At the beginning of 2020, your company buys a $34,400 piece of equipment that it expects to use for 4 years. The equipment has an estimated residual value of 4,000. The company expects to produce a total of 200,000 units. Actual production is as follows: 47,000 units in 2020, 51,000 units in 2021, 53,000 units in 2022, and 49,000 units in 2023. Required: a. Determine the depreciable cost. b. Calculate the depreciation expense per year under the straight-line method. c. Use the straight-line method to prepare a depreciation schedule. d. Calculate the depreciation rate per unit under the units-of-production method. e. Use the units-of-production method to prepare a depreciation schedule. Complete this question by entering your answers in the tabs below. Required C Required D Required E Use the units-of-production method to prepare a depreciation schedule. (Do not round your Depreciation rate per unit.) Depreciation Accumulated Expense Net Book Value Depreciation Required A Required B Year Acquisition Cost 2020 2021 2022 2023 $ $ $ $ 34,400 $ 27,256 $ 19,504 $ 11,448 $ 7,144 $ 7,752 $ 8,056 $ 7,448 $ 27,256 19,504 11,448 4,000

At the beginning of 2020, your company buys a $34,400 piece of equipment that it expects to use for 4 years. The equipment has an estimated residual value of 4,000. The company expects to produce a total of 200,000 units. Actual production is as follows: 47,000 units in 2020, 51,000 units in 2021, 53,000 units in 2022, and 49,000 units in 2023. Required: a. Determine the depreciable cost. b. Calculate the depreciation expense per year under the straight-line method. c. Use the straight-line method to prepare a depreciation schedule. d. Calculate the depreciation rate per unit under the units-of-production method. e. Use the units-of-production method to prepare a depreciation schedule. Complete this question by entering your answers in the tabs below. Required C Required D Required E Use the units-of-production method to prepare a depreciation schedule. (Do not round your Depreciation rate per unit.) Depreciation Accumulated Expense Net Book Value Depreciation Required A Required B Year Acquisition Cost 2020 2021 2022 2023 $ $ $ $ 34,400 $ 27,256 $ 19,504 $ 11,448 $ 7,144 $ 7,752 $ 8,056 $ 7,448 $ 27,256 19,504 11,448 4,000

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter11: Depreciation, Depletion, Impairment, And Disposal

Section: Chapter Questions

Problem 10E: Hathaway Company purchased a copying machine for 8,700 on October 1, 2019. The machines residual...

Related questions

Question

Please help ()()))())

Need net book value for both please

Transcribed Image Text:At the beginning of 2020, your company buys a $34,400 piece of equipment that it expects to use for 4 years. The equipment has an

estimated residual value of 4,000. The company expects to produce a total of 200,000 units. Actual production is as follows: 47,000

units in 2020, 51,000 units in 2021, 53,000 units in 2022, and 49,000 units in 2023.

Required:

a. Determine the depreciable cost.

b. Calculate the depreciation expense per year under the straight-line method.

c. Use the straight-line method to prepare a depreciation schedule.

d. Calculate the depreciation rate per unit under the units-of-production method.

e. Use the units-of-production method to prepare a depreciation schedule.

Complete this question by entering your answers in the tabs below.

