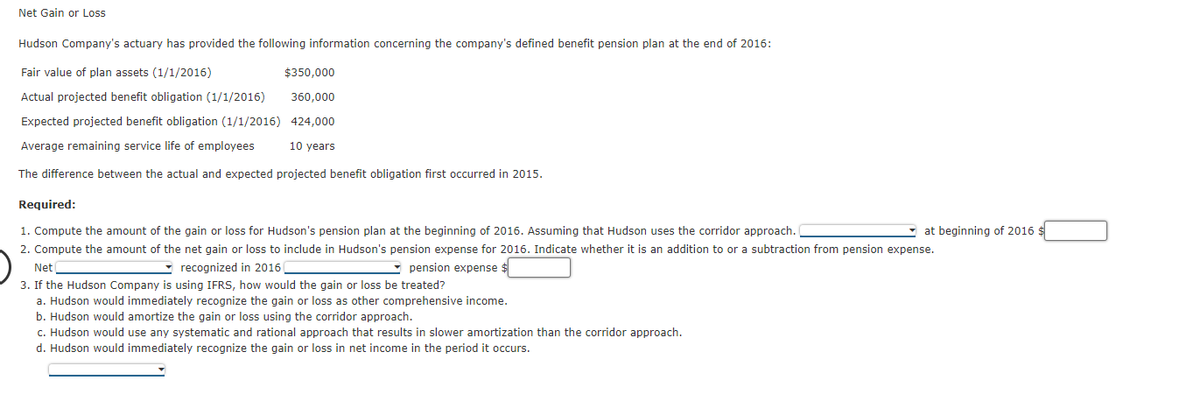

Net Gain or Loss Hudson Company's actuary has provided the following information concerning the company's defined benefit pension plan at the end of 2016: Fair value of plan assets (1/1/2016) $350,000 Actual projected benefit obligation (1/1/2016) 360,000 Expected projected benefit obligation (1/1/2016) 424,000 Average remaining service life of employees 10 years The difference between the actual and expected projected benefit obligation first occurred in 2015. Required: 1. Compute the amount of the gain or loss for Hudson's pension plan at the beginning of 2016. Assuming that Hudson uses the corridor approach. at beginning of 2016 s 2. Compute the amount of the net gain or loss to include in Hudson's pension expense for 2016. Indicate whether it is an addition to or a subtraction from pension expense. Net recognized in 2016 - pension expense $ 3. If the Hudson Company is using IFRS, how would the gain or loss be treated? a. Hudson would immediately recognize the gain or loss as other comprehensive income. b. Hudson would amortize the gain or loss using the corridor approach. c. Hudson would use any systematic and rational approach that results in slower amortization than the corridor approach. d. Hudson would immediately recognize the gain or loss in net income in the period it occurs.

Net Gain or Loss Hudson Company's actuary has provided the following information concerning the company's defined benefit pension plan at the end of 2016: Fair value of plan assets (1/1/2016) $350,000 Actual projected benefit obligation (1/1/2016) 360,000 Expected projected benefit obligation (1/1/2016) 424,000 Average remaining service life of employees 10 years The difference between the actual and expected projected benefit obligation first occurred in 2015. Required: 1. Compute the amount of the gain or loss for Hudson's pension plan at the beginning of 2016. Assuming that Hudson uses the corridor approach. at beginning of 2016 s 2. Compute the amount of the net gain or loss to include in Hudson's pension expense for 2016. Indicate whether it is an addition to or a subtraction from pension expense. Net recognized in 2016 - pension expense $ 3. If the Hudson Company is using IFRS, how would the gain or loss be treated? a. Hudson would immediately recognize the gain or loss as other comprehensive income. b. Hudson would amortize the gain or loss using the corridor approach. c. Hudson would use any systematic and rational approach that results in slower amortization than the corridor approach. d. Hudson would immediately recognize the gain or loss in net income in the period it occurs.

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter19: Accounting For Post Retirement Benefits

Section: Chapter Questions

Problem 12E

Related questions

Question

Transcribed Image Text:Net Gain or Loss

Hudson Company's actuary has provided the following information concerning the company's defined benefit pension plan at the end of 2016:

Fair value of plan assets (1/1/2016)

$350,000

Actual projected benefit obligation (1/1/2016)

360,000

Expected projected benefit obligation (1/1/2016) 424,000

Average remaining service life of employees

10 years

The difference between the actual and expected projected benefit obligation first occurred in 2015.

Required:

1. Compute the amount of the gain or loss for Hudson's pension plan at the beginning of 2016. Assuming that Hudson uses the corridor approach.

at beginning of 2016 $

2. Compute the amount of the net gain or loss to include in Hudson's pension expense for 2016. Indicate whether it is an addition to or a subtraction from pension expense.

- recognized in 2016

pension expense $

Net

3. If the Hudson Company is using IFRS, how would the gain or loss be treated?

a. Hudson would immediately recognize the gain or loss as other comprehensive income.

b. Hudson would amortize the gain or loss using the corridor approach.

c. Hudson would use any systematic and rational approach that results in slower amortization than the corridor approach.

d. Hudson would immediately recognize the gain or loss in net income in the period it occurs.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps

Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT