Q: Suppose you are a property owner and you are collecting rent for an apartment. The tenant has signed…

A: The present value is the equivalent value today of future payments to be received in the future…

Q: You have bought a car. The car dealer offers two payment plans: (A) Make 48 monthly payments of $130…

A: Buying decision process: The consumer decision process, also known as the buyer decision process,…

Q: d. A security has a cost of $1,000 and will return $4,000 after 6 years. What rate of return does…

A: d. Initial cost = $1,000 Amount returned = $4,000 Period = 6 years Rate of return = ? Rate of…

Q: Aunt May has three sums of money invested, one at 12%, one at 10%, the last at 8%. His total annual…

A: When we make investments the investment amount earns interest. Interest rate varies from one type of…

Q: RomZar Sdn Bhd takes a simple interest, 180-day note from a SoonWay Supplier with a face value RM…

A: Face Value 17,500.00 RomZar Sdn Time Period (Days) 180 RomZar Sdn Interest Rate 9.50%…

Q: 3) A savings bonds pay 3% annual real rate of return compounded daily. Professor John Jones invests…

A: The purchasing power of a currency is the number of products or services that one unit of money can…

Q: The total purchase price of a new home entertainment system is $14,260. If the down payment is $2900…

A: Value of system = $14,260 Down payment = $2900 Loan amount (P) = $14,260 - $2,900 = $11,360 Monthly…

Q: Find the future value of this loan. $13,081 at 6.8% for 6 months The future value of the loan is $…

A: Future value of loan can be calculated by using this equation Future value(FV) =P(1+r)n Where P=loan…

Q: The Butler-Perkins Company (BPC) must decide between two mutually exclusive projects. Each project…

A: a. Expected Annual Cash Flow = Sum of Probability weighted Cash Flows Project A; Expected…

Q: Use the following table to answer questions: Country (currency) Canada (dollar) Denmark (krone) Euro…

A: Exchange Rates on Jun2 30, 2010 1 USD($) = 7.782 Sweden krona (SKr) Exchange Rates on Jun2 30, 2009…

Q: We consider an auction on eBay. Suppose that the ticking price is $2 for all prices. The starting…

A: In bidding there is minimum or maximum upper limit allowed and in next bidding the prices changes by…

Q: Suppose you have decided to put $200 at the end of every month in a savings account that credits…

A: Future value of annuities includes the amount being deposited and amount of compounding interest…

Q: 2. Trecor Trecor is a computer accessories manufacturer. It plans to launch a new product which…

A: A capital budgeting decision is a one-time investment that is expected to pay off over some time.…

Q: OPTIMAL CAPITAL STRUCTURE Terrell Trucking Company is in the process of setting its target capital…

A: Optimal capital structure is referred to as that perfect mix of debt and equity that maximizes a…

Q: Petfeed plc has outstanding, a high yield Bond with following features: Face Value £ 10,000 10%…

A: Final answers Part 1)10293 Part 2)1742

Q: 6. Intention to create legal relations are presumed in which of the following relationships. In the…

A: Legal relations between the two or more parties can be created with the presence of mutual…

Q: please show the solution

A: A lease is a financing option where there are two parties lessor and lessee. The lessor leases an…

Q: MJ deposited 1,000, 1,500, and $2,000 at the end of the 2nd year, 3rd year and 4th year,…

A: The future value of deposits refers to the sum of the value of the deposits with the interest earned…

Q: Anirudh Corporation has the following capital structure as at December 31, 20x3: Convertible bonds,…

A: Basic and Diluted EPS: The net income of a company represents the earnings that belong to the…

Q: Additional Personal Injury Protection

A: Personal Injury Protection (PIP) covers medical expenses related to injuries sustained in motor…

Q: What are the impact of higher electricity charges on households and how can households put measures…

A: Electricity is the source of power used in the household for daily uses like air conditioners,…

Q: In an efficient market, a one-year call option on stock S with K = $25 is traded at $7.06, the…

A: Options: Options come in two varieties: calls and puts. Options of the American variety may be…

Q: Please answer section d) only

A: Degree of combined leverage (DCL) It is a leverage ratio that includes the combined effects, caused…

Q: On the news, LinkedIn's market capitalization increased to nearly $26 billion, while Microsoft's…

A: The question requires us to look into the reasons for drop in market capitalization of Microsoft…

Q: is the concept of financial management? A goal of financial management is to maximize the…

A: Financial management is very important departments of the company and with course of time value of…

Q: What is the volatility of your return over this period?

A: Information Provided: Duration = 12 years Yield on bond = 10% Volatility of yield = 0.2%

Q: Match each potential outcome to its corresponding argument either in favor of or against the bank…

A: During 2008 crisis, the several banks failed and they requested help from the government. Government…

Q: Required: Briefly discuss the types of hard peg

A: Hard Peg helps in establishing the fixed exchange rate, which are actually between the one nation's…

Q: .....#1.... ....#3..... ....#2.....

A: As per the concept of the Time value of money, today’s money value has more valuable than tomorrow.…

Q: amount borrowed plus a commitment fee of Rs.20, 000. Both alternatives also required a 20%…

A: Please see below attached file

Q: Now it's time for you to practice what you've learned. Suppose that you are given the following data…

A: Ratio analysis is a quantitative method to know the liquidity, operational efficiency, and…

Q: Clifford Clark is a recent retiree who is interested in investing some of his savings in corporate…

A: Par value: Par value means current value of the bond will be equal to redeemable value of the bond.…

Q: . Briefly explain why you would pay more for a European call option on a (non-dividend paying) stock…

A: European call options gives opportunity to buy stock on maturity and but no obligations to do that…

Q: What is the number of months required for a deposit of $1320 to earn $16.50 interest at 3.75%?

A: Deposited amount or principal balance is $1320 Interest earned is $16.50 Interest rate is 3.75% To…

Q: One way to measure risk is with standard deviation, as we saw before with asset classes. This method…

A: The return graph shows the performance of a security over a period. It reflects the rise or fall in…

Q: Galvatron Metals has a bond outstanding with a coupon rate of 6.4 percent and semiannual payments.…

A: Cost of Debt = ( Interest Amount ( 1 - t ) + Face Value Of Bond - Market Value of bond /…

Q: Question 3: A manufacturing Co. Ltd. opens the costing records, with the balances as on 1 April,…

A:

Q: anAir Reservations (PAR) borrowed $270,000 for 36 days from its bank. The interest rate on the loan…

A: Annual Percentage Rate(APR) The annual interest rate a borrower is required to pay on a loan or an…

Q: Blue Inc. has the following transactions for the month of April: Fees earned in cash $640,000…

A: Given: Fees earned is $640,000 Expenses paid = $300,000 Dividend paid =$50,000

Q: All else being constant, a bond will sell at __________ when the coupon rate is __________ the yield…

A: Bonds refer to investment securities in which money is to be lent to the company by an investor…

Q: Explain why the financial institution’s holdings of cash might have increased significantly as a…

A:

Q: Find the total monthly payment including taxes and insurance. Mortgage $56,400 Interest rate…

A: Given: Mortgage $56,400 Interest rate 5% Term of loan 10 years Annual taxes $662 Annual insurance…

Q: West Bank gives consumer loans at the annual interest rate of 8.25%. Suppose you take out a $5,200…

A: The amount paid each month to repay the loan over the course of the loan is known as the monthly…

Q: Suppose 0.3 is the correlation of returns between any two stocks in an equal-weighted portfolio…

A: Portfolio Risk: The portfolio risk measures the volatility of a given portfolio. It comprises the…

Q: Kayla contributed equal deposits at the end of every month for 4 years into an investment fund. She…

A: As per the given information: Interest rate - 3.92% compounded monthly Total time period - 8 years…

Q: Melanie earned $1430 on an investment she held for 8 months at 7.9% p.a. What was the principal…

A: Solution:- When an amount is invested somewhere, it earns interest on it. The amount initially…

Q: A Brazillian coffee exporter has found a market for his coffee to the tune of 1,800,000 Euros. At…

A: Interest rate parity With spot rate (S=in currency ksh per euro), interest rate in Kenya (ik),…

Q: S Ltd. Has equity of Rs.6Lacs issued at par. The following additional information is provided: r . .…

A: Please find attachment below In step 2 balence sheet with working notes

Q: One goal of the regulatory reforms that followed the 2007-2009 financial crisis was to address the…

A: The too big to problem was a problem associated with regulatory institutions who did not allow the…

Q: (e) What was the holding period return for an investor who held the bond from i. 31 May 1927 to 31…

A: As per instructions only question e will be solved. Holding Period return is calculated with the…

PLEASE ANSWER ALL OF THIS QUESTION!!! ASAP

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

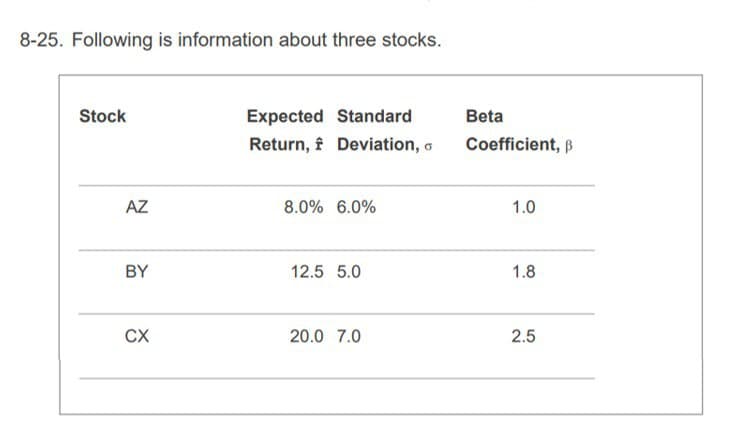

- Suppose you are an average risk-averse investor who can purchase only one of the following stocks. Which should you purchased? Explain your reasoning. Investment Expected Return, r Standard Deviation, (r Stock M 6.0% 4.0% Stock N 18.0 12.0 Stock O 12.0 7.0A close family friend has approached you to help her determine which of the two common stocksshe should invest in. Common Stock A Common Stock BProbability Return Probability Return 0.3 11% 0.2 -5% 0.4 15% 0.3 6% 0.3 19% 0.3 14% 0.2 22%Required:a) Calculate the expected returns of stock A b) Determine the risk (standard deviation) and return of stock Ac) Calculate the expected returns of stock B d) Determine the risk (standard deviation) and return of stock Be) Which investment should your friend invest in?PART A,B and C are completed. need help in D and E. TIA Unique vs. Market Risk. The figure below shows plots of monthly rates of return on three stocks versus the stock market index. The beta and standard deviation of each stock is given besides its plot. A. Which stock is riskiest to a diversified investor? B. Which stock is riskiest to an undiversified investor who puts all her funds in one of these stocks? C. Consider a portfolio with equal investments in each stock. What would this portfolio’s beta have been? D. Consider a well-diversified portfolio made up of stocks with the same beta as Exxon. What are the beta and standard deviation of this portfolio’s return? The standard deviation of the market portfolio’s return is 20 percent. E. What is the expected rate of return on each stock? Use the capital asset pricing model with a market risk premium of 8 percent. The risk-free rate of interest is 4 percent.

