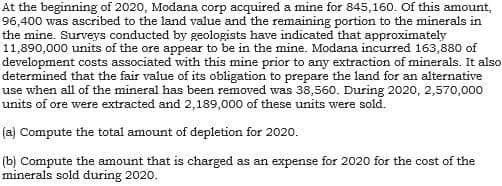

At the beginning of 2020, Modana corp acquired a mine for 845,160. Of this amount, 96,400 was ascribed to the land value and the remaining portion to the minerals in the mine. Surveys conducted by geologists have indicated that approximately 11,890,000 units of the ore appear to be in the mine. Modana incurred 163,880 of development costs associated with this mine prior to any extraction of minerals. It also determined that the fair value of its obligation to prepare the land for an alternative use when all of the mineral has been removed was 38,560. During 2020, 2,570,000 units of ore were extracted and 2,189,000 of these units were sold. (a) Compute the total amount of depletion for 2020. (b) Compute the amount that is charged as an expense for 2020 for the cost of the minerals sold during 2020.

At the beginning of 2020, Modana corp acquired a mine for 845,160. Of this amount, 96,400 was ascribed to the land value and the remaining portion to the minerals in the mine. Surveys conducted by geologists have indicated that approximately 11,890,000 units of the ore appear to be in the mine. Modana incurred 163,880 of development costs associated with this mine prior to any extraction of minerals. It also determined that the fair value of its obligation to prepare the land for an alternative use when all of the mineral has been removed was 38,560. During 2020, 2,570,000 units of ore were extracted and 2,189,000 of these units were sold. (a) Compute the total amount of depletion for 2020. (b) Compute the amount that is charged as an expense for 2020 for the cost of the minerals sold during 2020.

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter10: Property, Plant And Equipment: Acquisition And Subsequent Investments

Section: Chapter Questions

Problem 4E: Determination of Acquisition Cost In January 2019, Cordova Company entered into a contract to...

Related questions

Question

Transcribed Image Text:At the beginning of 2020, Modana corp acquired a mine for 845,160. Of this amount,

96,400 was ascribed to the land value and the remaining portion to the minerals in

the mine. Surveys conducted by geologists have indicated that approximately

11,890,000 units of the ore appear to be in the mine. Modana incurred 163,880 of

development costs associated with this mine prior to any extraction of minerals. It also

determined that the fair value of its obligation to prepare the land for an alternative

use when all of the mineral has been removed was 38,560. During 2020, 2,570,000

units of ore were extracted and 2,189,000 of these units were sold.

(a) Compute the total amount of depletion for 2020.

(b) Compute the amount that is charged as an expense for 2020 for the cost of the

minerals sold during 2020.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning