At a total cost of $6,700,000, Herrera Corporation acquired 238,000 shares of Tran Corp. common stock as a long-term investment. Tran Corp. has 700,000 shares of common stock outstanding, including the shares acquired by Herrera Corporation. Required: a. Journalize the entries by Herrera Corporation to record the following information on December 31: 1. Tran Corp. reports net income of $967,000 for the current period.* 2. A cash dividend of $0.29 per common share is paid by Tran Corp. during the current period.* b. Why is the equity method appropriate for the Tran Corp. investment?

At a total cost of $6,700,000, Herrera Corporation acquired 238,000 shares of Tran Corp. common stock as a long-term investment. Tran Corp. has 700,000 shares of common stock outstanding, including the shares acquired by Herrera Corporation. Required: a. Journalize the entries by Herrera Corporation to record the following information on December 31: 1. Tran Corp. reports net income of $967,000 for the current period.* 2. A cash dividend of $0.29 per common share is paid by Tran Corp. during the current period.* b. Why is the equity method appropriate for the Tran Corp. investment?

Chapter14: Corporation Accounting

Section: Chapter Questions

Problem 14MC: Which of the following is true of a stock dividend? A. It is a liability. B. The decision to issue a...

Related questions

Question

100%

At a total cost of $6,700,000, Herrera Corporation acquired 238,000 shares of Tran Corp. common stock as a long-term investment. Tran Corp. has 700,000 shares of common stock outstanding, including the shares acquired by Herrera Corporation.

Required:

| a. |

|

||||

| b. | Why is the equity method appropriate for the Tran Corp. investment? | ||||

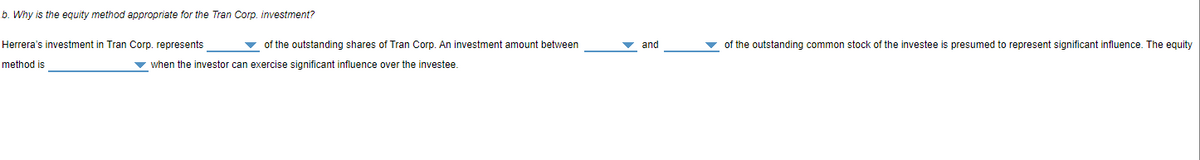

Transcribed Image Text:b. Why is the equity method appropriate for the Tran Corp. investment?

Herrera's investment in Tran Corp. represents

v of the outstanding shares of Tran Corp. An investment amount between

and

v of the outstanding common stock of the investee is presumed to represent significant influence. The equity

method is

v when the investor can exercise significant influence over the investee.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College