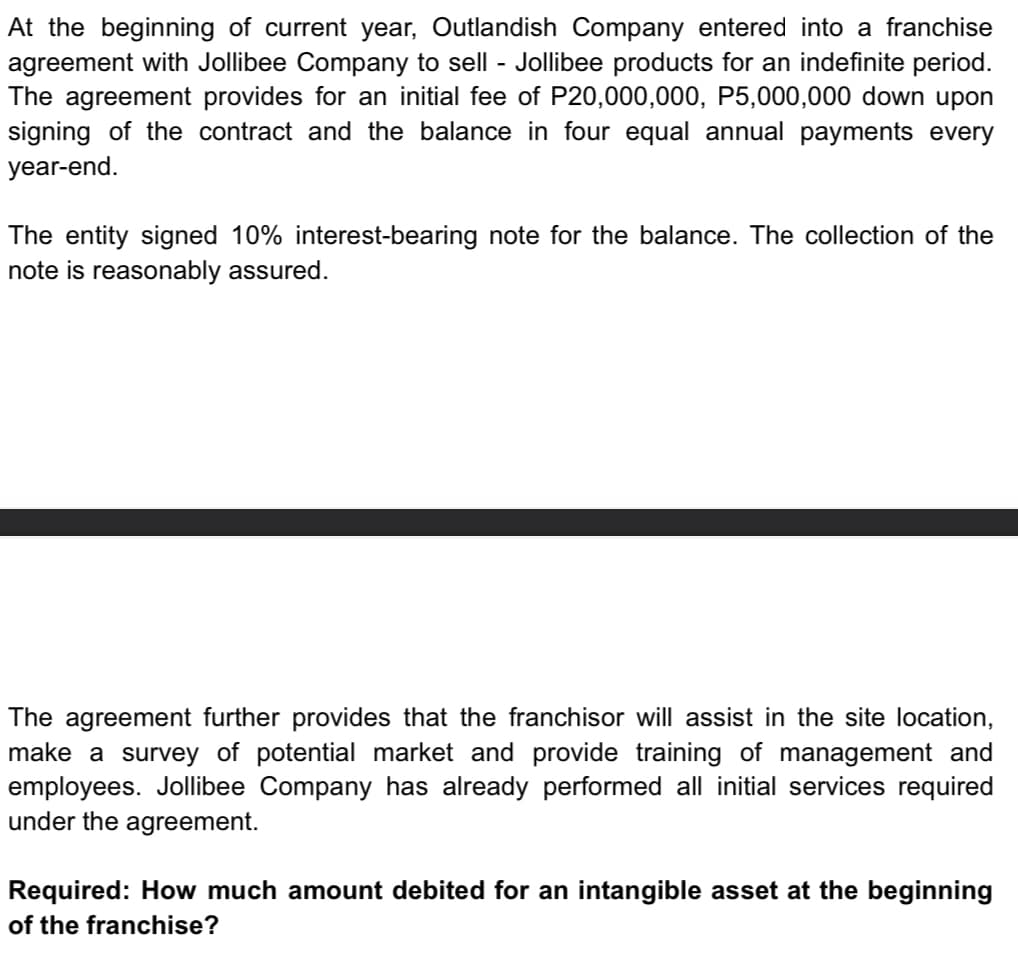

At the beginning of current year, Outlandish Company entered into a franchise agreement with Jollibee Company to sell - Jollibee products for an indefinite period. The agreement provides for an initial fee of P20,000,000, P5,000,000 down upon signing of the contract and the balance in four equal annual payments every year-end. The entity signed 10% interest-bearing note for the balance. The collection of the note is reasonably assured.

At the beginning of current year, Outlandish Company entered into a franchise agreement with Jollibee Company to sell - Jollibee products for an indefinite period. The agreement provides for an initial fee of P20,000,000, P5,000,000 down upon signing of the contract and the balance in four equal annual payments every year-end. The entity signed 10% interest-bearing note for the balance. The collection of the note is reasonably assured.

Chapter10: Cost Recovery On Property: Depreciation, Depletion, And Amortization

Section: Chapter Questions

Problem 62P

Related questions

Question

Transcribed Image Text:At the beginning of current year, Outlandish Company entered into a franchise

agreement with Jollibee Company to sell - Jollibee products for an indefinite period.

The agreement provides for an initial fee of P20,000,000, P5,000,000 down upon

signing of the contract and the balance in four equal annual payments every

year-end.

The entity signed 10% interest-bearing note for the balance. The collection of the

note is reasonably assured.

The agreement further provides that the franchisor will assist in the site location,

make a survey of potential market and provide training of management and

employees. Jollibee Company has already performed all initial services required

under the agreement.

Required: How much amount debited for an intangible asset at the beginning

of the franchise?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Business Its Legal Ethical & Global Environment

Accounting

ISBN:

9781305224414

Author:

JENNINGS

Publisher:

Cengage

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Business Its Legal Ethical & Global Environment

Accounting

ISBN:

9781305224414

Author:

JENNINGS

Publisher:

Cengage