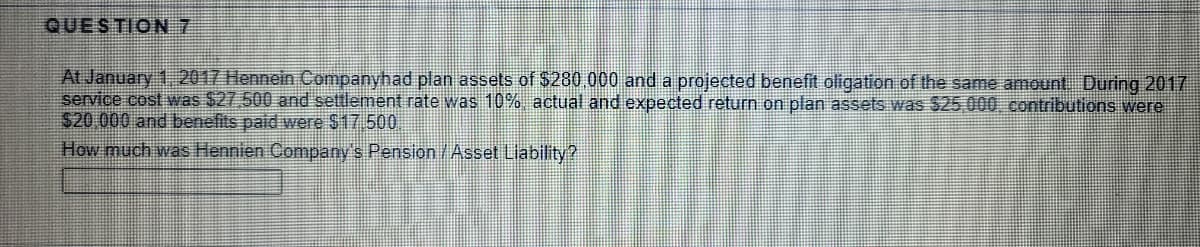

At January 1, 2017 Hennein Companyhad plan assets of $280 000 and a projected benefit oligation of the same amount During 2017 service cost was $27.500 and settlement rate was 10% actual and expected return on plan assets was $25,000, contributions were $20 000 and benefits paid were $17 500 How much was Hennien Company's Pension /Asset Liability?

Q: Hawkins Corporation has the following balances at December 31, 2017. Projected benefit obligation…

A: Given information is: Projected Benefit Obligation = $26,00,000 Plan assets at fair value =…

Q: The memorandum records of Galindez Trading at January 1, 2021 show the following data: Define…

A: Retirement benefit-cost taken to other comprehensive income for the year 2021 = Change in Return on…

Q: Pension data for the Ben Franklin Company include the following for the current calendar year:…

A: Journal: Recording of a business transactions in a chronological order.

Q: YULETIDE Corporation reported the following data on January 1, 2021: Projected benefit obligation…

A: Defined benefit cost for the current year = Current service costs + Interest costs - Actual interest…

Q: Elton Co. has the following postretirement benefit plan balances on January 1, 2020. Accumulated…

A: a)

Q: At January 1, 2020, Wembley Company had plan assets of $250,000 and a defined benefit obligation of…

A: Pension plan: Pension plan is the plan devised by corporations to pay the employees an income after…

Q: Coronado Corporation had a projected benefit obligation of $2,890,000 and plan assets of $3,097,000…

A: Corridor rule says that losses or gains which exceed 10 % of Higher of Pension benefit obligation…

Q: (Postretirement Benefit Expense Computation) Garner Inc. provides the following information related…

A: Postretirement benefit expense: This is an expense to the employer paid as compensation after the…

Q: On January 1, 2017, Roca Co. has the following balances: Projected benefit obligation $3,730,000…

A: The present amount required by an entity to fulfill the pension obligations relating to the future…

Q: Net Gain or Loss Hudson Company's actuary has provided the following information concerning the…

A: Gain at beginning of 2016 = Expected projected benefit obligation - Actual projected benefit…

Q: At December 31, 2017, Besler Corporation had a projected benefit obligation of $560,000, plan assets…

A: Pension asset: A pension asset is the funds of a company which is used to meet their future…

Q: Wella Company reported a prepaid benefit cost of P 1,500,000 on January 1, 2016. The entity provided…

A: Defined benefit pension plan: A kind of pension plan where a certain amount of pension is reimbursed…

Q: At January 1, 2020, Sarasota Company had plan assets of $283,600 and a projected benefit obligation…

A: Interest cost = plan assets on January 1, 2020 x settlement rate = $283,600*10% = $28,360

Q: A company's postretirement health care benefit plan had an APBO of $265,000 on January 1, 2018.…

A: SOLUTION- GIVEN, DISCOUNT RATE = 10% SERVICE COST = $80000 PLANT ASSETS(FAIR VALUE) = $45000 RETIREE…

Q: At January 1, 2019, Jolly Company had plan assets of P2, 800,000 and a projected benefit obligation…

A: Pension: It refers to a reserve made for employee retirement period by depositing the sum of money…

Q: At January 1, 2017, Wembley Company had plan assets of $250,000 and a defined benefit obligation of…

A: Defined benefit plans are those plans which are made for the benefits of employees. This is a form…

Q: ension data for Sam Adams Inc. include the following for the current calendar year: Discount rate,…

A: In this question, we have to calculate pension expenses.

