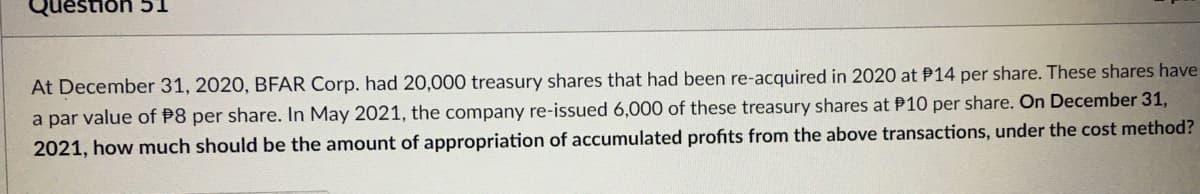

At December 31, 2020, BFAR Corp. had 20,000 treasury shares that had been re-acquired in 2020 at P14 per share. These shares have a par value of P8 per share. In May 2021, the company re-issued 6,000 of these treasury shares at P10 per share. On December 31, 2021, how much should be the amount of appropriation of accumulated profits from the above transactions, under the cost method?

Q: The cost of a manufactured product (product cost) generally consists of which of the following?…

A: Product Cost - Product Cost is the cost incurred by the organization for the product of the entity.…

Q: [S1] An advantage of the discounted cashflow valuation method is that it is less exposed to market…

A: Discounted cash flow method of valuation of investment is one of the methods of valuation of an…

Q: 3. In how many months will money become three times itself at 9% compounded semiannually? Solution:

A: Answer:- Compound interest meaning:- The interest someone earn on the interest is generally known…

Q: Hi-Tek Manufacturing, Incorporated, makes two types of industrial component parts-the 5300 and the…

A: Traditional costing system allocated the overhead on the basis of some plat wise, company wise or…

Q: Martinez Company’s relevant range of production is 7,500 units to 12,500 units. When it produces and…

A: Formula = contribution margin per unit sold = Selling price per unit - Less : total…

Q: Totals $ 107 $ 107 Transactions and events during 2021 (summarized in thousands of dollars) follow:…

A: The journal entries are prepared to keep the record of day to day transactions of the business on…

Q: Identify and discuss briefly the three (3) Cost Drivers: Labour cost, fuel cost and maintenance cost…

A: Cost Driver: A cost driver is the factor that has the most significant influence on the overall…

Q: 1 The sum of P35,000 invested on April 16, 2009 amounts to P58,300 on July 16, 2013. At what rate…

A: Present Value Or Principal Amount :— It is the value of Amount today Or Amount invested in present…

Q: A fundamental analyst uses the discounted cashflow method to value firms, and has a short-term…

A: Fundamental Analysis is a technique to value firms on the basis of their fundamentals i.e. their…

Q: Benefit Cost Ratio of Project Cos (expressed to three decimal places). Internal Rate of Return of…

A: Computation of depreciation per year amount of Project Cos Initial Investment in Project Cos =…

Q: Tetros bros producing oxygen valves and it was leading in market share for its oxygen new gen kit…

A: Bonds was used to raise money for the business for various purposes in which the company will pay…

Q: Hassock Corp. produces woven wall hangings. It takes 2 hours of direct labor to produce a single…

A: Introduction: The gap between actual and expected labor expenses is referred to as the labor rate…

Q: The balance in net accounts receivable on 30 June is: The balance in allowance for doubtful debts…

A: Computation of Balance of net accounts receivable as on 30 June in the hand of Com. A Accounts…

Q: The Bomb Pop Corporation sold ice cream equipment for $18,500. The equipment was originally…

A: Introduction:- Depreciation is a non cash expenses. Depreciation is charged on fixed asset over a…

Q: A company owns machinery with a book value of P2,200,000. It is estimated that the machinery will…

A: Impairment loss can be calculated with the help of its book value, where the book value of the…

Q: You must prepare a return on investment analysis for the regional manager of Fast & Great Burgers.…

A: Return on Investment (ROI) :— It represents return or net income with respect to investments. It is…

Q: Transactions and events during 2021 (summarized in thousands of dollars) follow: a. Borrowed $12…

A: Ratio Analysis - The ratio is the technique used by the prospective investor or an individual or…

Q: Classify each cost item of Pick, AUM branch, as variable, fixed or semi-variable.

A: Types of Cost 1. Variable Cost: The cost which vary with the variation in the volume of output is…

Q: Wesley Power Tools manufactures a wide variety of tools and accessories. One of its more popular…

A:

Q: program itself will:

A: If Auditing isn’t done by testing the input an output of a computer system instead of a computer…

Q: budgeted income statement

A: Fortune, Incorporated Budgeted Income Statement For the Quarter ended March 31 Particulars…

Q: 4. Find the compound amount and interest on P360,000 for 8 years and 6 months at 10% compounded…

A: Compound Amount = P x (1 + r)^n Interest = Compound Amount - Principal

Q: Equipment was acquired at the beginning of the year at a cost of $76,620. The equipment was…

A: Depreciation expense per year = (Cost of the equipment - Residual value) / estimated useful life…

Q: 2.2 Study the information provided below and calculate the expected value of closing inventory as at…

A: production of the good takes place there are certain inventory which are already in the stock at the…

Q: Dec 1 Mahmood invested $25,000 cash in his business. 5 Paid office rent for the month $2,300.

A: Introduction: Journals: All the business transactions are to be recorded in Journals. Journals are…

Q: Required information [The following information applies to the questions displayed below.] AirPro…

A: A volume variance is the difference between the amount that was actually consumed or sold and the…

Q: Motors Corporation manufactures motors for dirt bikes. The company requires a minimum $30,000 cash…

A: For a company or an organization cash is an important source which are are used by the company to…

Q: What type of cost accounting system would be most appropriate to be used by a graduation invitation…

A: Journal entries are the basic method for recording financial transactions in the books of accounts.…

Q: Equity Investments: Less than 20% ownership On September 12, 3,600 shares of Denver Company’s…

A: Journal entries means the entry in prime book with chronological sequence. Share has been valued at…

Q: Beginning Inventory 3 units @ $4 $12 Purchases 10 units @ $7 $70 Sales 8 units What is CGS…

A: Introduction: The cost of goods sold (COGS) is the cost of gaining or manufacturing a product that a…

Q: On January 15, Ross Furniture, Inc., accepts a $5,000, 180-day, 10 percent note from a customer at…

A: Introduction: Journals: 1 ) Journals are book of prime records. 2 ) All the business transactions…

Q: The person invested Sat 5%, $at 11%, and $at 13%.

A: Calculation of interest = Principal amount * rate of interest * time given We take time to be equal…

Q: Illes Corporation's comparative balance sheet appears below: Beginning Balance Assets: Current…

A: Cash flow statement termed as CFS which is one of the financial statements of the company and it…

Q: Travis Company reports the following for its single product. Travis produced and sold 34,000 units…

A: Contribution margin is the amount of profit after deducting the variable expenses from the sales.…

Q: If 8,000 units are produced, what is the average fixed manufacturing cost per unit produced?

A: The fixed manufacturing cost is the cost that incurs in the manufacturing of the product. The fixed…

Q: Which of the following would be considered as direct labor for the manufacture of denim jeans?…

A: Direct Labor - Direct Labor is the manpower used to operate some machine used in the manufacturing…

Q: The Clinton Antique Mall expects to make purchases in the first quarter of 2021 as follows: January…

A: Lets understand the basics. Management prepares cash collection and cash payment schedule in order…

Q: If JoBlo Inc., has a retained earnings opening balance of $50,000 at the beginning of the year, and…

A: Stockholders' equity: Stockholders' equity means the net assets available to shareholders after…

Q: Using the following performance data, calculate the volume adjusted labor rate variance and volume…

A: Variance is the measure which is used to determine the difference between the standard costs and the…

Q: Comparing Three Depreciation Methods Dexter Industries purchased packaging equipment on January 8…

A: Depreciation Expenses - Depreciation Expenses are the expense incurred on the wear and tear of the…

Q: Casas Modernas of Juarez, Mexico, is contemplating a major change in its cost structure. Currently,…

A: Introduction: The last line of the financial statements is net income. However, some income…

Q: In the cost behavior equation, b*X denotes the variable cost per unit. Select one: O True O False

A: Cost behavior formula = a+ b*x

Q: A certain sum of money is invested at 2 years at 12% compounded quarterly. If the sum is P43,000,…

A: Present value is equivalent value of money that is today of the future money to be received based on…

Q: Suppose Elon Musk Ltd. That produces and sells two products. The X space sells for 5 $ and has a…

A: The Break-even point indicates that total units are to be sold by the business entity to recover its…

Q: Malikhain Company Adjusted Trial Balance (In 000's) December 31, 2019 Cash on hand Accounts…

A: Ratio analysis helps to analyze the financial statements of the company. The management can take…

Q: Problem #2 Adjusting Entries and Accounting Policy The following are some of the transactions made…

A: Adjusting Entry – The inputs that make the accrual principle operate for the organization are known…

Q: If the selling price per unit is $50, the variable expense per unit is $20, and total fixed expenses…

A: The breakeven sales in dollars are $433,333.

Q: List Price Trade Discount Rate Trade Discount $282.00 25% Net Price

A: Trade discount is defined as the promotion tactic used by the trader or manufacturer to induce…

Q: Martinez Company’s relevant range of production is 7,500 units to 12,500 units. When it produces and…

A: Product cost includes all the direct expenses and indirect manufacturing overhead like direct…

Q: Martinez Company’s relevant range of production is 7,500 units to 12,500 units. When it produces and…

A: The manufacturing costs of a company include direct material, direct labor, and manufacturing…

Step by step

Solved in 2 steps

- Common Dividends Thompson Payroll Service began in 2019 with 1,500,000 authorized and 820,000 issued and outstanding S8 par common shares. During 2019, Thompson entered into the following transactions: Declared a S0.20 per-share cash dividend on March 24. Paid the S0.20 per-share dividend on April 6. Repurchased 13,000 common shares for the treasury at a cost of S12 each on May 9. Sold 2,500 unissued common shares for $15 per share on June 19. Declared a $0.40 per-share cash dividend on August 1. Paid the $0.40 per-share dividend on September 14. Declared and paid a 10% stock dividend on October 25 when the market price of the common stock was $15 per share. Declared a 50.45 per-share cash dividend on November 20. Paid the $0.45 per-share dividend on December 20. Required: Prepare journal entries for each of these transactions. (Note: Round to the nearest dollar.) What is the total dollar amount of dividends (cash and stock) for the year? CONCEPTUAL CONNECTION Determine the effect on total assets and total stockholders equity of these dividend transactions.On January 1, 2019, Kittson Company had a retained earnings balance of 218,600. It is subject to a 30% corporate income tax rate. During 2019, Kittson earned net income of 67,000, and the following events occurred: 1. Cash dividends of 3 per share on 4,000 shares of common stock were declared and paid. 2. A small stock dividend was declared and issued. The dividend consisted of 600 shares of 10 par common stock. On the date of declaration, the market price of the companys common stock was 36 per share. 3. The company recalled and retired 500 shares of 100 par preferred stock. The call price was 125 per share; the stock had originally been issued for 110 per share. 4. The company discovered that it had erroneously recorded depreciation expense of 45,000 in 2018 for both financial reporting and income tax reporting. The correct depreciation for 2018 should have been 20,000. This is considered a material error. Required: 1. Prepare journal entries to record Items 1 through 4. 2. Prepare Kittsons statement of retained earnings for the year ended December 31, 2019.Cary Corporation has 50,000 shares of 10 par common stock authorized. The following transactions took place during 2019, the first year of the corporations existence: Sold 5,000 shares of common stock for 18 per share. Issued 5,000 shares of common stock in exchange for a patent valued at 100,000. At the end of Carys first year, total contributed capital amounted to: a. 40,000 b. 90,000 c. 100,000 d. 190,000

