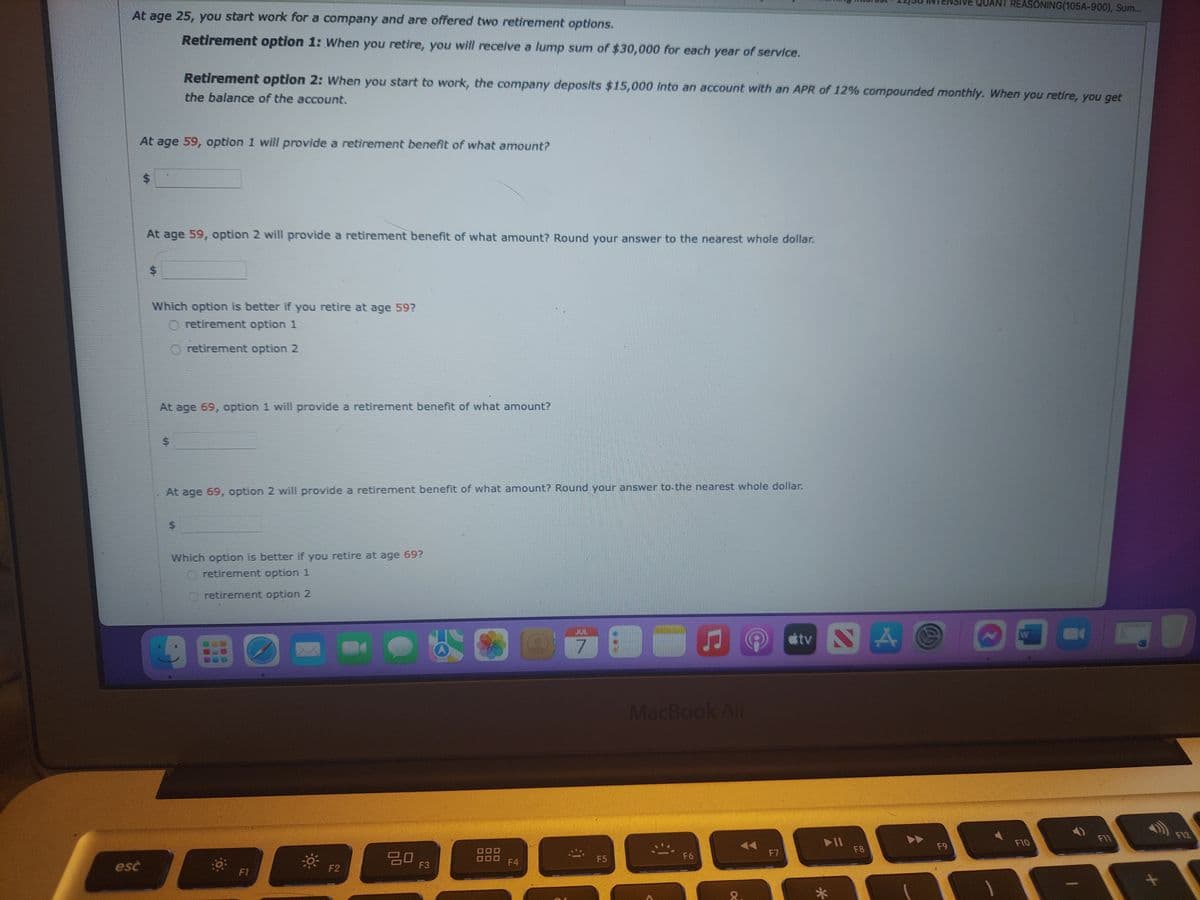

At age 25, you start work for a company and are offered two retirement options. Retirement option 1: When you retire, you will receive a lump sum of $30,000 for each year of service. At age 59, option 1 will provide a retirement benefit of what amount? $ At age 59, option 2 will provide a retirement benefit of what amount? Round your answer to the nearest whole dollar. $ Retirement option 2: When you start to work, the company deposits $15,000 into an account with an APR of 12% compounded monthly. When you retire, you get the balance of the account. Which option is better if you retire at age 59? O retirement option 1 O retirement option 2 At age 69, option 1 will provide a retirement benefit of what amount? $ At age 69, option 2 will provide a retirement benefit of what amount? Round your answer to the nearest whole dollar. $ Which option is better if you retire at age 69? retirement option 1 retirement option 2

At age 25, you start work for a company and are offered two retirement options. Retirement option 1: When you retire, you will receive a lump sum of $30,000 for each year of service. At age 59, option 1 will provide a retirement benefit of what amount? $ At age 59, option 2 will provide a retirement benefit of what amount? Round your answer to the nearest whole dollar. $ Retirement option 2: When you start to work, the company deposits $15,000 into an account with an APR of 12% compounded monthly. When you retire, you get the balance of the account. Which option is better if you retire at age 59? O retirement option 1 O retirement option 2 At age 69, option 1 will provide a retirement benefit of what amount? $ At age 69, option 2 will provide a retirement benefit of what amount? Round your answer to the nearest whole dollar. $ Which option is better if you retire at age 69? retirement option 1 retirement option 2

Chapter5: The Time Value Of Money

Section: Chapter Questions

Problem 32P

Related questions

Question

100%

Transcribed Image Text:At age 25, you start work for a company and are offered two retirement options.

Retirement option 1: When you retire, you will receive a lump sum of $30,000 for each year of service.

At age 59, option 1 will provide a retirement benefit of what amount?

esc

$

At age 59, option 2 will provide a retirement benefit of what amount? Round your answer to the nearest whole dollar.

$

Retirement option 2: When you start to work, the company deposits $15,000 into an account with an APR of 12% compounded monthly. When you retire, you get

the balance of the account.

Which option is better if you retire at age 59?

O retirement option 1

retirement option 2

At age 69, option 1 will provide a retirement benefit of what amount?

$

At age 69, option 2 will provide a retirement benefit of what amount? Round your answer to the nearest whole dollar.

$

Which option is better if you retire at age 69?

retirement option 1

O retirement option 2

D

F1

F2

ㅁㅁ 13

F3

5

F4

JUL

D

DŹ BO

F5

♫

MacBook Air

F6

8

F7

tv NA

▶11

F8

QUANT REASONING(105A-900), Sum...

F9

N

D

W

F10

F11

F12

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 2 images

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,