Required A Required B Required C Required D Required E

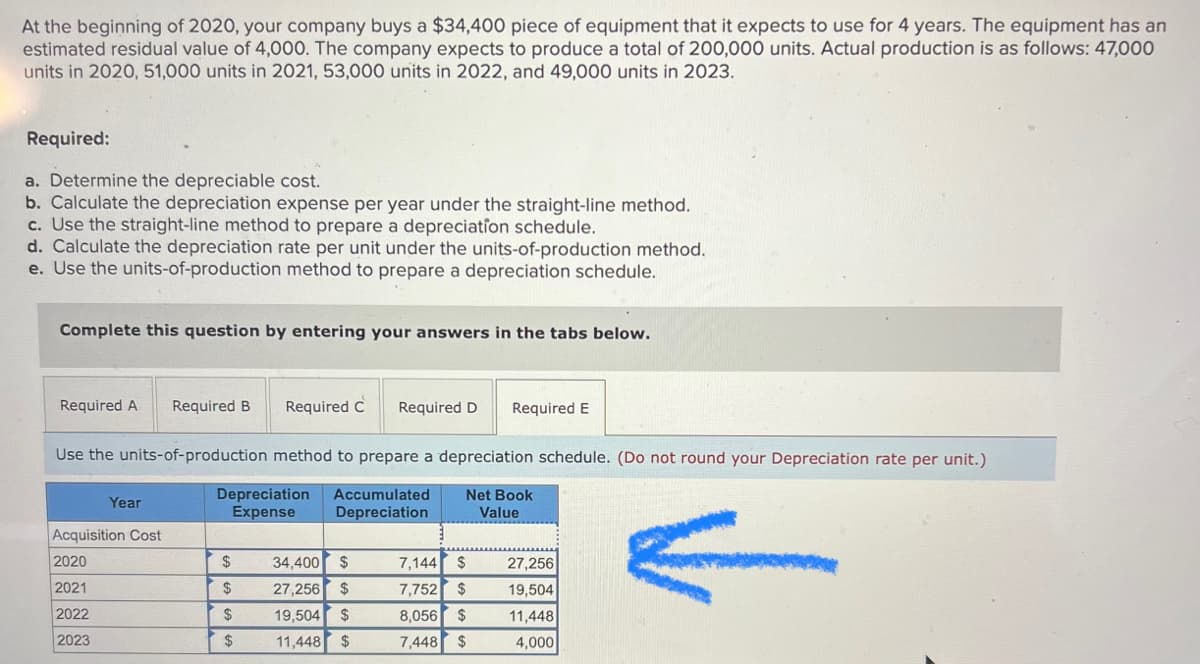

Use the units-of-production method to prepare a depreciation schedule. (Do not round your Depreciation rate per unit.)

Depreciation Accumulated Net Book

Expense

Depreciation

Value

Year

Acquisition Cost

2020

2021

2022

2023

$

$

$

$

34,400 $

27,256 $

19,504 $

11,448 $

7,144 $

7,752 $

8,056 $

7,448 $

27,256

19,504

11,448

4,000

Transcribed Image Text:At the beginning of 2020, your company buys a $34,400 piece of equipment that it expects to use for 4 years. The equipment has an

estimated residual value of 4,000. The company expects to produce a total of 200,000 units. Actual production is as follows: 47,000

units in 2020, 51,000 units in 2021, 53,000 units in 2022, and 49,000 units in 2023.

Required:

a. Determine the depreciable cost.

b. Calculate the depreciation expense per year under the straight-line method.

c. Use the straight-line method to prepare a depreciation schedule.

d. Calculate the depreciation rate per unit under the units-of-production method.

e. Use the units-of-production method to prepare a depreciation schedule.

Complete this question by entering your answers in the tabs below.

Required A Required B Required C Required D Required E

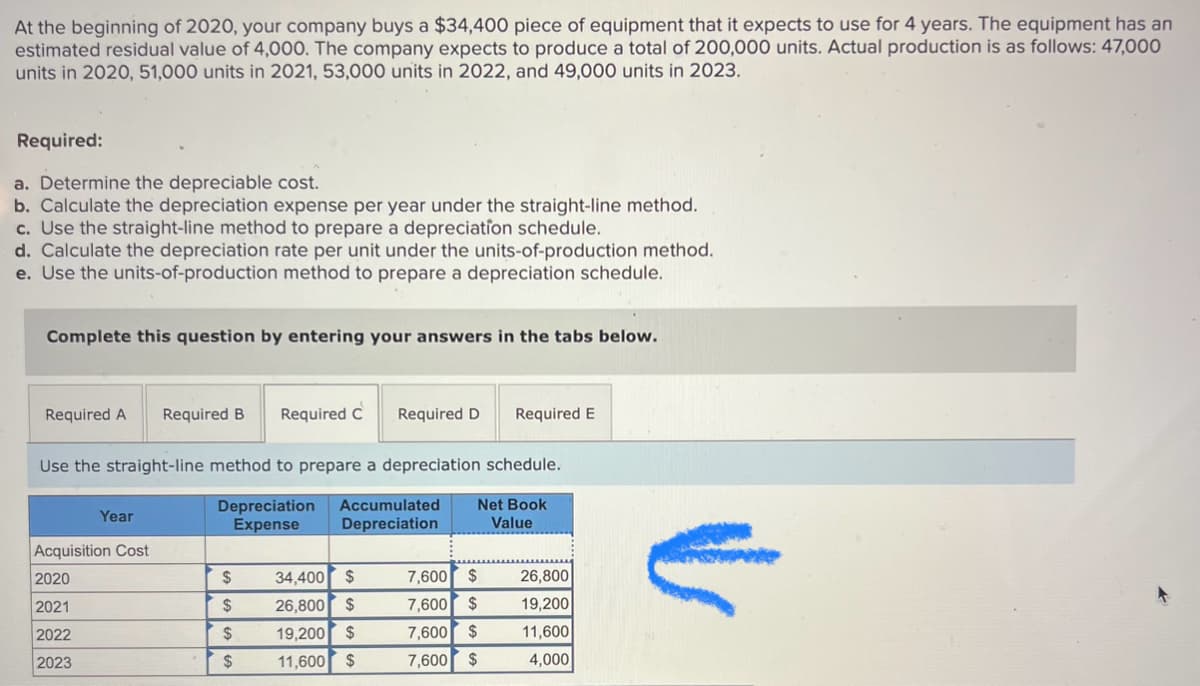

Use the straight-line method to prepare a depreciation schedule.

Depreciation Accumulated Net Book

Expense Depreciation

Value

Year

Acquisition Cost

2020

2021

2022

2023

$

$

$

$

34,400 $

26,800 $

19,200 $

11,600 $

7,600 $

7,600 $

7,600 $

7,600 $

26,800

19,200

11,600

4,000

11

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College