Q: yuletide corporation reported the following data on january 1, 2021: projected benefit obligation…

A: Defined benefit cost for the current year = Current service costs + Interest costs - Actual interest…

Q: 3. Presented below is information related to the pension plan of Zimmer Inc. for the year 2018. 1.…

A: Pension Expense:- Pension expense is considered as the amount that a firm charges to expense in…

Q: Buffalo Corporation had a projected benefit obligation of $3,280,000 and plan assets of $3,446,000…

A: Solution:- calculation of the Minimum amortization of the actuarial loss as follows under:-

Q: ed (1,200) actuarial revaluation,…

A: Net benefit obligation is the difference between the present benefit obligation and the fair value…

Q: At January 1, 2016, C Company had plan assets of P215,000 and a defined benefit obligation of the…

A: Benifit obligation for C company for 2016: P244,000

Q: At January 1, 2017, Wembley Company had plan assets of $250,000 and a defined benefit obligation of…

A: Pension plan: Pension plan is the plan devised by corporations to pay the employees an income after…

Q: ) At January 1, 2020, Hennein Company had plan assets of $280,000 and a projected benefit obligation…

A: Interest Cost:Interest for the period on the projected benefit obligation outstanding during the…

Q: At January 1 2017 Hennein Companyhad plan assets of $280.000 and a projected beneft olligation of…

A: In this question, we have been given related information from the pension plan, on the basis of…

Q: Tevez Company experienced an actuarial loss of $750 in its defined benefit plan in 2017. For 2017,…

A: A statement of Comprehensive Income depicts the adjustments on equity during the given period of…

Q: Presented below is information related to the pension plan of Zimmer Inc. er the year 2018. The…

A: SOLUTION- A- DETERMINE THE PENSION EXPENSE TO BE REPORTED ON THE INCOME STATEMENT FOR 2018-…

Q: (Pension Expense, Journal Entries for 2 Years) Gordon Company sponsors a defined benefit pension…

A: Formulation-

Q: At January 1, 2016, R Company had plan assets of P250,000 and a defined benefit obligation of the…

A: Interest cost = Beginning defined benefit obligation x discount rate = P250,000 x 12% = P30,000

Q: On January 1, 2017, Makoto Co. has the following balances: Projected benefit obligation $2,730,000…

A:

Q: On January 1, 2017, Makoto Co. has the following balances: Projected benefit obligation $2,730,000…

A: SOLUTION- NOTE= IN THAT QUESTION NOTHING IS ASKED WHAT TO CALCULATE . ACCORDING TO QUESTION I…

Q: Presented below is pension information for A Company for the year 2016: Interest on plan assets…

A: The expenses incurred in the organisation have the debit balance.

Q: On January 1, 2016, Burleson Corporation’s projected benefit obligation was $30 million. During 2016…

A:

Q: Stars Inc. has a noncontributory defined pension plan for its employees. During 2020, the company…

A: Pension Expense = Service Cost + Interest cost - Expected return on the plan assets + Amortization…

Q: At January 1, 2017 Hennein Companyhad plan assets of $280 000 and a projected benefit oligation of…

A: Interest cost: It is cost that is incurred on regular basis for the amount of borrowing taken by the…

Q: Jablonski Corp. sponsors a defined benefit pension plan for its employees. On January 1, 2017, the…

A: a. The worksheet is as follows: The result of the above table is as follows:

Q: At January 1, 2017, Hennein Company had plan assets of $280,000 and a projected benefit obligation…

A:

Q: Pension data for the Ben Franklin Company Include the following for the current calendar year:…

A: Journal entry - It refers to the process where the business transactions are recorded in the books…

Q: Hukle Company has provided the following information pertaining to its postretirement plan for 2017:…

A: Post-retirement benefit plan: A fixed sum of money, receivable in future or after the age of…

Q: Assume that at the beginning of the current year, a company has a net gain-AOCI of $25,600,000. At…

