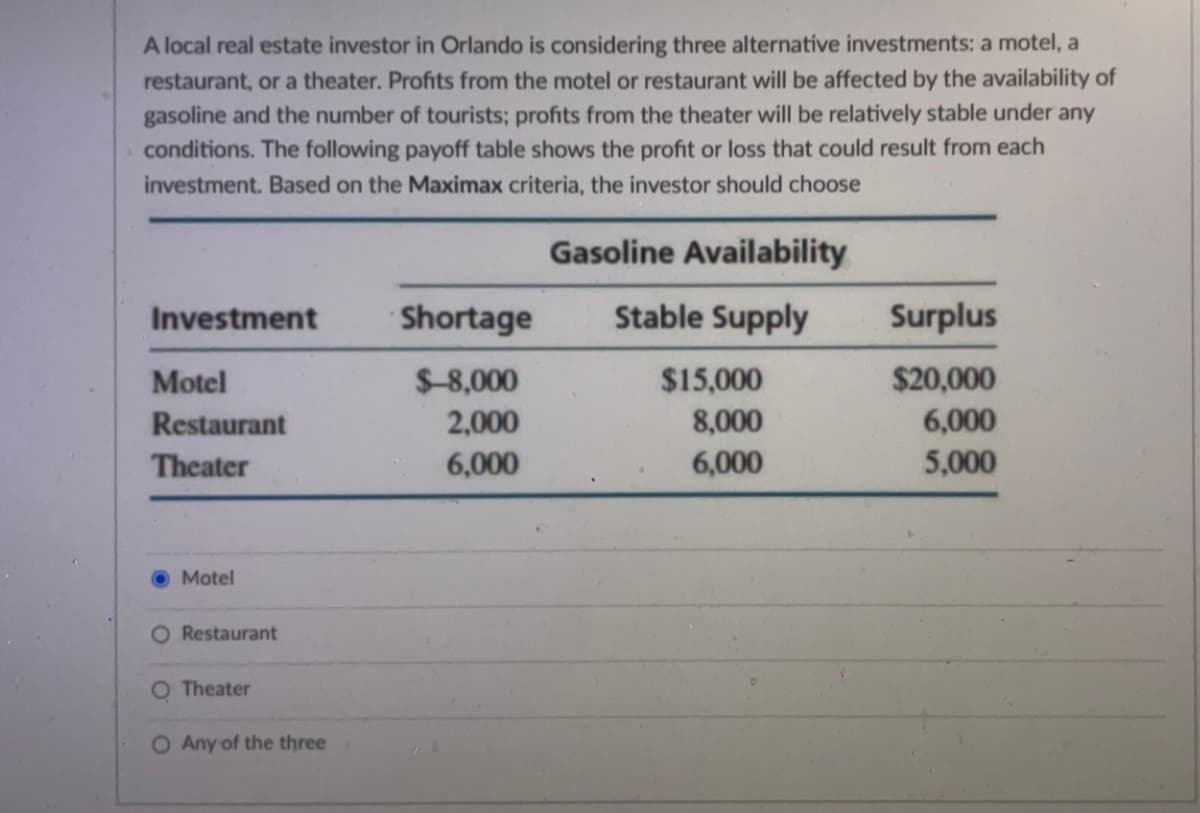

A local real estate investor in Orlando is considering three alternative investments: a motel, a restaurant, or a theater. Profits from the motel or restaurant will be affected by the availability of gasoline and the number of tourists; profits from the theater will be relatively stable under any conditions. The following payoff table shows the profit or loss that could result from each investment. Based on the Maximax criteria, the investor should choose

A local real estate investor in Orlando is considering three alternative investments: a motel, a restaurant, or a theater. Profits from the motel or restaurant will be affected by the availability of gasoline and the number of tourists; profits from the theater will be relatively stable under any conditions. The following payoff table shows the profit or loss that could result from each investment. Based on the Maximax criteria, the investor should choose

Chapter11: Capital Budgeting Decisions

Section: Chapter Questions

Problem 9PA: Pitt Company is considering two alternative investments. The company requires a 12% return from its...

Related questions

Question

Transcribed Image Text:A local real estate investor in Orlando is considering three alternative investments: a motel, a

restaurant, or a theater. Profits from the motel or restaurant will be affected by the availability of

gasoline and the number of tourists; profits from the theater will be relatively stable under any

conditions. The following payoff table shows the profit or loss that could result from each

investment. Based on the Maximax criteria, the investor should choose

Investment

Motel

Restaurant

Theater

Motel

Restaurant

O Theater

O Any of the three

Shortage

$-8,000

2,000

6,000

Gasoline Availability

Stable Supply

$15,000

8,000

6,000

Surplus

$20,000

6,000

5,000

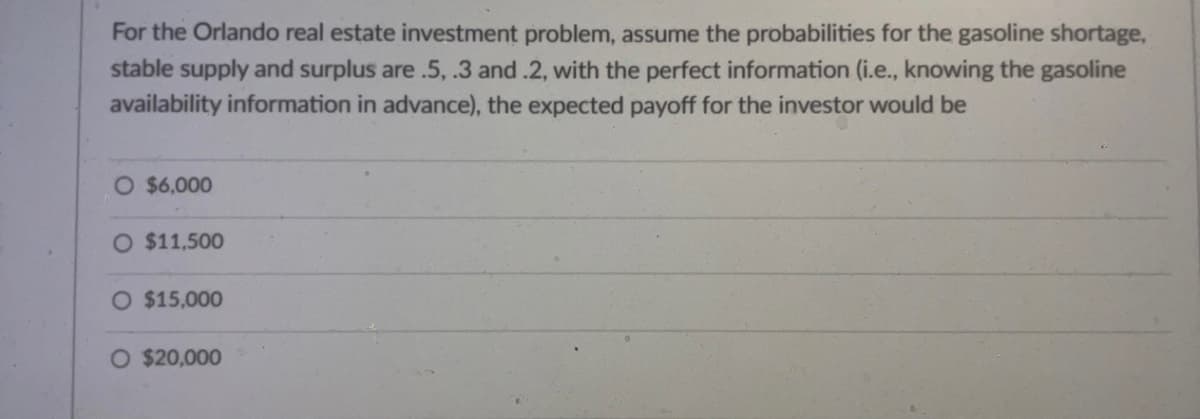

Transcribed Image Text:For the Orlando real estate investment problem, assume the probabilities for the gasoline shortage,

stable supply and surplus are .5, .3 and .2, with the perfect information (i.e., knowing the gasoline

availability information in advance), the expected payoff for the investor would be

O $6,000

O $11,500

O $15,000

O $20,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Essentials of Business Analytics (MindTap Course …

Statistics

ISBN:

9781305627734

Author:

Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Essentials of Business Analytics (MindTap Course …

Statistics

ISBN:

9781305627734

Author:

Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:

Cengage Learning