- A close family friend has approached you to help her determine which of the two common stocks she should invest in. Common Stock A Common stock B Probability Return Probability Return 0.25 11% 0.25 -5% 0.15 15% 0.25 6% 0.6 19% 0.25 14% 0.25 22% Required: Calculate the expected returns of stock A Determine the risk (standard deviation) and return of stock A Calculate the expected returns of stock B Determine the risk (standard deviation) and return of stock B Which investment should your friend invest in?A highly risk-averse investor is considering adding one additional stock to a 4-stock portfolio. Two stocks are under consideration. Both have an expected return,, of 15%. However, the distribution of possible returns associated with Stock A has a standard deviation of 12%, while Stock B’s standard deviation is 8%. Both stocks are equally highly correlated with the market, with correlation equal to 0.75 for both stocks. Which stock should this risk-averse, will add to his/her portfolio? Explain with reasoningYou meet with two investors who have different expectations for stock CBD that can be addressed with various positions in puts, calls, and the underlying stock (or combination). For each investor, document the (1) name of the recommended strategy, (2) the components of the suggested trade, and (3) draw the payoff as a function of the stock price. a. Investor A already holds CBD stock and wants to lock in gains if the stock drops below its current levels, while maintaining upside exposure. b. Investor B wants to profit if CBD’s upcoming earnings announcement is either unexpectedly good or disappointingly bad. c. Investor C already holds CBD stock and believes the stock will not increase much in the near term. As such, she wants to earn some extra income using options.

- Clay Jensen is evaluating whether to purchase one of 2 different stocks and is considering the investment in isolation (he has no other investments). Clay believes stock A has equal probabilities of returning 6%, -10%, or 22%. He believes stock B has equal probabilities of returning 9%, -20%, or 35%. The risk-free rate is 4%. What is the appropriate measure to compare these two stocks and which investment should he choose?Which of the following statements is CORRECT? a. If an investor buys enough stocks, he or she can, through diversification, eliminate all of the diversifiable risk inherent in owning stocks. Therefore, if a portfolio contained all publicly traded stocks, it would be essentially riskless. b. The required return on a firm's common stock is, in theory, determined solely by its market risk. If the market risk is known, and if that risk is expected to remain constant, then no other information is required to specify the firm's required return. c. Portfolio diversification reduces the variability of returns (as measured by the standard deviation) of each individual stock held in a portfolio. d. A security's beta measures its non-diversifiable, or market, risk relative to that of an average stock. e. A stock's beta is less relevant as a measure of risk to an investor with a well-diversified portfolio than to an investor who holds only that one stock.A close family friend has approached you to help her determine which of the two common stocks she should invest in Common Stock A Common Stock B Probability Return Probability Return 0.25 11% 0.25 -5% 0.15 15% 0.25 6% 0.6 19% 0.25 14% 0.25 22% Required: Calculate the expected returns of stock A Determine the risk (standard deviation) and return of stock A Calculate the expected returns of stock B Determine the risk (standard deviation) and return of stock B Which investment should your friend invest in? Jenny has decided that she will invest her $100,000 savings in stocks as follows: What rate of return should Jenny expects to receive on her portfolio? Company Percentage of Investment Expected rate of return Standards Company Limited 45% 9% Starbucks 15% 12% Treasury Bill 40% 4%

- Assume that a risk-averse investor owning stock in Miller Corporation decides to add the stock of either Mac or Green Corporation to her portfolio. All three stocks offer the same expected return and total variability. The correlation of return between Miller and Mac is −.05 and between Miller and Green is +.05. Portfolio risk is expected to:a. Decline more when the investor buys Mac.b. Decline more when the investor buys Green.c. Increase when either Mac or Green is bought.d. Decline or increase, depending on other factors.Given the information in the table below, which of the following statements is correct, assuming that either security will be held in a portfolio with other investments? Stock Expected Return Required Return Beta Standard Deviation A 10% 12% 0.9 25% B 8% 5% 0.3 35% Question 26 options: The investor should purchase both stocks because their beta is less than that of the market. The investor should purchase A since its risk, as measured by standard deviation, is the lowest. The investor should purchase A because it requires the highest rate of return. The investor should purchase B since its expected return exceeds its required return.A) Assume that you have some shares of stock in ABC Inc. Why do we say that if you also purchase a put option on the same stock, the price paid to buy the put option is like paying an insurance premium? B) We understand standard deviation of returns as a measure of risk and rational investors would like to minimize risk. Notwithstanding this, you may have read that as the standard deviation of returns of the underlying asset increases the value of an option rises. If standard deviation is a measure of risk and investors do not particularly like it, why does it lead to an increase in an option's value?