- Contributed Capital Adams Companys records provide the following information on December 31, 2019: Additional information: 1. Common stock has a 5 par value, 50,000 shares are authorized, 15,000 shares have been issued and are outstanding. 2. Preferred stock has a 100 par value, 3,000 shares are authorized, 800 shares have been issued and are outstanding. Two hundred shares have been subscribed at 120 per share. The stock pays an 8% dividend, is cumulative, and is callable at 130 per share. 3. Bonds payable mature on January 1, 2023. They carry a 12% annual interest rate, payable semiannually. Required: Prepare the Contributed Capital section of the December 31, 2019, balance sheet for Adams. Include appropriate parenthetical notes.Common Dividends Fusion Payroll Service began 2019 with 1,200,000 authorized and 375,000 issued and outstand ing $5 par common shares. During 2019, Fusion entered into the following transactions: Declared a S0.30 per-share cash dividend on March 10. Paid the $0.30 per-share dividend on April 10. Repurchased 8,000 common shares at a cost of $18 each on May 2. Sold 1.500 unissued common shares for $23 per share on June 9. Declared a $0.45 per-share cash dividend on August 10. Paid the $0.45 per-share dividend on September 10. Declared and paid a 5% stock dividend on October 15 when the market price of the common stock was $25 per share. Declared a $0.50 per-share cash dividend on November 10. Paid the $0.50 per-share dividend on December 10. Required: Prepare journal entries for each of these transactions. (Note: Round to the nearest dollar.) Determine the total dollar amount of dividends (cash and stock) for the year. CONCEPTUAL CONNECTION Determine the effect on total assets and total stockholders equity of these dividend transactions.Fisafolia Corporation has gross income from operations of $210,000 and operating expenses of $160,000 for 2019. The corporation also has $30,000 in dividends from publicly traded domestic corporations in which the ownership percentage was 45 percent. Calculate the corporation's dividends received deduction for 2019. $_____________ Assume that instead of $210,000, Fisafolia Corporation has gross income from operations of $135,000. Calculate the corporation's dividends received deduction for 2019. $___________ Assume that instead of $210,000, Fisafolia Corporation has gross income from operations of $158,000. Calculate the corporation's dividends received deduction for 2019. $_____________

- Cash dividends on the 10 par value common stock of Garrett Company were as follows: The 4th-quarter cash dividend was declared on December 21, 2019, to shareholders of record on December 31, 2019. Payment of the 4th-quarter cash dividend was made on January 18, 2020. In addition, Garrett declared a 5% stock dividend on its 10 par value common stock on December 3, 2019, when there were 300,000 shares issued and outstanding and the market value of the common stock was 20 per share. The shares were issued on December 24, 2019. What was the effect on Garretts shareholders equity accounts as a result of the preceding transactions?Frost Company has accumulated the following information relevant to its 2019 earningsper share. 1. Net income for 2019: 150,500. 2. Bonds payable: On January 1, 2019, the company had issued 10%, 200,000 bonds at 110. The premium is being amortized in the amount of 1,000 per year. Each 1,000 bond is currently convertible into 22 shares of common stock. To date, no bonds have been converted. 3. Bonds payable: On December 31, 2017, the company had issued 540,000 of 5.8% bonds at par. Each 1,000 bond is currently convertible into 11.6 shares of common stock. To date, no bonds have been converted. 4. Preferred stock: On July 3, 2018, the company had issued 3,800 shares of 7.5%, 100 par, preferred stock at 108 per share. Each share of preferred stock is currently convertible into 2.45 shares of common stock. To date, no preferred stock has been converted and no additional shares of preferred stock have been issued. The current dividends have been paid. 5. Common stock: At the beginning of 2019, 25,000 shares were outstanding. On August 3, 7,000 additional shares were issued. During September, a 20% stock dividend was declared and issued. On November 30, 2,000 shares were reacquired as treasury stock. 6. Compensatory share options: Options to acquire common stock at a price of 33 per share were outstanding during all of 2019. Currently, 4,000 shares may be acquired. To date, no options have been exercised. The unrecognized compens Frost Company has accumulated the following information relevant to its 2019 earnings ns is 5 per share. 7. Miscellaneous: Stock market prices on common stock averaged 41 per share during 2019, and the 2019 ending stock market price was 40 per share. The corporate income tax rate is 30%. Required: 1. Compute the basic earnings per share. Show supporting calculations. 2. Compute the diluted earnings per share. Show supporting calculations. 3. Indicate which earnings per share figure(s) Frost would report on its 2019 income statement.Waseca Company had 5 convertible securities outstanding during all of 2019. It paid the appropriate interest (and amortized any related premium or discount using the straight line method) and dividends on each security during 2019. Each of the convertible securities is described in the following table: Additional data: Net income for 2019 totaled 119,460. The weighted average number of common shares outstanding during 2019 was 40,000 shares. No share options or warrants arc outstanding. The effective corporate income tax rate is 30%. Required: 1. Prepare a schedule that lists the impact of the assumed conversion of each convertible security on diluted earnings per share. 2. Prepare a ranking of the order in which each of the convertible securities should be included in diluted earnings per share. 3. Compute basic earnings per share. 4. Compute diluted earnings per share. 5. Indicate the amount(s) of the earnings per share that Waseca would report on its 2019 income statement.

- Monona Company reported net income of 29,975 for 2019. During all of 2019, Monona had 1,000 shares of 10%, 100 par, nonconvertible preferred stock outstanding, on which the years dividends had been paid. At the beginning of 2019, the company had 7,000 shares of common stock outstanding. On April 2, 2019, the company issued another 2,000 shares of common stock so that 9,000 common shares were outstanding at the end of 2019. Common dividends of 17,000 had been paid during 2019. At the end of 2019, the market price per share of common stock was 17.50. Required: 1. Compute Mononas basic earnings per share for 2019. 2. Compute the price/earnings ratio for 2019.Roseau Company is preparing its annual earnings per share amounts to be disclosed on its 2019 income statement. It has collected the following information at the end of 2019: 1. Net income: 120,400. Included in the net income is income from continuing operations of 130,400 and a loss from discontinued operations (net of income taxes) of 10,000. Corporate income tax rate: 30%. 2. Common stock outstanding on January 1, 2019: 20,000 shares. 3. Common stock issuances during 2019: July 6, 4,000 shares; August 24, 3,000 shares. 4. Stock dividend: On October 19, 2019, the company declared a 10% stock dividend that resulted in 2,700 additional outstanding shares of common stock. 5. Common stock prices: 2019 average market price, 30 per share; 2019 ending market price, 27 per share. 6. 7% preferred stock outstanding on January 1, 2019: 1,000 shares. Terms: 100 par, nonconvertible. Current dividends have been paid. No preferred stock issued during 2019. 7. 8% convertible preferred stock outstanding on January 1, 2019: 800 shares. The stock was issued in 2018 at 130 per share. Each 100 par preferred stock is currently convertible into 1.7 shares of common stock. Current dividends have been paid. To date, no preferred stock has been converted. 8. Bonds payable outstanding on January 1, 2019: 100,000 face value. These bonds were issued several years ago at 97 and pay annual interest of 9.6%. The discount is being amortized in the amount of 300 per year. Each 1,000 bond is currently convertible into 22 shares of common stock. To date, no bonds have been converted. 9. Compensatory share options outstanding: Key executives may currently acquire 3,000 shares of common stock at 20 per share. The options were granted in 2018. To date, none have been exercised. The unrecognized compensation cost (net of tax) related to the options is 4 per share. Required: 1. Compute the basic earnings per share. Show supporting calculations. 2. Compute the diluted earnings per share. Show supporting calculations. 3. Show how Roseau would report these earnings per share figures on its 2019 income statement. Include an explanatory note to the financial statements.Statement of Stockholders' Equity At the end of 2019, Stanley Utilities Inc. had the following equity accounts and balances: During 2020, Haley engaged in the following transactions involving its equity accounts: Sold 5,000 shares of common stock for $19 per share. Sold 1.200 shares of 12%, $50 par preferred stock at $75 per share. Declared and paid cash dividends of $22,000. Repurchased 1,000 shares of treasury stock (common) for $24 per share. Sold 300 of the treasury shares for $26 per share. Required: Prepare the journal entries for Transactions a through e. Assume that 2020 net income was $123,700. Prepare a statement of stockholders equity at December 31, 2020.