a. What net income would Ravine Corporation have reported for each of the years, assuming Ravine accounts for the intercorporate investment either by carrying the investment at fair value, or by using the equity method? b-1. Give all appropriate journal entries for 20X8 that Ravine would make if it carries the investment at fair value. b-2. Give all appropriate journal entries for 20X8 that Ravine would make if it uses the equity method.

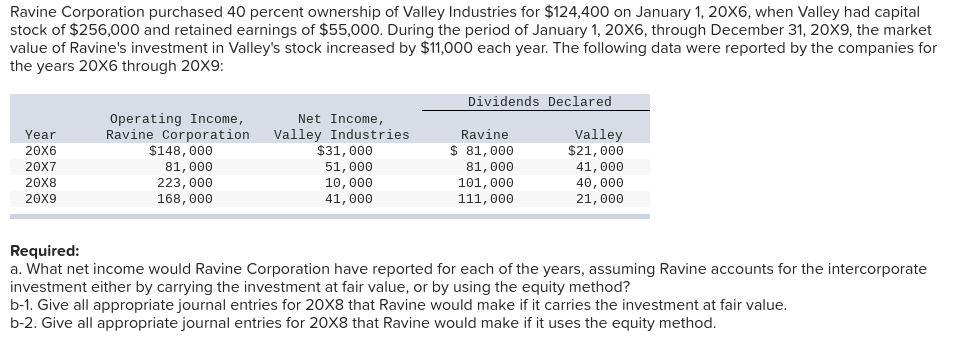

Ravine Corporation purchased 40 percent ownership of Valley Industries for $124,400 on January 1, 20X6, when Valley had capital stock of $256,000 and

Required:

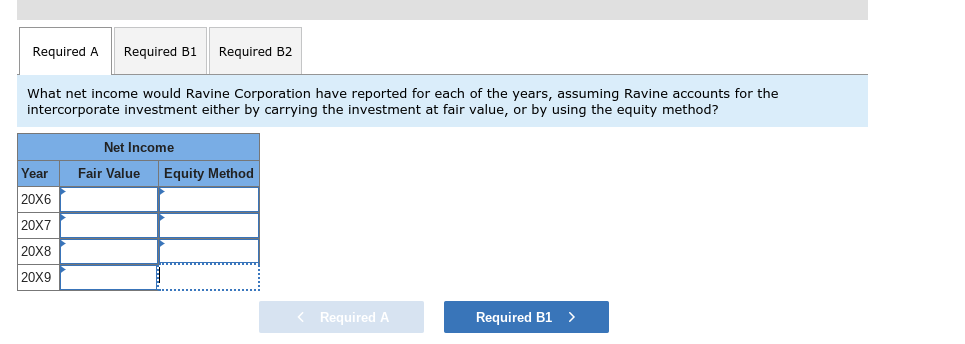

a. What net income would Ravine Corporation have reported for each of the years, assuming Ravine accounts for the intercorporate investment either by carrying the investment at fair value, or by using the equity method?

b-1. Give all appropriate

b-2. Give all appropriate journal entries for 20X8 that Ravine would make if it uses the equity method.

Required A

net income

| year | fair value | equity method |

| 2016 | ||

| 2017 | ||

| 2018 | ||

| 2019 |

required b

Record the dividend received from Valley Industries under the fair value method.

Record the unrealized gain from Valley Industries under the fair value method.

required b2

Record the dividend received from Valley Industries under the equity method.

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 5 images