A: For the purpose of accounting for pension plans, the predicted return on plan assets are required to…

Q: At January 1, 2020, Hennein Company had plan assets of $280,000 and a projected benefit obligation…

A: Interest cost: Interest Cost = Projected benefit Obligation × Settlement Discount Rate Service Cost:…

Q: U.S. Metallurgical Inc. reported the following balances in its financial statements and disclosure…

A: Hey, since there are multiple sub-parts posted, we will answer the three sub-parts. If you want any…

Q: (Computation of Actual Return) Gingrich Importers provides the following pension plan information.…

A: Pension plan: Pension plan is the plan devised by corporations to pay the employees an income after…

Q: (Comprehensive 2-Year Worksheet) Lemke Company sponsors a defined benefit pension plan for its…

A: Pension means the retirement benefit fund to employees of the organisation after their retirement.…

Step by step

Solved in 2 steps

- Pinecone Company has plan assets of 500,000 at the beginning of the current year and expects to earn 12% on its plan assets during the year. Pinecones service cost is 230,000, and its interest cost is 55,000. Compute Pine-cones pension expense for the current year.3b. The following information is available for the pension plan of Vaughn Company for the year 2020. Actual and expected return on plan assets $ 14,700 Benefits paid to retirees 40,800 Contributions (funding) 81,100 Interest/discount rate 10 % Prior service cost amortization 7,600 Projected benefit obligation, January 1, 2020 458,000 Service cost 63,900 (a) Your answer has been saved. See score details after the due date. Compute pension expense for the year 2020. Pension expense for 2020 $enter pension expense for 2017 in dollars Attempts: 1 of 1 used (b) Prepare the journal entry to record pension expense and the employer’s contribution to the pension plan in 2020. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for…3) U.S. Metallurgical Inc. reported the following balances in its financial statements and disclosure notes at December 31, 2020. Plan assets $580,000 Projected benefit obligation 500,000 U.S.M.’s actuary determined that 2021 service cost is $78,000. Both the expected and actual rate of return on plan assets are 10%. The interest (discount) rate is 5%. U.S.M. contributed $138,000 to the pension fund at the end of 2021, and retirees were paid $62,000 from plan assets. (Enter your answers in thousands (i.e., 10,000 should be entered as 10).) Required: What is the pension expense at the end of 2021? What is the projected benefit obligation at the end of 2021? What is the plan assets balance at the end of 2021? What is the net pension asset or net pension liability at the end of 2021? Prepare journal entries to record the (a) pension expense, (b) funding of plan assets, and (c) retiree benefit payments.

- On January 1, 2016, Burleson Corporation’s projected benefit obligation was $30 million. During 2016 pension benefits paid by the trustee were $4 million. Service cost for 2016 is $12 million. Pension plan assets (at fair value) increased during 2016 by $6 million as expected. At the end of 2016, there was no prior service cost and a negligible balance in net loss–AOCI. The actuary’s discount rate was 10%. Required: Determine the amount of the projected benefit obligation at December 31, 2016.Question 9# Oriole Company provides the following information about its defined benefit pension plan for the year 2020. Service cost $91,700 Contribution to the plan 104,300 Prior service cost amortization 10,800 Actual and expected return on plan assets 65,300 Benefits paid 39,700 Plan assets at January 1, 2020 633,400 Projected benefit obligation at January 1, 2020 711,600 Accumulated OCI (PSC) at January 1, 2020 148,000 Interest/discount (settlement) rate 10 % (b) Prepare the journal entry recording pension expense. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts.) Account Titles and Explanation Debit Credit enter an account title enter a debit amount enter a credit amount enter an account title enter a debit amount enter a credit amount…Question 9 Oriole Company provides the following information about its defined benefit pension plan for the year 2020. Service cost $91,700 Contribution to the plan 104,300 Prior service cost amortization 10,800 Actual and expected return on plan assets 65,300 Benefits paid 39,700 Plan assets at January 1, 2020 633,400 Projected benefit obligation at January 1, 2020 711,600 Accumulated OCI (PSC) at January 1, 2020 148,000 Interest/discount (settlement) rate 10 % General Journal Entries Memo Record Items AnnualPension Expense Cash OCIPrior Service Cost Pension Asset/Liability Projected BenefitObligation PlanAssets (b) The parts of this question must be completed in order. This part will be available when you complete the part above.

- 5b. Indigo Company provides the following information about its defined benefit pension plan for the year 2020. Service cost $91,000 Contribution to the plan 104,000 Prior service cost amortization 9,400 Actual and expected return on plan assets 62,900 Benefits paid 39,900 Plan assets at January 1, 2020 630,400 Projected benefit obligation at January 1, 2020 701,800 Accumulated OCI (PSC) at January 1, 2020 153,000 Interest/discount (settlement) rate 10 % (b) Prepare the journal entry recording pension expense. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts.) Account Titles and Explanation Debit Credit enter an account title enter a debit amount enter a credit amount enter an account title enter a debit amount enter a credit amount enter an…Question 16## Buffalo Corp. sponsors a defined benefit pension plan for its employees. On January 1, 2020, the following balances relate to this plan. Plan assets $463,200 Projected benefit obligation 578,200 Pension asset/liability 115,000 Accumulated OCI (PSC) 100,100 Dr. As a result of the operation of the plan during 2020, the following additional data are provided by the actuary. Service cost $86,600 Settlement rate, 8% Actual return on plan assets 53,200 Amortization of prior service cost 18,000 Expected return on plan assets 50,200 Unexpected loss from change in projected benefit obligation, due to change in actuarial predictions 79,600 Contributions 99,600 Benefits paid retirees 85,100 Also please help me answer part B. (b) Prepare the journal entry for pension expense for 2020. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is…Question 16 Buffalo Corp. sponsors a defined benefit pension plan for its employees. On January 1, 2020, the following balances relate to this plan. Plan assets $463,200 Projected benefit obligation 578,200 Pension asset/liability 115,000 Accumulated OCI (PSC) 100,100 Dr. As a result of the operation of the plan during 2020, the following additional data are provided by the actuary. Service cost $86,600 Settlement rate, 8% Actual return on plan assets 53,200 Amortization of prior service cost 18,000 Expected return on plan assets 50,200 Unexpected loss from change in projected benefit obligation, due to change in actuarial predictions 79,600 Contributions 99,600 Benefits paid retirees 85,100 Prepare the journal entry for pension expense for 2020. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and…

- Question 16# Buffalo Corp. sponsors a defined benefit pension plan for its employees. On January 1, 2020, the following balances relate to this plan. Plan assets $463,200 Projected benefit obligation 578,200 Pension asset/liability 115,000 Accumulated OCI (PSC) 100,100 Dr. As a result of the operation of the plan during 2020, the following additional data are provided by the actuary. Service cost $86,600 Settlement rate, 8% Actual return on plan assets 53,200 Amortization of prior service cost 18,000 Expected return on plan assets 50,200 Unexpected loss from change in projected benefit obligation, due to change in actuarial predictions 79,600 Contributions 99,600 Benefits paid retirees 85,100 (b) Prepare the journal entry for pension expense for 2020. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the…Question 21 Sage Company provides the following selected information related to its defined benefit pension plan for 2020. Pension asset/liability (January 1) $25,600 Cr. Accumulated benefit obligation (December 31) 400,600 Actual and expected return on plan assets 10,400 Contributions (funding) in 2020 148,800 Fair value of plan assets (December 31) 796,000 Settlement rate 10 % Projected benefit obligation (January 1) 698,500 Service cost 79,600 (b) New attempt is in progress. Some of the new entries may impact the last attempt grading. Your answer is partially correct. Indicate the pension-related amounts that would be reported in the company’s income statement and balance sheet for 2020. Sage CompanyIncome Statement (Partial)…On January 1, 2022, Woody Corporation’s projected benefit obligation was $36 million. During 2022, pension benefits paid by the trustee were $8 million. Service cost for 2022 is $16 million. Pension plan assets (at fair value) increased during 2022 by $10 million as expected. At the end of 2022, there were no pension-related other comprehensive income (OCI) accounts. The actuary’s discount rate was 10%. Required:Determine the amount of the projected benefit obligation at December 31, 2022.