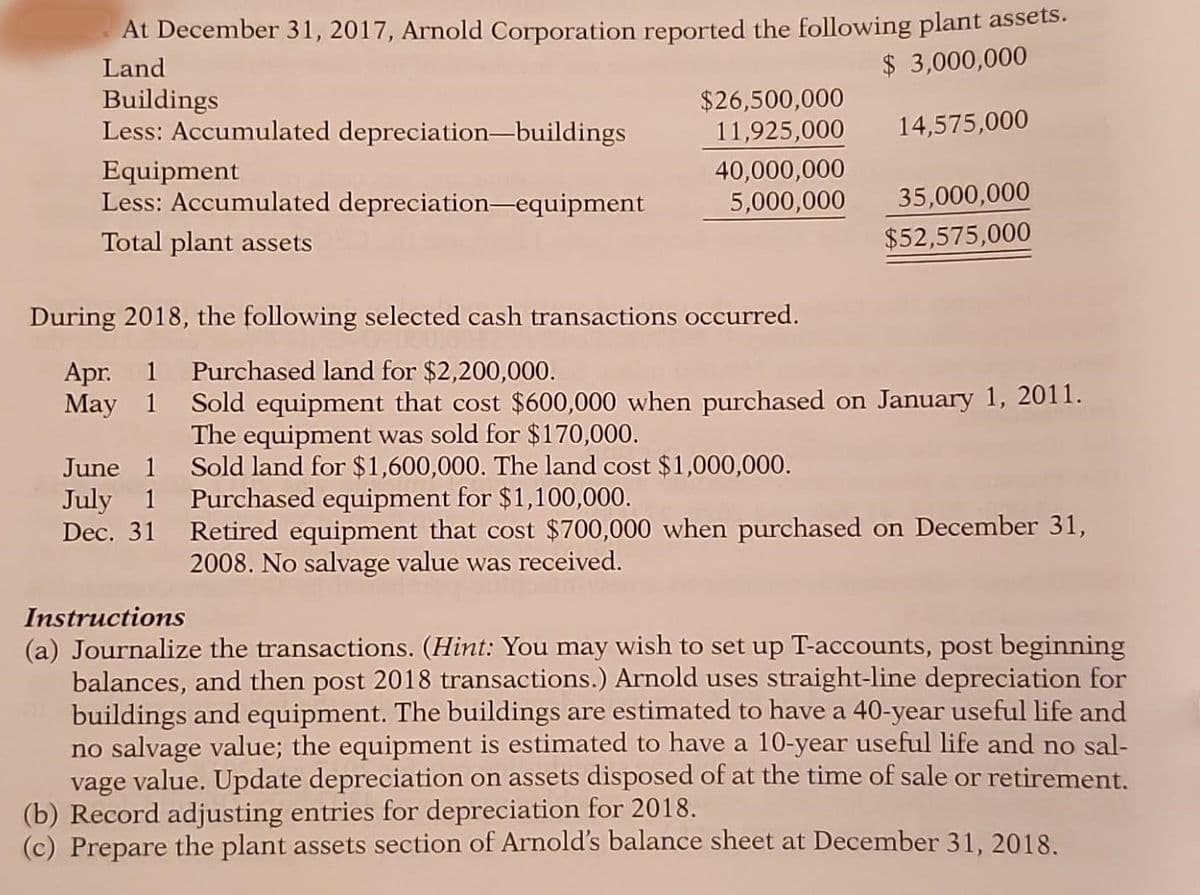

At December 31, 2017, Arnold Corporation reported the following plant assets. Land $ 3,000,000 14,575,000 Buildings Less: Accumulated depreciation-buildings Equipment Less: Accumulated depreciation-equipment Total plant assets $26,500,000 11,925,000 June 1 July 1 Dec. 31 40,000,000 5,000,000 During 2018, the following selected cash transactions occurred. Apr. 1 Purchased land for $2,200,000. May 1 35,000,000 $52,575,000 Sold equipment that cost $600,000 when purchased on January 1, 2011. The equipment was sold for $170,000. Sold land for $1,600,000. The land cost $1,000,000. Purchased equipment for $1,100,000. Retired equipment that cost $700,000 when purchased on December 31, 2008. No salvage value was received. Instructions (a) Journalize the transactions. (Hint: You may wish to set up T-accounts, post beginning balances, and then post 2018 transactions.) Arnold uses straight-line depreciation for buildings and equipment. The buildings are estimated to have a 40-year useful life and no salvage value; the equipment is estimated to have a 10-year useful life and no sal- vage value. Update depreciation on assets disposed of at the time of sale or retirement. (b) Record adjusting entries for depreciation for 2018. (c) Prepare the plant assets section of Arnold's balance sheet at December 31, 2018.

At December 31, 2017, Arnold Corporation reported the following plant assets. Land $ 3,000,000 14,575,000 Buildings Less: Accumulated depreciation-buildings Equipment Less: Accumulated depreciation-equipment Total plant assets $26,500,000 11,925,000 June 1 July 1 Dec. 31 40,000,000 5,000,000 During 2018, the following selected cash transactions occurred. Apr. 1 Purchased land for $2,200,000. May 1 35,000,000 $52,575,000 Sold equipment that cost $600,000 when purchased on January 1, 2011. The equipment was sold for $170,000. Sold land for $1,600,000. The land cost $1,000,000. Purchased equipment for $1,100,000. Retired equipment that cost $700,000 when purchased on December 31, 2008. No salvage value was received. Instructions (a) Journalize the transactions. (Hint: You may wish to set up T-accounts, post beginning balances, and then post 2018 transactions.) Arnold uses straight-line depreciation for buildings and equipment. The buildings are estimated to have a 40-year useful life and no salvage value; the equipment is estimated to have a 10-year useful life and no sal- vage value. Update depreciation on assets disposed of at the time of sale or retirement. (b) Record adjusting entries for depreciation for 2018. (c) Prepare the plant assets section of Arnold's balance sheet at December 31, 2018.

Financial Accounting: The Impact on Decision Makers

10th Edition

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Gary A. Porter, Curtis L. Norton

Chapter8: Operating Assets: Property, Plant, And Equipment, And Intangibles

Section: Chapter Questions

Problem 8.5P

Related questions

Question

Transcribed Image Text:At December 31, 2017, Arnold Corporation reported the following plant assets.

Land

$3,000,000

14,575,000

Buildings

Less: Accumulated depreciation-buildings

Equipment

Less: Accumulated depreciation equipment

Total plant assets

$26,500,000

11,925,000

June 1

July 1

Dec. 31

40,000,000

5,000,000

During 2018, the following selected cash transactions occurred.

Apr. 1 Purchased land for $2,200,000.

May 1

35,000,000

$52,575,000

Sold equipment that cost $600,000 when purchased on January 1, 2011.

The equipment was sold for $170,000.

Sold land for $1,600,000. The land cost $1,000,000.

Purchased equipment for $1,100,000.

Retired equipment that cost $700,000 when purchased on December 31,

2008. No salvage value was received.

Instructions

(a) Journalize the transactions. (Hint: You may wish to set up T-accounts, post beginning

balances, and then post 2018 transactions.) Arnold uses straight-line depreciation for

buildings and equipment. The buildings are estimated to have a 40-year useful life and

no salvage value; the equipment is estimated to have a 10-year useful life and no sal-

vage value. Update depreciation on assets disposed of at the time of sale or retirement.

(b) Record adjusting entries for depreciation for 2018.

(c) Prepare the plant assets section of Arnold's balance sheet at December 31, 2018.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning