at amoun haron hop e Value o hution

Chapter15: Choice Of Business Entity—other Considerations

Section: Chapter Questions

Problem 94TPC

Related questions

Question

100%

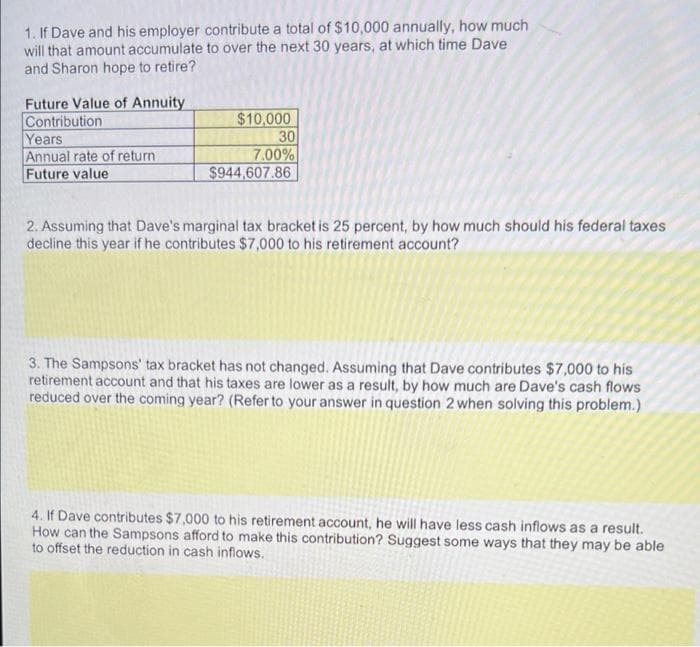

Transcribed Image Text:1. If Dave and his employer contribute a total of $10,000 annually, how much

will that amount accumulate to over the next 30 years, at which time Dave

and Sharon hope to retire?

Future Value of Annuity

Contribution

Years

Annual rate of return

Future value

$10,000

30

7.00%

$944,607.86

2. Assuming that Dave's marginal tax bracket is 25 percent, by how much should his federal taxes

decline this year if he contributes $7,000 to his retirement account?

3. The Sampsons' tax bracket has not changed. Assuming that Dave contributes $7,000 to his

retirement account and that his taxes are lower as a result, by how much are Dave's cash flows

reduced over the coming year? (Refer to your answer in question 2 when solving this problem.)

4. If Dave contributes $7,000 to his retirement account, he will have less cash inflows as a result.

How can the Sampsons afford to make this contribution? Suggest some ways that they may be able

to offset the reduction in cash inflows.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT