns of various investment alternatives for each scenario. Answer the questions that follow. % Return on T-Bills, Stocks and Market Index States of Economy Probability T-Bills Phillips Pay-up Rubber-Made Market Index Recession 0.2 7 -22 28 10 -13 Below Average 0.1 7 -2 14.7 -10 1 Average 0.3 7 20 0 7 15 Above Average 0.3 7 35 -10 45 29 Boom 0.1 7 50 -20 30 43 Mean 7 16.9 20.7 19.6 15 Variance (%) ^2 0 549.09 244.124 358.04 313.6 Standard Deviation 0 23.4326695 15.6244712 18.92194493 17.7087549 Coefficient of Variation 0 1.386548491 7.54805372 0.965405354 1.18058366 Covariance wit MP 0 4.13 -275 231 313.60 Correlation with Market Index 0.9953 -0.9953 0.6894 1.0000 Beta 0 1.32…Consider the following information about the various states of economy and the returns of various investment alternatives for each scenario. Answer the questions that follow. % Return on T-Bills, Stocks and Market Index States of Economy Probability T-Bills Phillips Pay-up Rubber-Made Market Index Recession 0.2 7 -22 28 10 -13 Below Average 0.1 7 -2 14.7 -10 1 Average 0.3 7 20 0 7 15 Above Average 0.3 7 35 -10 45 29 Boom 0.1 7 50 -20 30 43 Mean Variance (%) ^2 Standard Deviation Coefficient of Variation Covariance wit MP Correlation with Market Index Beta CAPM Req. Return Valuation ( Overvalued / Undervalued/Fairly Valued) Nature of Stock…

- Consider the following scenario analysis: Scenario Probability Stocks Bonds Recession 0.30 -6 % +15% Normal Economy 0.30 +14 + 7 Boom 0.40 +26 +5 Calculate the expected rate of return and standard deviation for each investment? Which investment would you prefer?An investor holds a portfolio of stocks and is considering investing in the DBB Company. The firm’s prospects look neutral, and you estimate the following probability distribution of possible returns: Conditions P Returns on DBB Returns on DVI Recession 0.12 -33% -12% Below Average 0.15 -18% 7% Average 0.46 12% 11% Above Average 0.15 25% 23% Boom 0.12 37% 25% a) How much isthe expected return for DBB? b) How much isthe coefficient of variation for DBB? c) Now let’s say you want to add another asset, DVI, to your portfolio. You sell 35% of DBB to purchase DVI. How much is your expected return for this portfolio? d) How much isthe coefficient of variation for the new portfolio?Consider the following information about the various states of economy and the returns of various investment alternatives for each scenario. Answer the questions that follow. % Return on T-Bills, Stocks and Market Index State of the Economy Probability T- Phillips Pay- Rubber- Market Bills up made Index Recession 0.2 7 -22 28 10 -13 Below Average 0.1 7 -2 14.7 -10 1 Average 0.3 7 20 0 7 15…

- Blue Bell stock is expected to return 8.4 percent in a boom, 8.9 percent in a normal economy, and 9.2 percent in a recession. The probabilities of a boom, normal economy, and a recession are 6 percent, 92 percent, and 2 percent respectively. What is the standard deviation of the returns on this stock? Can the calculator an excel solution be provided?assume that an individual investor wants to select one market segment for a new investment. a forecast shows stable to declining economic conditions with the following probabilities: improving (0.2), stable (0.5), and declining (0.3). what is the preferred market segment for the investor, and what is the expected return percentage?Suppose that two factors have been identified for the U.S. economy: the growth rate of industrial production, IP, and the inflation rate, IR. IP is expected to be 5%, and IR 4.0%. A stock with a beta of 1.2 on IP and 0.6 on IR currently is expected to provide a rate of return of 8%. If industrial production actually grows by 6%, while the inflation rate turns out to be 6.0%, what is your revised estimate of the expected rate of return on the stock? (Do not round intermediate calculations. Round your answer to 1 decimal place.)